Financial Statements Preparation

- The following accounts were taken from the trial balance of Milton Imported Goods, a calendar-year business, as of December 31, 2014 [disregarding effect of income taxes]. Unsold merchandise inventory at year-end amounted to PHP 75,000.

PREPARE THE FOLLOWING:

1. Income Statement - natural form;

2.Statement of Changes in Owner's Equity

3. Statement of Financial Position - report form; and

4. Notes to financial statements.

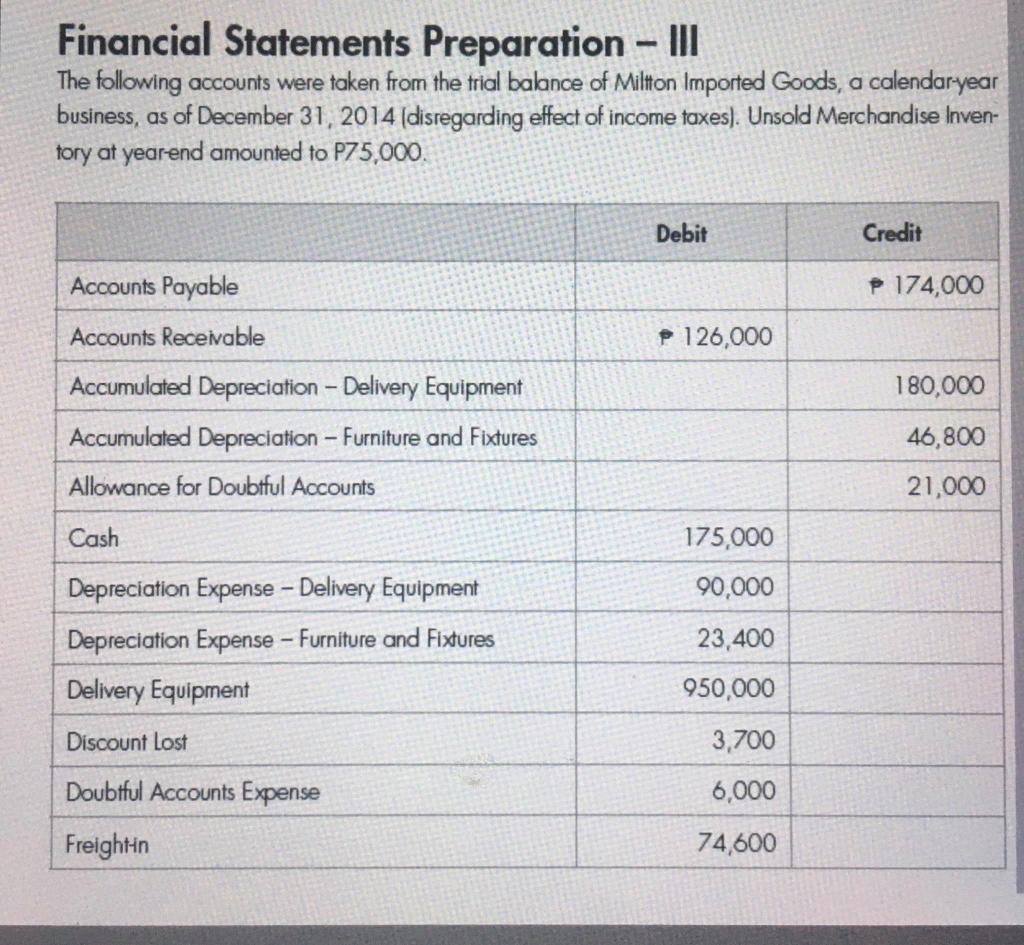

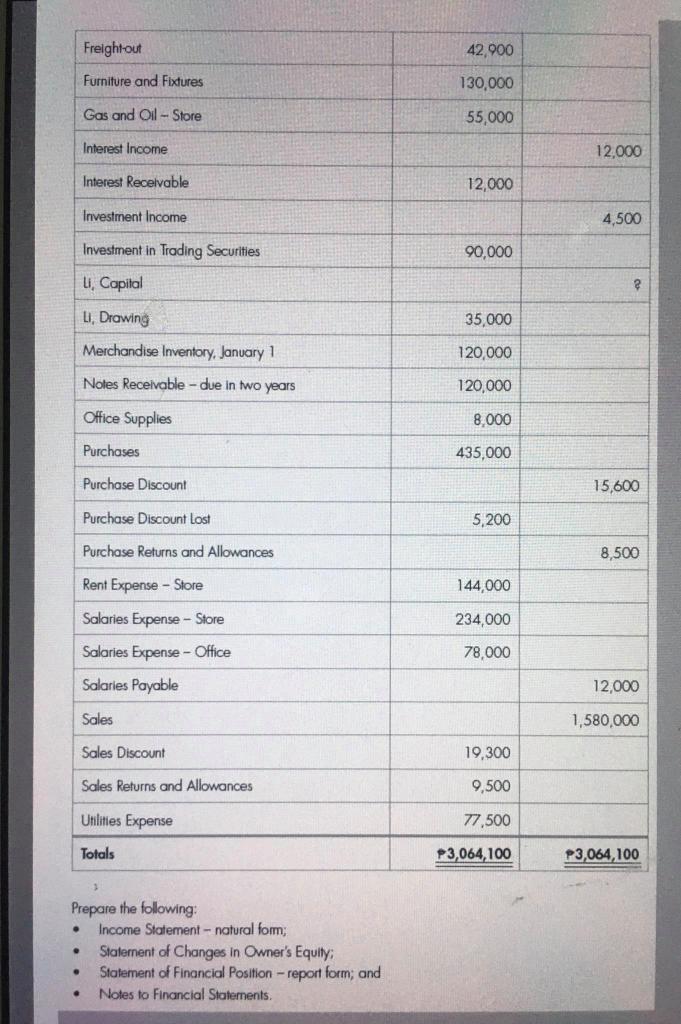

Financial Statements Preparation - III The following accounts were taken from the trial balance of Milton Imported Goods, a calendaryear business, as of December 31, 2014 (disregarding effect of income taxes). Unsold Merchandise Inven- tory at year-end amounted to P75,000. Debit Credit P 174,000 P 126,000 Accounts Payable Accounts Receivable Accumulated Depreciation - Delivery Equipment Accumulated Depreciation - Furniture and Fixtures Allowance for Doubtful Accounts 180,000 46,800 21,000 Cash 175,000 90,000 Depreciation Expense - Delivery Equipment Depreciation Expense - Furniture and Fixtures Delivery Equipment 23,400 950,000 Discount Lost 3,700 Doubtful Accounts Expense 6,000 Freight in 74,600 Freightout 42,900 Furniture and Fixtures 130,000 Gas and oil - Store 55,000 Interest Income 12.000 Interest Receivable 12,000 Investment Income 4,500 Investment in Trading Securities 90,000 LI. Capital 35,000 LI, Drawing Merchandise Inventory, January 1 Notes Receivable - due in two years 120,000 120,000 Office Supplies 8,000 Purchases 435,000 Purchase Discount 15,600 Purchase Discount Lost 5,200 Purchase Returns and Allowances 8,500 144,000 234,000 Rent Expense - Store Salaries Expense - Store Salaries Expense - Office Salaries Payable 78,000 12,000 Sales 1,580,000 Sales Discount 19,300 Sales Returns and Allowances 9,500 Unlities Expense 77,500 Totals P3,064,100 P3,064,100 Prepare the following: Income Statement - natural form: Statement of Changes in Owner's Equity; Statement of Financial Position - report form, and Notes to Financial Statements. Financial Statements Preparation - III The following accounts were taken from the trial balance of Milton Imported Goods, a calendaryear business, as of December 31, 2014 (disregarding effect of income taxes). Unsold Merchandise Inven- tory at year-end amounted to P75,000. Debit Credit P 174,000 P 126,000 Accounts Payable Accounts Receivable Accumulated Depreciation - Delivery Equipment Accumulated Depreciation - Furniture and Fixtures Allowance for Doubtful Accounts 180,000 46,800 21,000 Cash 175,000 90,000 Depreciation Expense - Delivery Equipment Depreciation Expense - Furniture and Fixtures Delivery Equipment 23,400 950,000 Discount Lost 3,700 Doubtful Accounts Expense 6,000 Freight in 74,600 Freightout 42,900 Furniture and Fixtures 130,000 Gas and oil - Store 55,000 Interest Income 12.000 Interest Receivable 12,000 Investment Income 4,500 Investment in Trading Securities 90,000 LI. Capital 35,000 LI, Drawing Merchandise Inventory, January 1 Notes Receivable - due in two years 120,000 120,000 Office Supplies 8,000 Purchases 435,000 Purchase Discount 15,600 Purchase Discount Lost 5,200 Purchase Returns and Allowances 8,500 144,000 234,000 Rent Expense - Store Salaries Expense - Store Salaries Expense - Office Salaries Payable 78,000 12,000 Sales 1,580,000 Sales Discount 19,300 Sales Returns and Allowances 9,500 Unlities Expense 77,500 Totals P3,064,100 P3,064,100 Prepare the following: Income Statement - natural form: Statement of Changes in Owner's Equity; Statement of Financial Position - report form, and Notes to Financial Statements