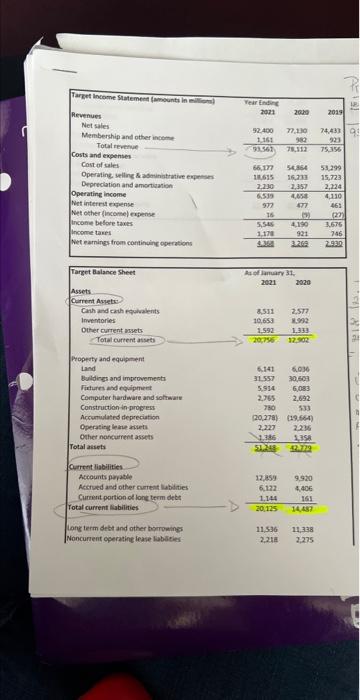

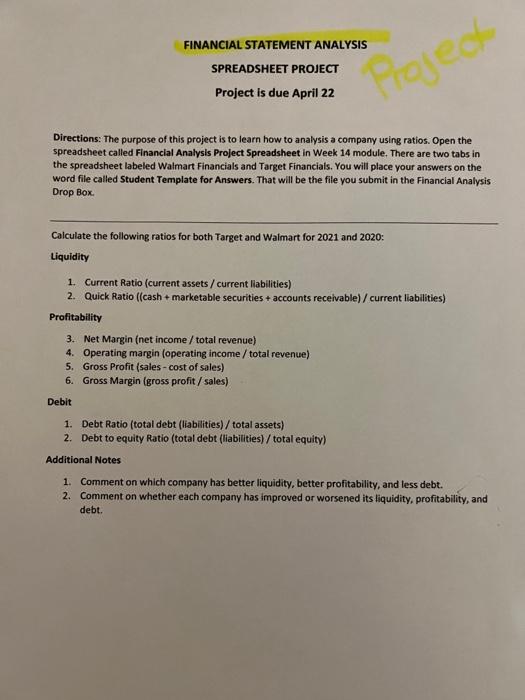

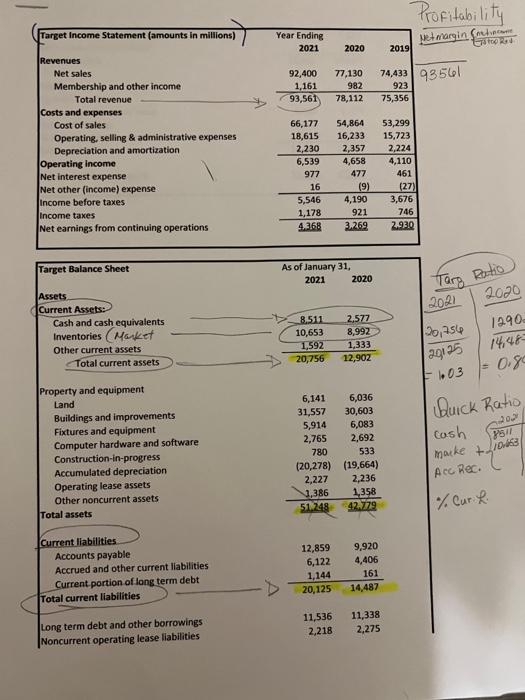

FINANCIAL STATEMENT ANALYSIS SPREADSHEET PROJECT Project is due April 22 Directions: The purpose of this project is to learn how to analvsis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the

FINANCIAL STATEMENT ANALYSIS SPREADSHEET PROJECT Project is due April 22 Directions: The purpose of this project is to learn how to analvsis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the

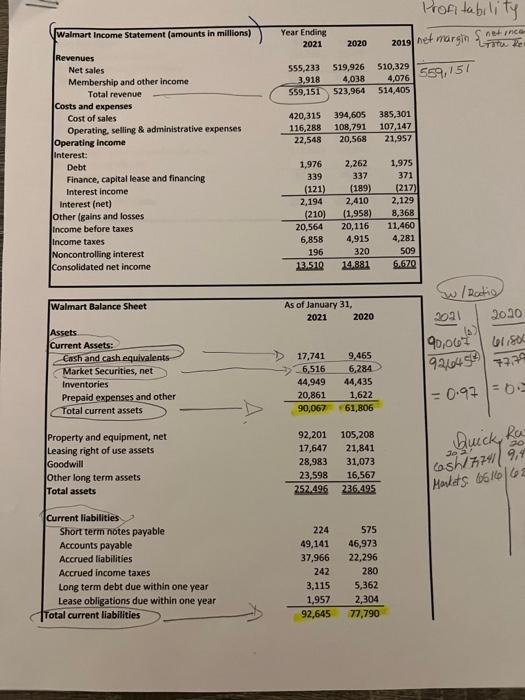

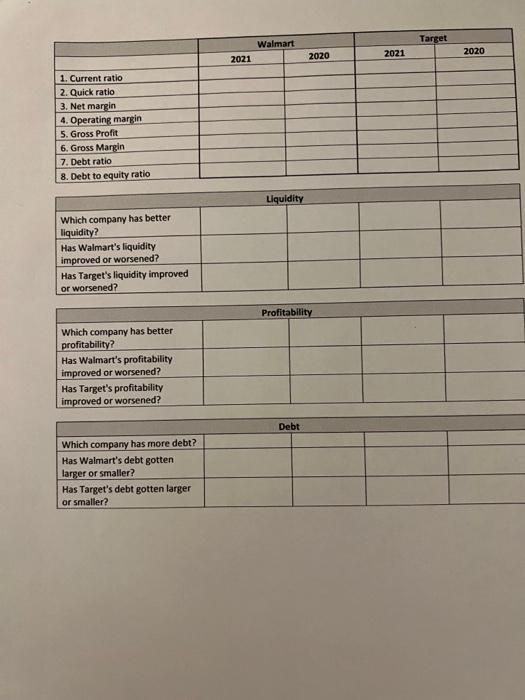

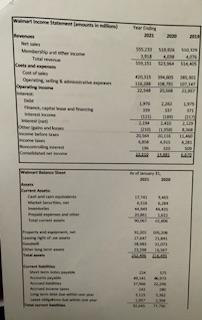

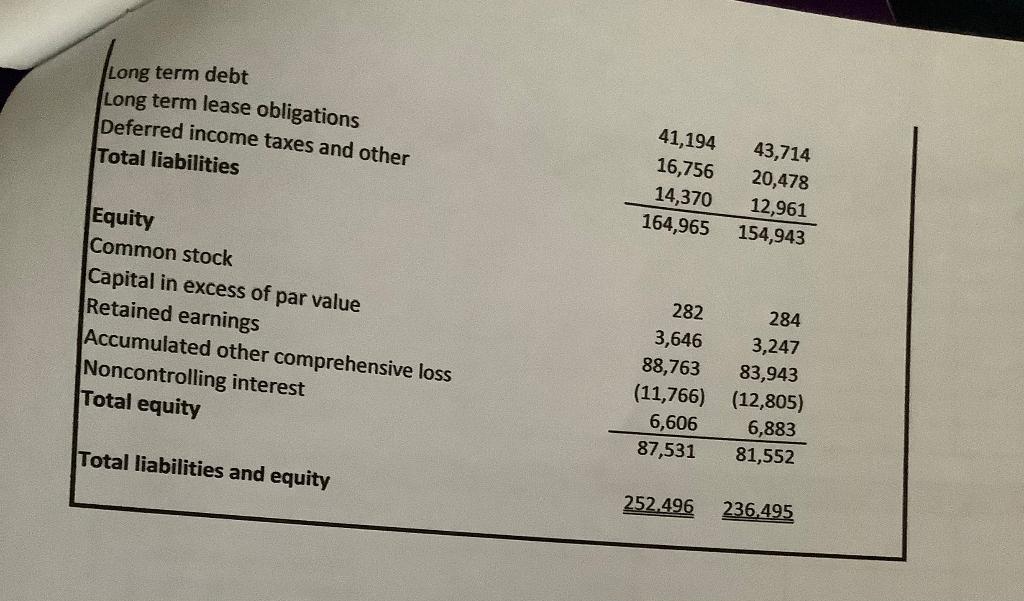

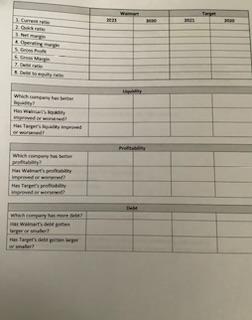

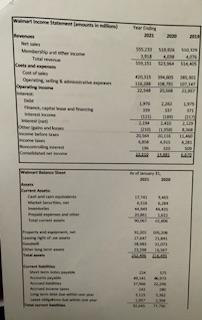

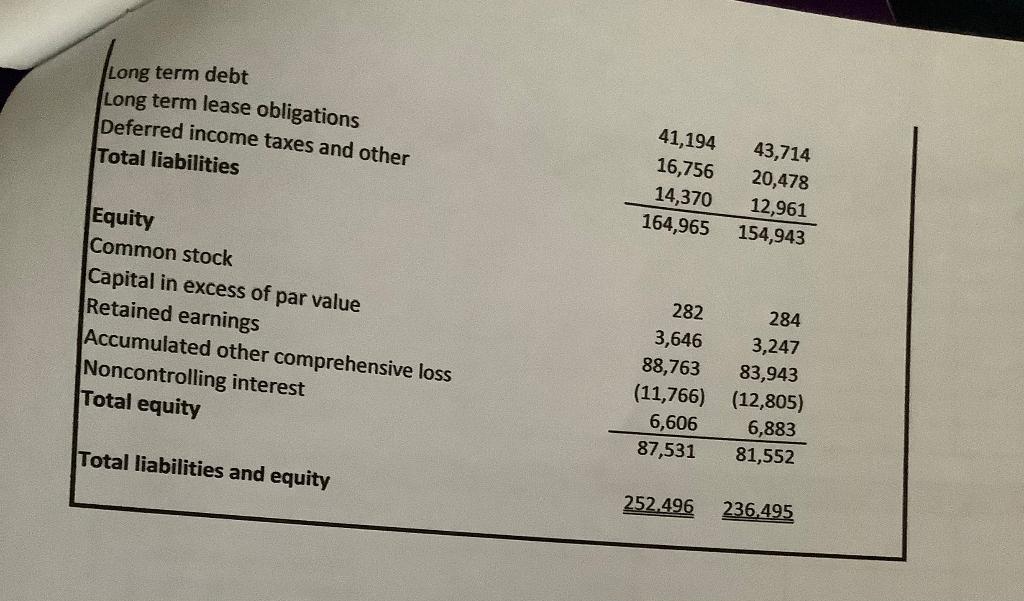

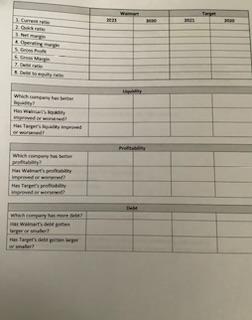

Long term debt Long term lease obligations Deferred income taxes and other Total liabilities Equity Common stock Capital in excess of par value Retained earnings Noncontrolling interest Total equity Total liabilities and equity \begin{tabular}{rr} 282 & 284 \\ 3,646 & 3,247 \\ 88,763 & 83,943 \\ (11,766) & (12,805) \\ 6,606 & 6,883 \\ \hline 87,531 & 81,552 \\ 252,496 & 236,495 \\ \hline \end{tabular} Directions: The purpose of this project is to learn how to analysis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the following ratios for both Target and Walmart for 2021 and 2020: Liquidity 1. Current Ratio (current assets / current liabilities) 2. Quick Ratio ((cash + marketable securities + accounts receivable) / current liabilities) Profitability 3. Net Margin (net income/ total revenue) 4. Operating margin (operating income / total revenue) 5. Gross Profit (sales - cost of sales) 6. Gross Margin (gross profit/sales) Debit 1. Debt Ratio (total debt (liabilities)/ total assets) 2. Debt to equity Ratio (total debt (liabilities) / total equity) Additional Notes 1. Comment on which company has better liquidity, better profitability, and less debt. 2. Comment on whether each company has improved or worsened its liquidity, profitability, and debt. Revenues Net sales Membership and other income Total revenue Costs and expenses \begin{tabular}{rrr} 555,233 & 519,926 & 510,329 \\ 3,918 & 4,038 & 4,076 \\ \hline 559,151 & 523,964 & 514,405 \end{tabular} Cost of sales Operating selling \& administrative expenses Operating income \begin{tabular}{rrr} 420,315 & 394,605 & 385,301 \\ 116,288 & 108,791 & 107,147 \\ \hline 22,548 & 20,568 & 21,957 \end{tabular} Interest: Debt Finance, capital lease and financing Interest income Interest (net) Other (gains and losses income before taxes Income taxes Noncontrolling interest Consolidated net income \begin{tabular}{rrr} 1,976 & 2,262 & 1,975 \\ 339 & 337 & 371 \\ (121) & (189) & (217) \\ \hline 2,194 & 2,410 & 2,129 \\ (210) & (1,958) & 8,368 \\ \hline 20,564 & 20,116 & 11,460 \\ 6,858 & 4,915 & 4,281 \\ 196 & 320 & 509 \\ \hline 13,510 & 14,881 & 6,670 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & \multicolumn{1}{|c|}{ Walmart } & \multicolumn{2}{|c|}{ Target } \\ \hline & 2021 & 2020 & 2020 \\ \hline 1. Current ratio & & & & \\ \hline 2. Quick ratio & & & & \\ \hline 3. Net margin & & & & \\ \hline 4. Operating margin & & & & \\ \hline 5. Gross Profit & & & & \\ \hline 6. Gross Margin & & & & \\ \hline 7. Debt ratio & & & & \\ \hline 8. Debt to equity ratio & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Uquidity } & \\ \hline Whichcompanyhasbetterliquidity? & & & & \\ \hline HasWalmartsliquidityimprovedorworsened? & & & \\ \hline HasTargetsliquidityimprovedorworsened? & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debt } & \\ \hline Which company has more debt? & & & \\ \hline HasWalmartsdebtgottenlargerorsmaller? & & & \\ \hline HasTargetsdebtgottenlargerorsmaller? & & & \\ \hline \end{tabular} Long term debt Long term lease obligations Deferred income taxes and other Total liabilities Equity Common stock Capital in excess of par value Retained earnings Noncontrolling interest Total equity Total liabilities and equity \begin{tabular}{rr} 282 & 284 \\ 3,646 & 3,247 \\ 88,763 & 83,943 \\ (11,766) & (12,805) \\ 6,606 & 6,883 \\ \hline 87,531 & 81,552 \\ 252,496 & 236,495 \\ \hline \end{tabular} Directions: The purpose of this project is to learn how to analysis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the following ratios for both Target and Walmart for 2021 and 2020: Liquidity 1. Current Ratio (current assets / current liabilities) 2. Quick Ratio ((cash + marketable securities + accounts receivable) / current liabilities) Profitability 3. Net Margin (net income/ total revenue) 4. Operating margin (operating income / total revenue) 5. Gross Profit (sales - cost of sales) 6. Gross Margin (gross profit/sales) Debit 1. Debt Ratio (total debt (liabilities)/ total assets) 2. Debt to equity Ratio (total debt (liabilities) / total equity) Additional Notes 1. Comment on which company has better liquidity, better profitability, and less debt. 2. Comment on whether each company has improved or worsened its liquidity, profitability, and debt. Revenues Net sales Membership and other income Total revenue Costs and expenses \begin{tabular}{rrr} 555,233 & 519,926 & 510,329 \\ 3,918 & 4,038 & 4,076 \\ \hline 559,151 & 523,964 & 514,405 \end{tabular} Cost of sales Operating selling \& administrative expenses Operating income \begin{tabular}{rrr} 420,315 & 394,605 & 385,301 \\ 116,288 & 108,791 & 107,147 \\ \hline 22,548 & 20,568 & 21,957 \end{tabular} Interest: Debt Finance, capital lease and financing Interest income Interest (net) Other (gains and losses income before taxes Income taxes Noncontrolling interest Consolidated net income \begin{tabular}{rrr} 1,976 & 2,262 & 1,975 \\ 339 & 337 & 371 \\ (121) & (189) & (217) \\ \hline 2,194 & 2,410 & 2,129 \\ (210) & (1,958) & 8,368 \\ \hline 20,564 & 20,116 & 11,460 \\ 6,858 & 4,915 & 4,281 \\ 196 & 320 & 509 \\ \hline 13,510 & 14,881 & 6,670 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & \multicolumn{1}{|c|}{ Walmart } & \multicolumn{2}{|c|}{ Target } \\ \hline & 2021 & 2020 & 2020 \\ \hline 1. Current ratio & & & & \\ \hline 2. Quick ratio & & & & \\ \hline 3. Net margin & & & & \\ \hline 4. Operating margin & & & & \\ \hline 5. Gross Profit & & & & \\ \hline 6. Gross Margin & & & & \\ \hline 7. Debt ratio & & & & \\ \hline 8. Debt to equity ratio & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Uquidity } & \\ \hline Whichcompanyhasbetterliquidity? & & & & \\ \hline HasWalmartsliquidityimprovedorworsened? & & & \\ \hline HasTargetsliquidityimprovedorworsened? & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debt } & \\ \hline Which company has more debt? & & & \\ \hline HasWalmartsdebtgottenlargerorsmaller? & & & \\ \hline HasTargetsdebtgottenlargerorsmaller? & & & \\ \hline \end{tabular}

FINANCIAL STATEMENT ANALYSIS SPREADSHEET PROJECT Project is due April 22 Directions: The purpose of this project is to learn how to analvsis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the

FINANCIAL STATEMENT ANALYSIS SPREADSHEET PROJECT Project is due April 22 Directions: The purpose of this project is to learn how to analvsis a company using ratios. Open the spreadsheet called Financial Analysis Project Spreadsheet in Week 14 module. There are two tabs in the spreadsheet labeled Walmart Financials and Target Financials. You will place your answers on the word file called Student Template for Answers. That will be the file you submit in the Financial Analysis Drop Box. Calculate the