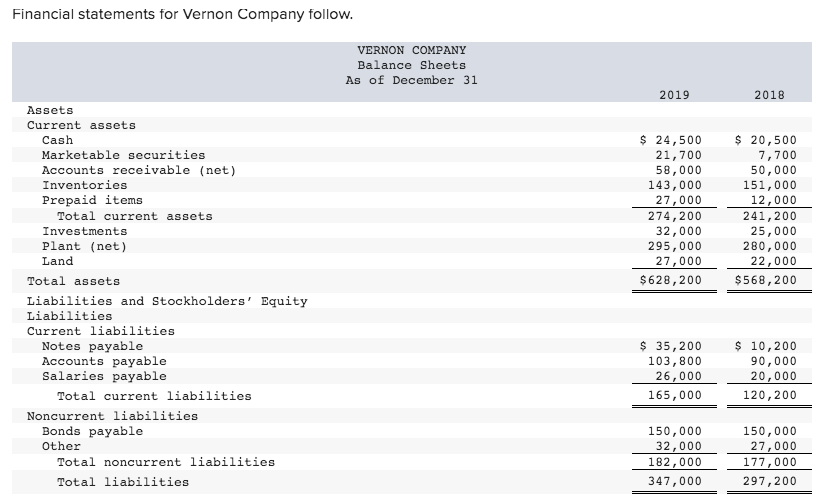

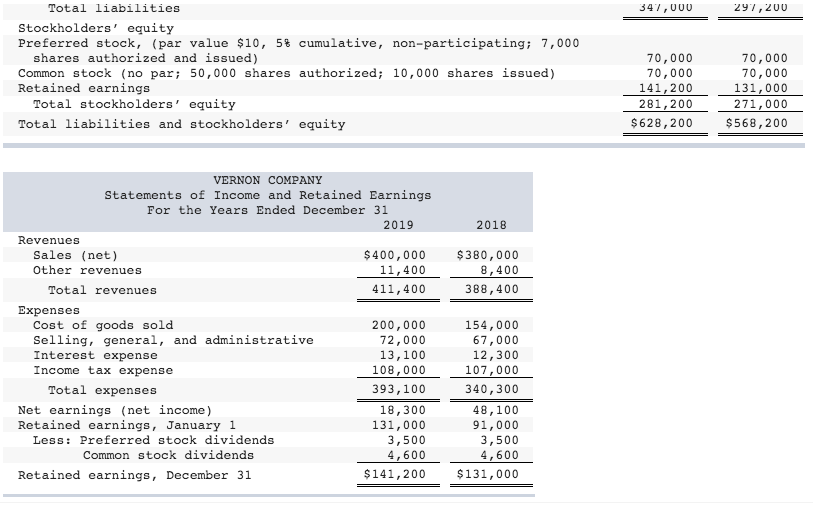

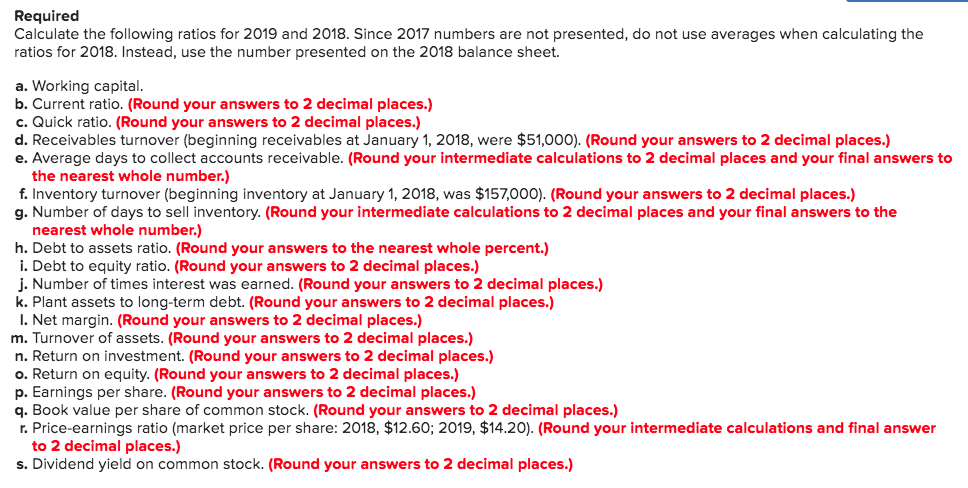

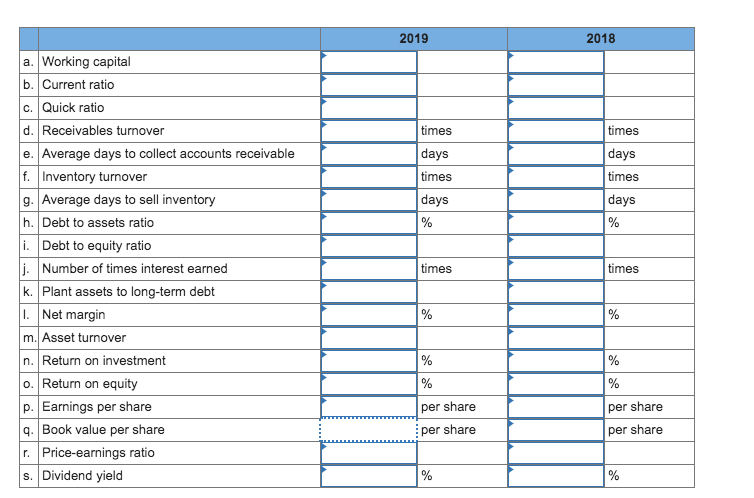

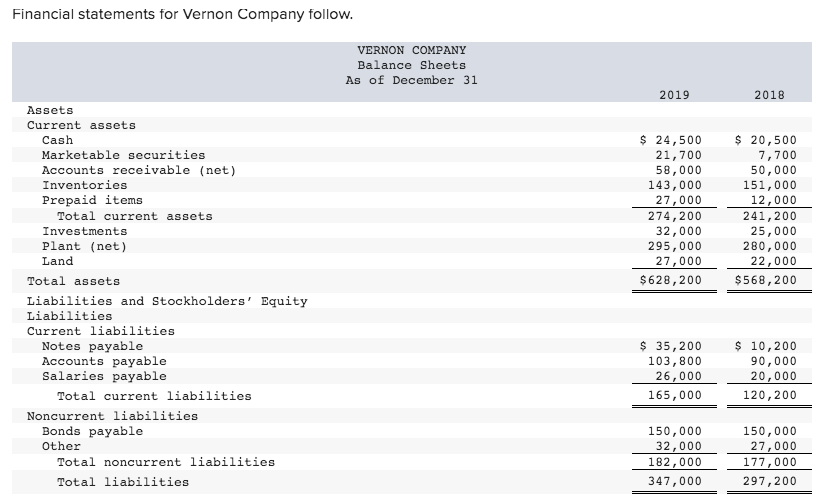

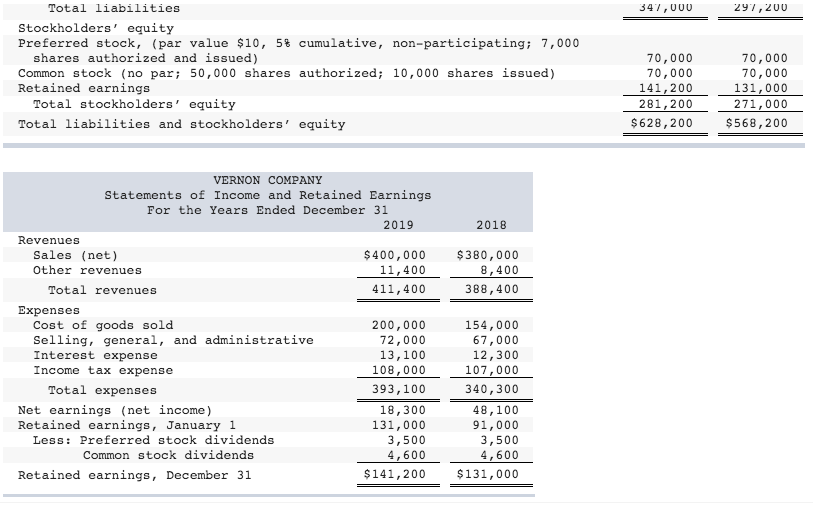

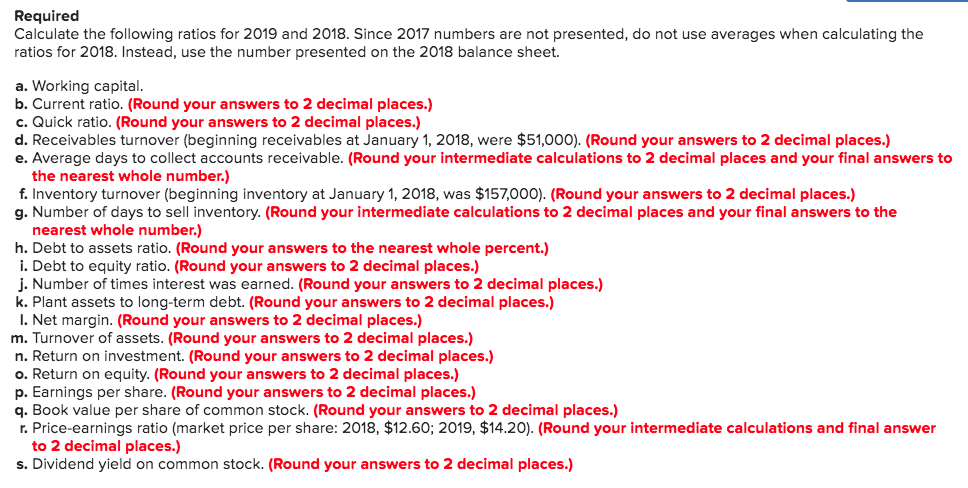

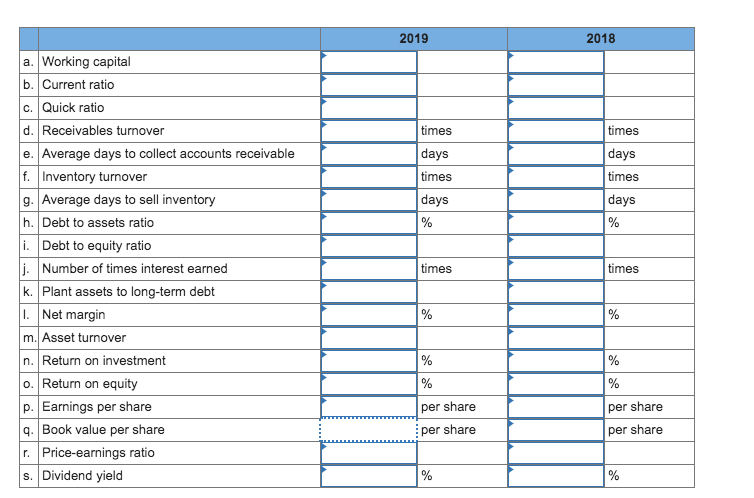

Financial statements for Vernon Company follow. VERNON COMPANY Balance Sheets As of December 31 2019 2018 $ 24,500 21,700 58,000 143,000 27,000 274,200 32,000 295,000 27,000 $628,200 $ 20,500 7,700 50,000 151,000 12,000 241,200 25,000 280,000 22,000 $568,200 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other Total noncurrent liabilities Total liabilities $ 35,200 103,800 26,000 165,000 $ 10,200 90,000 20,000 120, 200 150,000 32,000 182,000 347,000 150,000 27,000 177,000 297,200 347,000 297,200 Total liabilities Stockholders' equity Preferred stock, (par value $10, 5% cumulative, non-participating; 7,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 70,000 70,000 141,200 281, 200 $628,200 70,000 70,000 131,000 271,000 $568,200 2018 $380,000 8,400 388,400 VERNON COMPANY Statements of Income and Retained Earnings For the Years Ended December 31 2019 Revenues Sales (net) $400,000 Other revenues 11,400 Total revenues 411,400 Expenses Cost of goods sold 200,000 Selling, general, and administrative 72,000 Interest expense 13,100 Income tax expense 108,000 Total expenses 393,100 Net earnings (net income) 18,300 Retained earnings, January 1 131,000 Less: Preferred stock dividends 3,500 Common stock dividends 4,600 Retained earnings, December 31 $141,200 154,000 67,000 12,300 107,000 340,300 48, 100 91,000 3,500 4,600 $131,000 Required Calculate the following ratios for 2019 and 2018. Since 2017 numbers are not presented, do not use averages when calculating the ratios for 2018. Instead, use the number presented on the 2018 balance sheet. a. Working capital. b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, 2018, were $51,000). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1, 2018, was $157,000). (Round your answers to 2 decimal places.) g. Number of days to sell inventory. (Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) h. Debt to assets ratio. (Round your answers to the nearest whole percent.) i. Debt to equity ratio. (Round your answers to 2 decimal places.) j. Number of times interest was earned. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 decimal places.) I. Net margin. (Round your answers to 2 decimal places.) m. Turnover of assets. (Round your answers to 2 decimal places.) n. Return on investment. (Round your answers to 2 decimal places.) o. Return on equity. (Round your answers to 2 decimal places.) p. Earnings per share. (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price-earnings ratio (market price per share: 2018, $12.60; 2019, $14.20). (Round your intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.) 2019 2018 times days times days times days times days a. Working capital b. Current ratio c. Quick ratio d. Receivables turnover e. Average days to collect accounts receivable f. Inventory turnover g. Average days to sell inventory h. Debt to assets ratio i. Debt to equity ratio j. Number of times interest earned k. Plant assets to long-term debt I. Net margin m. Asset turnover n. Return on investment o. Return on equity p. Earnings per share q. Book value per share r. Price-earnings ratio s. Dividend yield times times 1 % per share per share per share per share