Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Statement Preparation Case Tyler Smith had worked in an upholstery shop for 1 0 years. Last year, Tyler's wages were $ 2 5 ,

Financial Statement Preparation Case

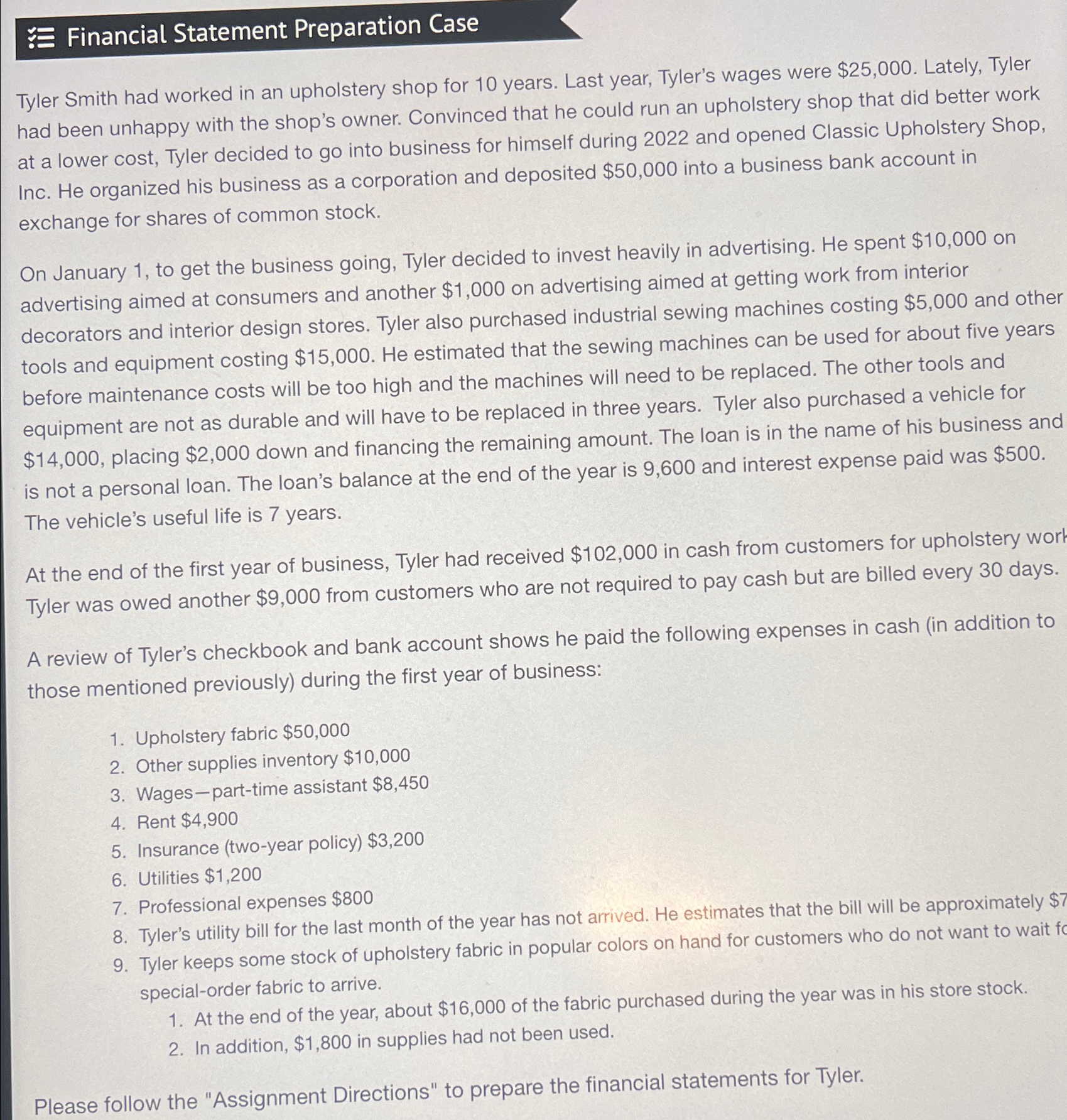

Tyler Smith had worked in an upholstery shop for years. Last year, Tyler's wages were $ Lately, Tyler had been unhappy with the shop's owner. Convinced that he could run an upholstery shop that did better work at a lower cost, Tyler decided to go into business for himself during and opened Classic Upholstery Shop, Inc. He organized his business as a corporation and deposited $ into a business bank account in exchange for shares of common stock.

On January to get the business going, Tyler decided to invest heavily in advertising. He spent $ on advertising aimed at consumers and another $ on advertising aimed at getting work from interior decorators and interior design stores. Tyler also purchased industrial sewing machines costing $ and other tools and equipment costing $ He estimated that the sewing machines can be used for about five years before maintenance costs will be too high and the machines will need to be replaced. The other tools and equipment are not as durable and will have to be replaced in three years. Tyler also purchased a vehicle for $ placing $ down and financing the remaining amount. The loan is in the name of his business and is not a personal loan. The loan's balance at the end of the year is and interest expense paid was $ The vehicle's useful life is years.

At the end of the first year of business, Tyler had received $ in cash from customers for upholstery worl Tyler was owed another $ from customers who are not required to pay cash but are billed every days.

A review of Tyler's checkbook and bank account shows he paid the following expenses in cash in addition to those mentioned previously during the first year of business:

Upholstery fabric $

Other supplies inventory $

Wagesparttime assistant $

Rent $

Insurance twoyear policy $

Utilities $

Professional expenses $

Tyler's utility bill for the last month of the year has not arrived. He estimates that the bill will be approximately $

Tyler keeps some stock of upholstery fabric in popular colors on hand for customers who do not want to wait fo specialorder fabric to arrive.

At the end of the year, about $ of the fabric purchased during the year was in his store stock.

In addition, $ in supplies had not been used.

Please follow the "Assignment Directions" to prepare the financial statements for Tyler.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started