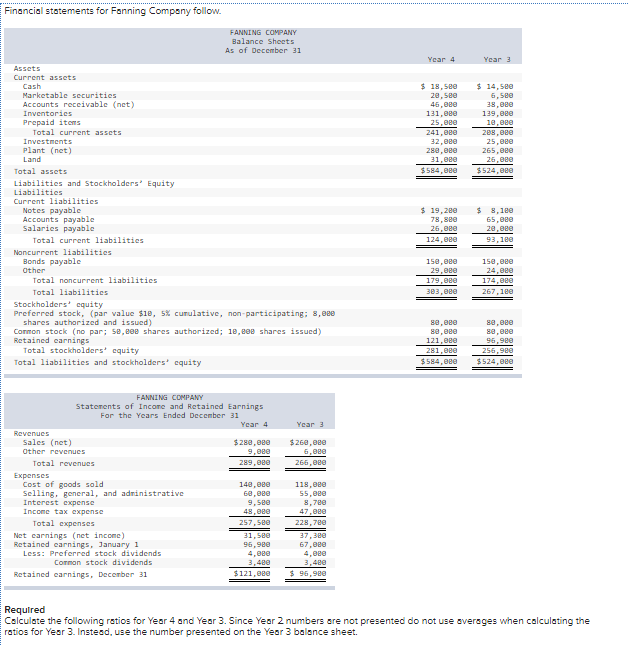

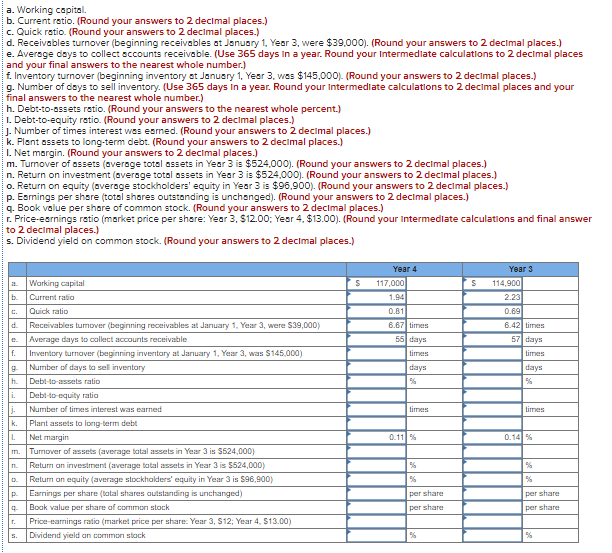

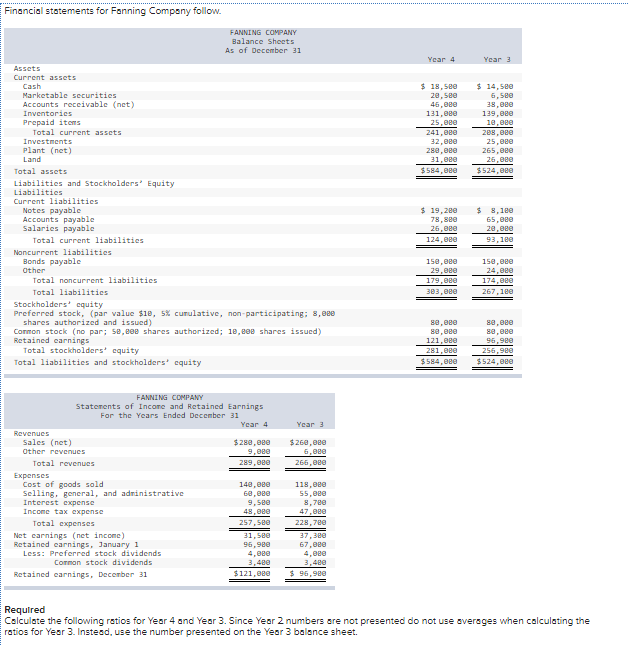

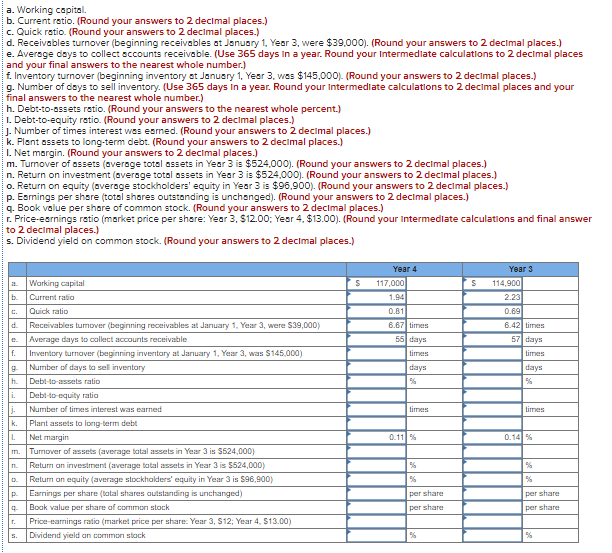

Financial statements for Fanning Company follow. FANNING COMPANY Balance Sheets As of December 31 Year 4 Year 3 $ 18, see 28,588 46, ese 131, eee 25, ese 241,080 32, eee 280, ere 31, 2e $584, eee $ 14,5ee 6,50 38,620 139, eee 10, eee 208, ese 25.000 265.000 26,620 $524,280 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other Total noncurrent liabilities Total liabilities Stockholderst equity Preferred stock, (par value $10, 5% cumulative, non-participating: 3,820 shares authorized and issued) Common stock (no par; 50,200 shares authorized; 10,200 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' cquity $ 19,280 78,880 26,20 124.028 $ 8,120 65.08e 20,20 93,18e 152, ose 29, ege 179, eee 383.000 150.000 24.ee 174,000 267.180 88, ese se, eee 121, ese 281,028 $584, ese 82.ee 88,62 96.900 256.980 $524, Be Year 3 $260, ese 6. eee 266, ege FANNING COMPANY Statements of Income and retained Earnings For the Years Ended December 31 Year 4 Revenues Sales (net) $280,000 Other revenues 9.ece Total revenues 289,08e Expenses Cost of goods sold 140.000 Selling, general, and administrative 68,eee Interest expense 9.500 Income tax expense 48.000 Total expenses 257.580 Net carnings (net income) 31,500 Retained earnings, January 1 96.900 Less: Preferred stock dividends 4.80 Common stock dividends 3.48e Retained carnings, December 31 $121, ese 118.000 55.ee 8.780 47.000 228.780 37,3ee 67.se 4,020 3,40e $ 96,92e Required Calculate the following ratios for Year 4 and Year 3. Since Year 2 numbers are not presented do not use everages when calculating the ratios for Year 3. Instead, use the number presented on the Year 3 balance sheet. a. Working capital b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, Year 3, were $39.000). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable. (Use 365 days in a year. Round your Intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1, Yesr 3. wes $145,000). (Round your answers to 2 decimal places.) 9. Number of days to sell inventory. (Use 365 days in a year. Round your Intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) h. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) 1. Debt-to-equity ratio (Round your answers to 2 decimal places.) 1. Number of times interest wes esmed. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 decimal places.) 1. Net margin. (Round your answers to 2 decimal places.) m. Turnover of assets (average total assets in Year 3 is $524,000). (Round your answers to 2 decimal places.) n. Return on investment (average total assets in Year 3 is $524.000). (Round your answers to 2 decimal places.) o. Return on equity (sverage stockholders' equity in Year 3 is $96.900). (Round your answers to 2 decimal places.) p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) 1. Price-earnings ratio (market price per share: Year 3. $12.00: Year 4. $13.00). (Round your Intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.) Years S Year 4 117,000 1.94 S b 114,900 2.23 0.69 C. 0.81 6.67 56 days times 6.42 time 571 days times f. 9 days 96 days % h. i. Working capital Current ratio Quick ratio Receivables tumover (beginning receivables at January 1. Year 3, were $39,000) Average days to collect accounts receivable Inventory turnover (beginning inventory at January 1, Year 3, was $145,000) Number of days to sel inventory Debt-to-assets ratio Debt-to-equity ratio Number of times interest was earned Plant assets to long-term debt Netmargin Tumover of assets (average total assets in Year 3 is $524,000) Return on investment (average total assets in Year 3 is $524,000) Return on equity (average stockholders' equity in Year 3 is 596,900) Earnings per Share total shares outstanding is unchanged) Book value per share of common stock Price-earnings ratio (market price per share: Year 3, S12 Year 4. $13.00) Dividend yield on common stock times times 1. 0.11% 0.14% m n. % % % 0. % P. per share per share 9- per share per share r. % %