Answered step by step

Verified Expert Solution

Question

1 Approved Answer

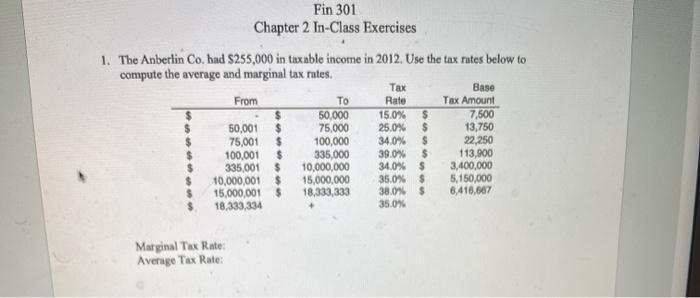

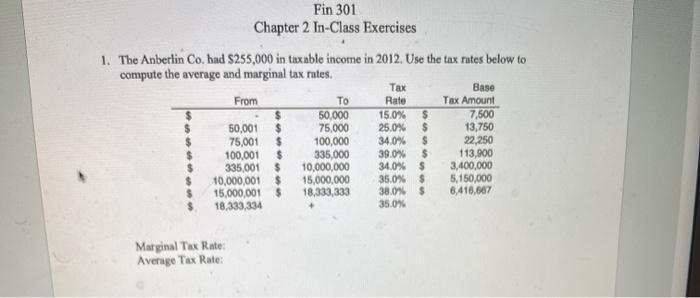

Fin 301 Chapter 2 In-Class Exercises 1. The Anberlin Co. had S255,000 in taxable income in 2012. Use the tax rates below to compute the

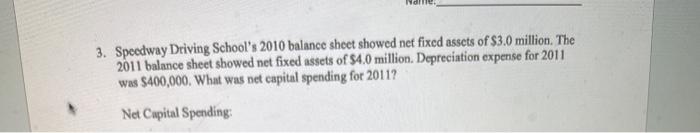

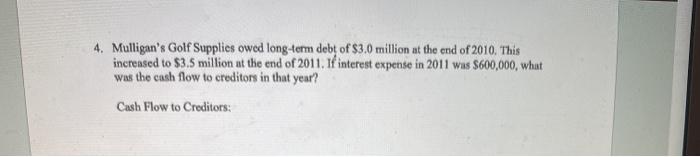

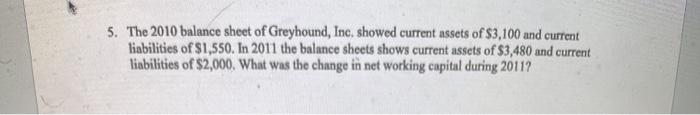

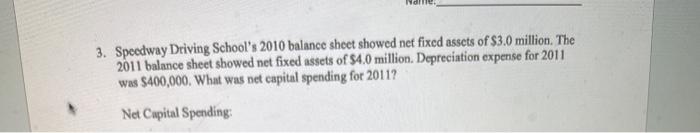

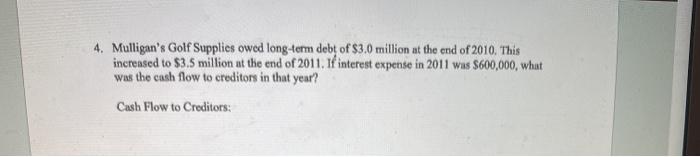

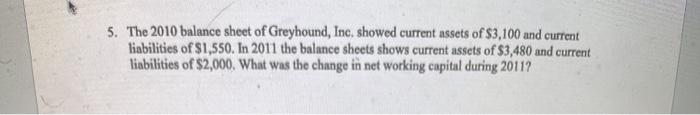

Fin 301 Chapter 2 In-Class Exercises 1. The Anberlin Co. had S255,000 in taxable income in 2012. Use the tax rates below to compute the average and marginal tax rates Tax Base From TO Rate Tax Amount 50,000 15.0% $ 7,500 50,001 75,000 25.0% $ 13,750 75,001 100,000 34.0% $ 22,250 $ 100,001 $ 335,000 39.0% $ 113,900 $ 335,001 $ 10,000,000 34,0% $ 3,400,000 $ 10,000,001$ 15,000,000 35.0% $ 5,150,000 $ 15,000,001 18,333,333 38.0% $ 6,410,667 $ 18,333,334 35.0% Marginal Tax Rate: Average Tax Rate: 3. Speedway Driving School's 2010 balance sheet showed net fixed assets of $3.0 million. The 2011 balance sheet showed net fixed assets of $4.0 million. Depreciation expense for 2011 was $400,000. What was net capital spending for 2011? Net Capital Spending 4. Mulligan's Golf Supplies owod long-term debt of $3.0 million at the end of 2010. This increased to $3.5 million at the end of 2011. If interest expense in 2011 was $600,000, what was the cash flow to creditors in that year? Cash Flow to Creditors: 5. The 2010 balance sheet of Greyhound, Inc. showed current assets of $3,100 and current liabilities of $1,550. In 2011 the balance sheets shows current assets of $3,480 and current liabilities of $2,000. What was the change in net working capital during 2011

Fin 301 Chapter 2 In-Class Exercises 1. The Anberlin Co. had S255,000 in taxable income in 2012. Use the tax rates below to compute the average and marginal tax rates Tax Base From TO Rate Tax Amount 50,000 15.0% $ 7,500 50,001 75,000 25.0% $ 13,750 75,001 100,000 34.0% $ 22,250 $ 100,001 $ 335,000 39.0% $ 113,900 $ 335,001 $ 10,000,000 34,0% $ 3,400,000 $ 10,000,001$ 15,000,000 35.0% $ 5,150,000 $ 15,000,001 18,333,333 38.0% $ 6,410,667 $ 18,333,334 35.0% Marginal Tax Rate: Average Tax Rate: 3. Speedway Driving School's 2010 balance sheet showed net fixed assets of $3.0 million. The 2011 balance sheet showed net fixed assets of $4.0 million. Depreciation expense for 2011 was $400,000. What was net capital spending for 2011? Net Capital Spending 4. Mulligan's Golf Supplies owod long-term debt of $3.0 million at the end of 2010. This increased to $3.5 million at the end of 2011. If interest expense in 2011 was $600,000, what was the cash flow to creditors in that year? Cash Flow to Creditors: 5. The 2010 balance sheet of Greyhound, Inc. showed current assets of $3,100 and current liabilities of $1,550. In 2011 the balance sheets shows current assets of $3,480 and current liabilities of $2,000. What was the change in net working capital during 2011

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started