Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial accounting Alilali LTD is a consumer products manufacturing company based in the Gauteng province. Alilali LTD got listed on the JSE LTD in 2015.

financial accounting

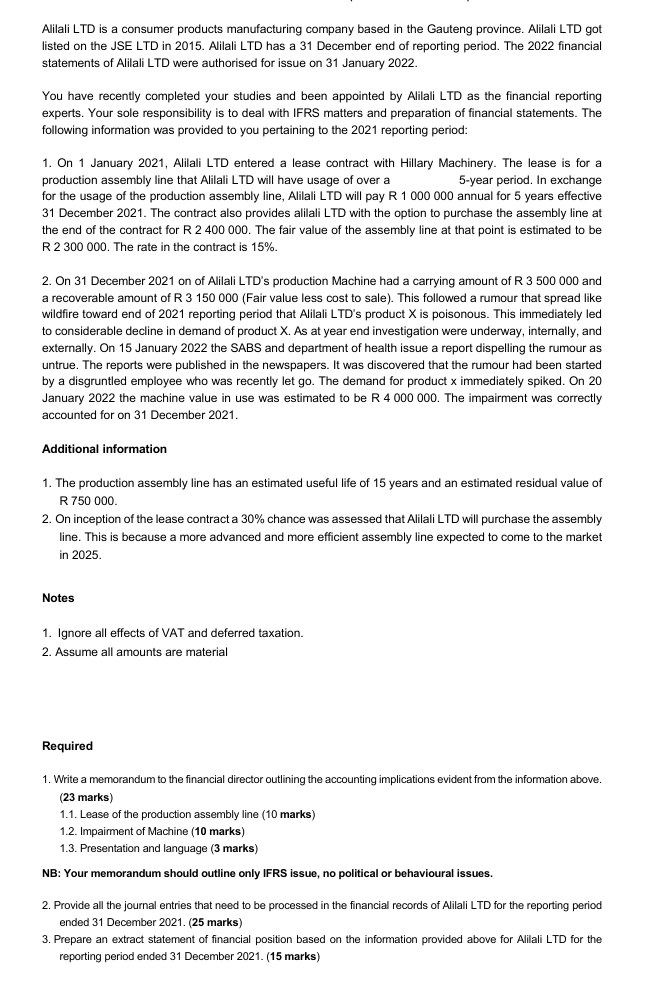

Alilali LTD is a consumer products manufacturing company based in the Gauteng province. Alilali LTD got listed on the JSE LTD in 2015. Alilali LTD has a 31 December end of reporting period. The 2022 financial statements of Alilali LTD were authorised for issue on 31 January 2022. You have recently completed your studies and been appointed by Alilali LTD as the financial reporting experts. Your sole responsibility is to deal with IFRS matters and preparation of financial statements. The following information was provided to you pertaining to the 2021 reporting period: 1. On 1 January 2021, Alilali LTD entered a lease contract with Hillary Machinery. The lease is for a production assembly line that Alilali LTD will have usage of over a 5-year period. In exchange for the usage of the production assembly line, Alilali LTD will pay R 1 000 000 annual for 5 years effective 31 December 2021. The contract also provides alilali LTD with the option to purchase the assembly line at the end of the contract for R 2 400 000. The fair value of the assembly line at that point is estimated to be R 2 300 000. The rate in the contract is 15%. 2. On 31 December 2021 on of Alilali LTD's production Machine had a carrying amount of R 3 500 000 and a recoverable amount of R 3 150 000 (Fair value less cost to sale). This followed a rumour that spread like wildfire toward end of 2021 reporting period that Alilali LTD's product X is poisonous. This immediately led to considerable decline in demand of product X. As at year end investigation were underway, internally, and externally. On 15 January 2022 the SABS and department of health issue a report dispelling the rumour as untrue. The reports were published in the newspapers. It was discovered that the rumour had been started by a disgruntled employee who was recently let go. The demand for product x immediately spiked. On 20 January 2022 the machine value in use was estimated to be R 4 000 000. The impairment was correctly accounted for on 31 December 2021. Additional information 1. The production assembly line has an estimated useful life of 15 years and an estimated residual value of R 750 000. 2. On inception of the lease contract a 30% chance was assessed that Alilali LTD will purchase the assembly line. This is because a more advanced and more efficient assembly line expected to come to the market in 2025. Notes 1. Ignore all effects of VAT and deferred taxation. 2. Assume all amounts are material Required 1. Write a memorandum to the financial director outlining the accounting implications evident from the information above. (23 marks) 1.1. Lease of the production assembly line (10 marks) 1.2. Impairment of Machine (10 marks) 1.3. Presentation and language (3 marks) NB: Your memorandum should outline only IFRS issue, no political or behavioural issues. 2. Provide all the journal entries that need to be processed in the financial records of Alilali LTD for the reporting period ended 31 December 2021. (25 marks) 3. Prepare an extract statement of financial position based on the information provided above for Alilali LTD for the reporting period ended 31 December 2021. (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started