fill out entry for 8-b-6

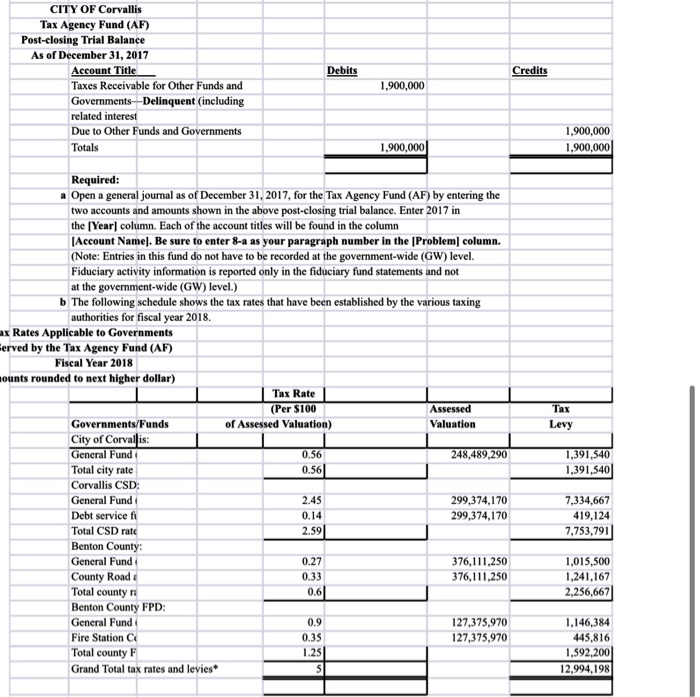

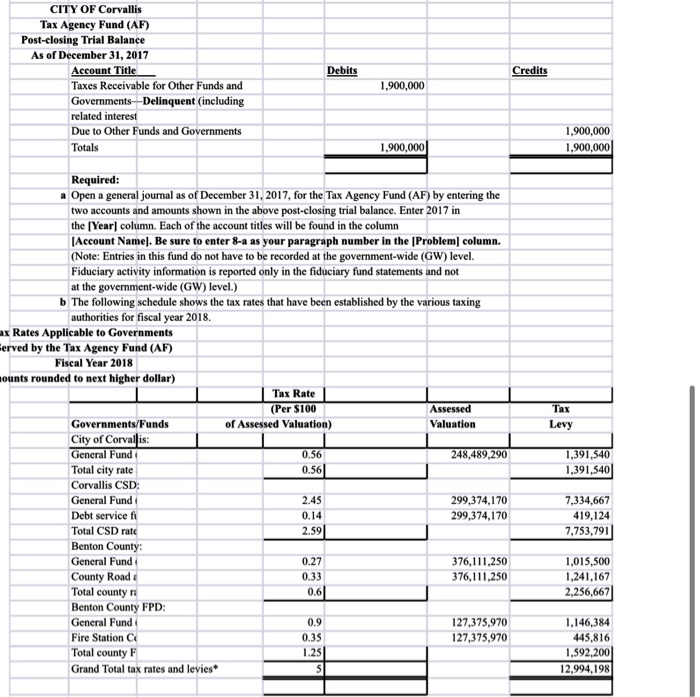

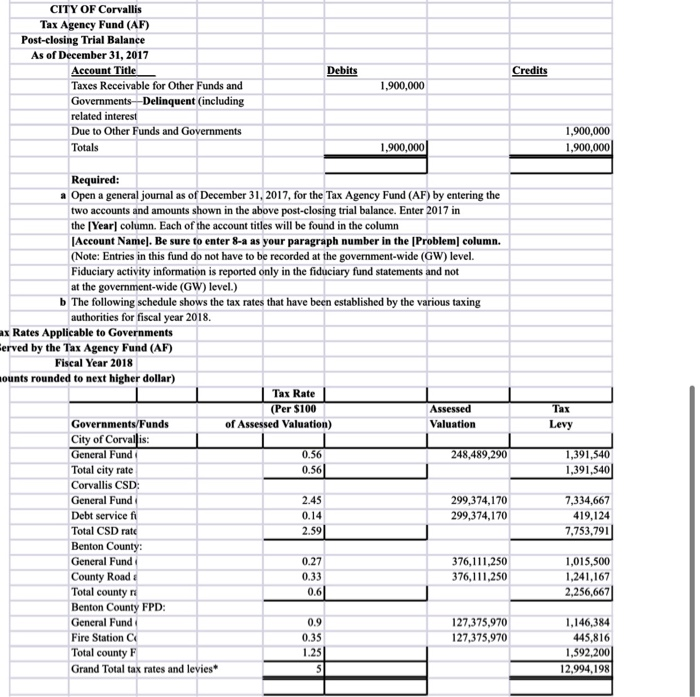

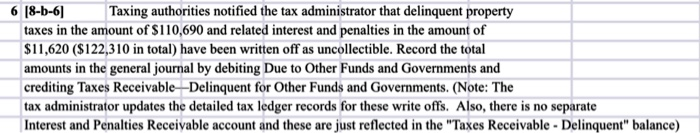

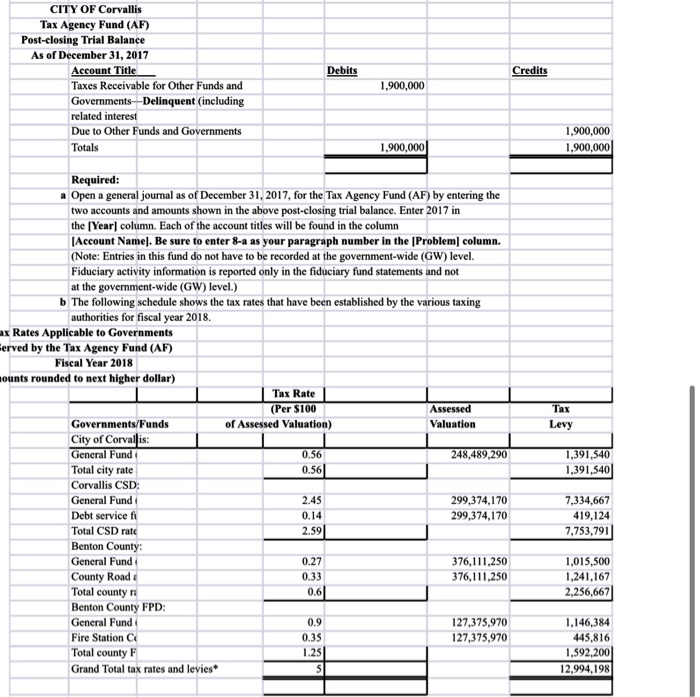

Debits Credits CITY OF Corvallis Tax Agency Fund (AF) Post-closing Trial Balance As of December 31, 2017 Account Title Taxes Receivable for Other Funds and Governments - Delinquent (including related interest Due to Other Funds and Governments Totals 1,900,000 1,900,000 1,900,000 1,900,000 Required: a Open a general journal as of December 31, 2017, for the Tax Agency Fund (AF) by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2017 in the [Year] column. Each of the account titles will be found in the column [Account Name]. Be sure to enter 8-a as your paragraph number in the [Problem column. (Note: Entries in this fund do not have to be recorded at the government-wide (GW) level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide (GW) level.) b The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2018. ax Rates Applicable to Governments erved by the Tax Agency Fund (AF) Fiscal Year 2018 ounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Corvallis General Fund 0.56 248,489,290 Total city rate 0.56 Corvallis CSD: General Fund 2.45 299,374,170 Debt service fit 0.14 299,374,170 Total CSD rate 2.591 Benton County: General Fund 0.27 376,111,250 County Road 0.33 376,111,250 Total county Benton County FPD: General Fund 0.9 127,375,970 Fire Station C 0.35 127,375,970 Total county F 1.25 Grand Total tax rates and levies* 5 Tax Levy 1,391,540 1,391,5401 7,334,667 419.124 7,753,791) 1,015,500 1,241,167 2,256,667 0.6 1,146,384 445,816 1,592,200 12,994,198 Debits Credits CITY OF Corvallis Tax Agency Fund (AF) Post-closing Trial Balance As of December 31, 2017 Account Title Taxes Receivable for Other Funds and Governments - Delinquent (including related interest Due to Other Funds and Governments Totals 1,900,000 1,900,000 1,900,000 1,900,000 Required: a Open a general journal as of December 31, 2017, for the Tax Agency Fund (AF) by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2017 in the [Year] column. Each of the account titles will be found in the column [Account Name]. Be sure to enter 8-a as your paragraph number in the [Problem column. (Note: Entries in this fund do not have to be recorded at the government-wide (GW) level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide (GW) level.) b The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2018. ax Rates Applicable to Governments erved by the Tax Agency Fund (AF) Fiscal Year 2018 ounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Corvallis General Fund 0.56 248,489,290 Total city rate 0.56 Corvallis CSD: General Fund 2.45 299,374,170 Debt service fit 0.14 299,374,170 Total CSD rate 2.591 Benton County: General Fund 0.27 376,111,250 County Road 0.33 376,111,250 Total county Benton County FPD: General Fund 0.9 127,375,970 Fire Station C 0.35 127,375,970 Total county F 1.25 Grand Total tax rates and levies* 5 Tax Levy 1,391,540 1,391,5401 7,334,667 419.124 7,753,791) 1,015,500 1,241,167 2,256,667 0.6 1,146,384 445,816 1,592,200 12,994,198 6 (8-1-61 Taxing authorities notified the tax administrator that delinquent property taxes in the amount of $110,690 and related interest and penalties in the amount of $11,620 ($122,310 in total) have been written off as uncollectible. Record the total amounts in the general journal by debiting Due to Other Funds and Governments and crediting Taxes Receivable--Delinquent for Other Funds and Governments. (Note: The tax administrator updates the detailed tax ledger records for these write offs. Also, there is no separate Interest and Penalties Receivable account and these are just reflected in the "Taxes Receivable - Delinquent" balance) Debits Credits CITY OF Corvallis Tax Agency Fund (AF) Post-closing Trial Balance As of December 31, 2017 Account Title Taxes Receivable for Other Funds and Governments - Delinquent (including related interest Due to Other Funds and Governments Totals 1,900,000 1,900,000 1,900,000 1,900,000 Required: a Open a general journal as of December 31, 2017, for the Tax Agency Fund (AF) by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2017 in the [Year] column. Each of the account titles will be found in the column [Account Name]. Be sure to enter 8-a as your paragraph number in the [Problem column. (Note: Entries in this fund do not have to be recorded at the government-wide (GW) level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide (GW) level.) b The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2018. ax Rates Applicable to Governments erved by the Tax Agency Fund (AF) Fiscal Year 2018 ounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Corvallis General Fund 0.56 248,489,290 Total city rate 0.56 Corvallis CSD: General Fund 2.45 299,374,170 Debt service fit 0.14 299,374,170 Total CSD rate 2.591 Benton County: General Fund 0.27 376,111,250 County Road 0.33 376,111,250 Total county Benton County FPD: General Fund 0.9 127,375,970 Fire Station C 0.35 127,375,970 Total county F 1.25 Grand Total tax rates and levies* 5 Tax Levy 1,391,540 1,391,5401 7,334,667 419.124 7,753,791) 1,015,500 1,241,167 2,256,667 0.6 1,146,384 445,816 1,592,200 12,994,198 Debits Credits CITY OF Corvallis Tax Agency Fund (AF) Post-closing Trial Balance As of December 31, 2017 Account Title Taxes Receivable for Other Funds and Governments - Delinquent (including related interest Due to Other Funds and Governments Totals 1,900,000 1,900,000 1,900,000 1,900,000 Required: a Open a general journal as of December 31, 2017, for the Tax Agency Fund (AF) by entering the two accounts and amounts shown in the above post-closing trial balance. Enter 2017 in the [Year] column. Each of the account titles will be found in the column [Account Name]. Be sure to enter 8-a as your paragraph number in the [Problem column. (Note: Entries in this fund do not have to be recorded at the government-wide (GW) level. Fiduciary activity information is reported only in the fiduciary fund statements and not at the government-wide (GW) level.) b The following schedule shows the tax rates that have been established by the various taxing authorities for fiscal year 2018. ax Rates Applicable to Governments erved by the Tax Agency Fund (AF) Fiscal Year 2018 ounts rounded to next higher dollar) Tax Rate (Per $100 Assessed Governments/Funds of Assessed Valuation) Valuation City of Corvallis General Fund 0.56 248,489,290 Total city rate 0.56 Corvallis CSD: General Fund 2.45 299,374,170 Debt service fit 0.14 299,374,170 Total CSD rate 2.591 Benton County: General Fund 0.27 376,111,250 County Road 0.33 376,111,250 Total county Benton County FPD: General Fund 0.9 127,375,970 Fire Station C 0.35 127,375,970 Total county F 1.25 Grand Total tax rates and levies* 5 Tax Levy 1,391,540 1,391,5401 7,334,667 419.124 7,753,791) 1,015,500 1,241,167 2,256,667 0.6 1,146,384 445,816 1,592,200 12,994,198 6 (8-1-61 Taxing authorities notified the tax administrator that delinquent property taxes in the amount of $110,690 and related interest and penalties in the amount of $11,620 ($122,310 in total) have been written off as uncollectible. Record the total amounts in the general journal by debiting Due to Other Funds and Governments and crediting Taxes Receivable--Delinquent for Other Funds and Governments. (Note: The tax administrator updates the detailed tax ledger records for these write offs. Also, there is no separate Interest and Penalties Receivable account and these are just reflected in the "Taxes Receivable - Delinquent" balance)