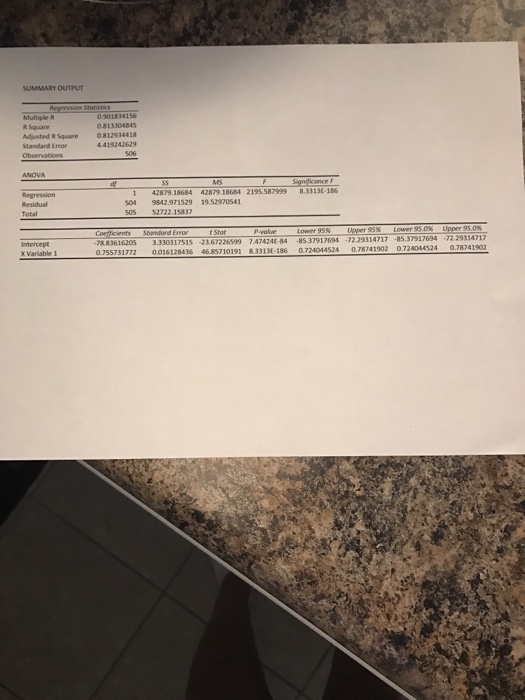

Finance 4020 Homework 5 Due Tuesday, 3/14 at the beginning of class Use Yahoo Finance (finance.yahoo.com) to download the historical prices for Caterpillar (CAT) and (SPY). Download adjusted closing prices at a daily frequency for the period from 3/9/2015 to 3/9/2017. For the purposes of this assignment and given the recent interest rate environment, you may assume a risk- free rate of 0% when running the regression. However, note that this will not always be the case, and normally we would subtract the risk-free rate from each return. Please staple your regression output (reduced to one single printed page) to this document to turn in. 1. Use a CAPM single-index framework to find the beta for CAT. What information does this beta provide you as an investor? Interpret the coefficient in terms of both magnitude and statistical significance. 2. What is CAT s alpha? What information does the alpha provide an investor? Interpret the alpha in terms of magnitude and significance. 3. Using CAT's beta, find the difference between CAT's actual return and expected return on March 2nd, 2017. Finance 4020 Homework 5 Due Tuesday, 3/14 at the beginning of class Use Yahoo Finance (finance.yahoo.com) to download the historical prices for Caterpillar (CAT) and (SPY). Download adjusted closing prices at a daily frequency for the period from 3/9/2015 to 3/9/2017. For the purposes of this assignment and given the recent interest rate environment, you may assume a risk- free rate of 0% when running the regression. However, note that this will not always be the case, and normally we would subtract the risk-free rate from each return. Please staple your regression output (reduced to one single printed page) to this document to turn in. 1. Use a CAPM single-index framework to find the beta for CAT. What information does this beta provide you as an investor? Interpret the coefficient in terms of both magnitude and statistical significance. 2. What is CAT s alpha? What information does the alpha provide an investor? Interpret the alpha in terms of magnitude and significance. 3. Using CAT's beta, find the difference between CAT's actual return and expected return on March 2nd, 2017