Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Investments Need full answers Thanks. Question 4 (16 Marks) a) You are managing an employee benefit fund which has a number of liabilities due

Finance Investments Need full answers Thanks.

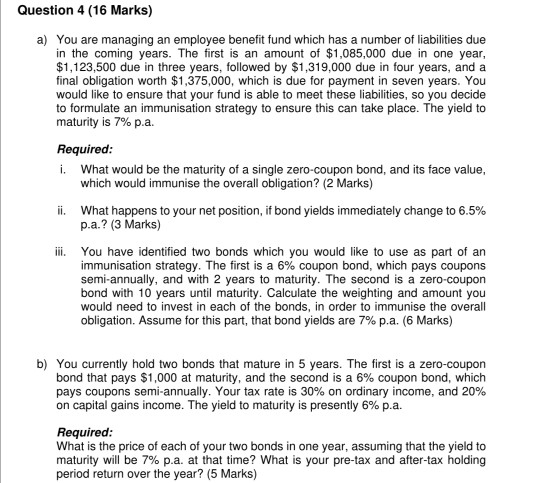

Question 4 (16 Marks) a) You are managing an employee benefit fund which has a number of liabilities due in the coming years. The first is an amount of $1,085,000 due in one year, $1,123,500 due in three years, followed by $1,319,000 due in four years, and a final obligation worth $1,375,000, which is due for payment in seven years. You would like to ensure that your fund is able to meet these liabilities, so you decide to formulate an immunisation strategy to ensure this can take place. The yield to maturity is 7% p.a. Required: i. What would be the maturity of a single zero-coupon bond, and its face value, which would immunise the overall obligation? (2 Marks) ii. What happens to your net position, if bond yields immediately change to 6.5% p.a.? (3 Marks) iii. You have identified two bonds which you would like to use as part of an immunisation strategy. The first is a 6% coupon bond, which pays coupons semi-annually, and with 2 years to maturity. The second is a zero-coupon bond with 10 years until maturity. Calculate the weighting and amount you would need to invest in each of the bonds, in order to immunise the overall obligation. Assume for this part, that bond yields are 7% p.a. (6 Marks) b) You currently hold two bonds that mature in 5 years. The first is a zero-coupon bond that pays $1,000 at maturity, and the second is a 6% coupon bond, which pays coupons semi-annually. Your tax rate is 30% on ordinary income, and 20% on capital gains income. The yield to maturity is presently 6% p.a. Required: What is the price of each of your two bonds in one year, assuming that the yield to maturity will be 7% p.a. at that time? What is your pre-tax and after-tax holding period return over the year? (5 Marks) Question 4 (16 Marks) a) You are managing an employee benefit fund which has a number of liabilities due in the coming years. The first is an amount of $1,085,000 due in one year, $1,123,500 due in three years, followed by $1,319,000 due in four years, and a final obligation worth $1,375,000, which is due for payment in seven years. You would like to ensure that your fund is able to meet these liabilities, so you decide to formulate an immunisation strategy to ensure this can take place. The yield to maturity is 7% p.a. Required: i. What would be the maturity of a single zero-coupon bond, and its face value, which would immunise the overall obligation? (2 Marks) ii. What happens to your net position, if bond yields immediately change to 6.5% p.a.? (3 Marks) iii. You have identified two bonds which you would like to use as part of an immunisation strategy. The first is a 6% coupon bond, which pays coupons semi-annually, and with 2 years to maturity. The second is a zero-coupon bond with 10 years until maturity. Calculate the weighting and amount you would need to invest in each of the bonds, in order to immunise the overall obligation. Assume for this part, that bond yields are 7% p.a. (6 Marks) b) You currently hold two bonds that mature in 5 years. The first is a zero-coupon bond that pays $1,000 at maturity, and the second is a 6% coupon bond, which pays coupons semi-annually. Your tax rate is 30% on ordinary income, and 20% on capital gains income. The yield to maturity is presently 6% p.a. Required: What is the price of each of your two bonds in one year, assuming that the yield to maturity will be 7% p.a. at that time? What is your pre-tax and after-tax holding period return over the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started