Find the amount of a deposit worth Php 1200 earning 0.75% interest compounded quarterly after 3 years. How much would you need to invest

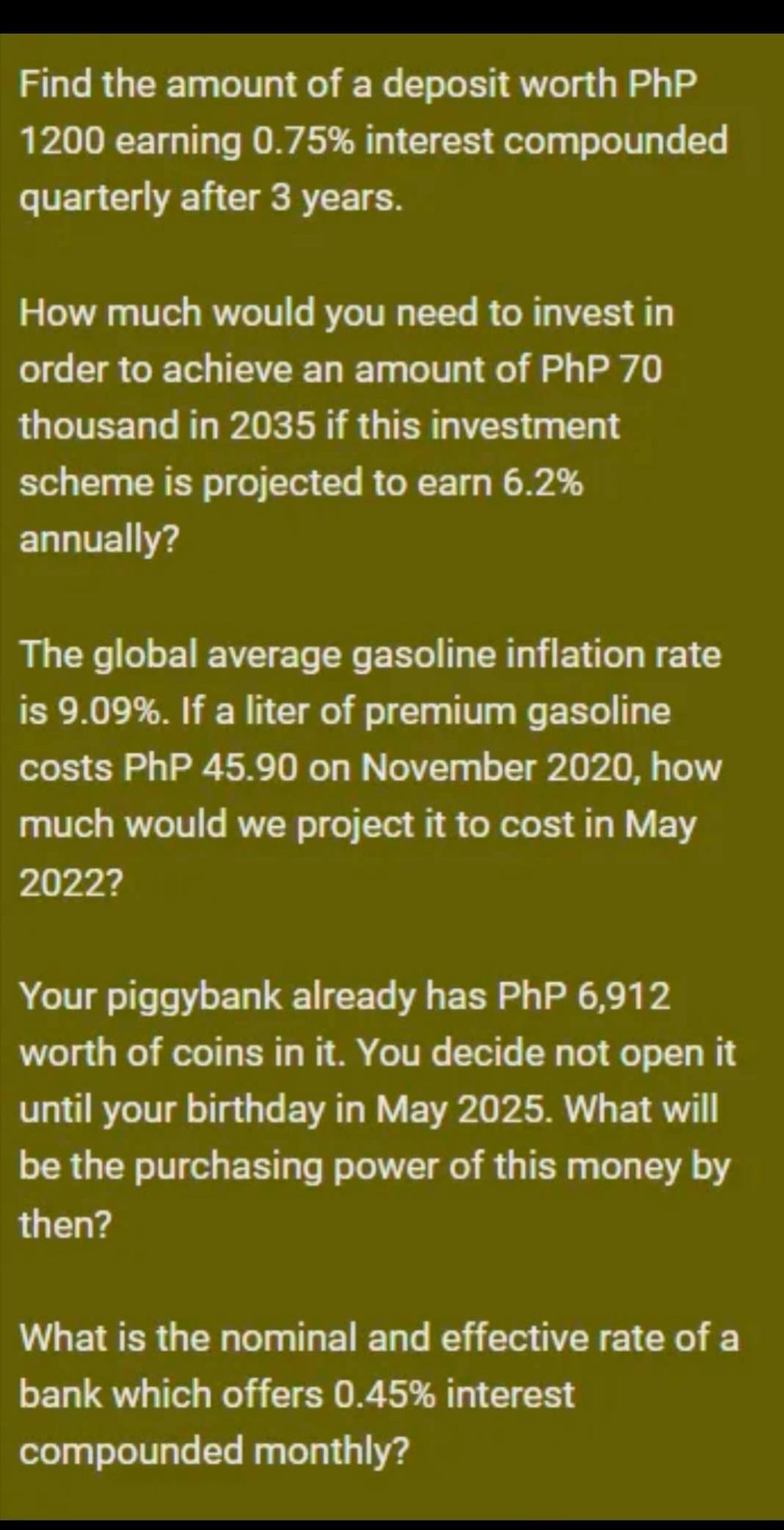

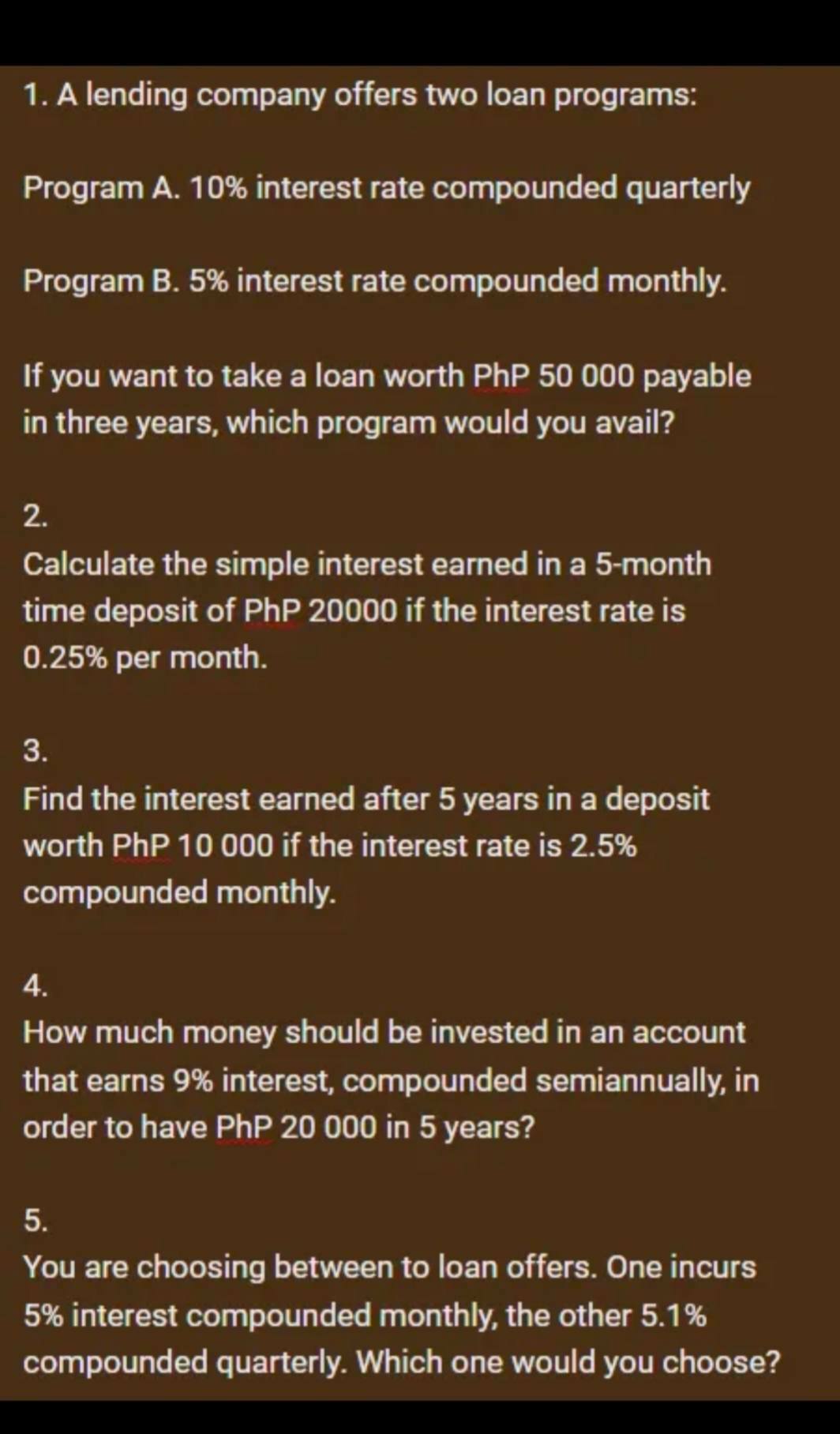

Find the amount of a deposit worth Php 1200 earning 0.75% interest compounded quarterly after 3 years. How much would you need to invest in order to achieve an amount of Php 70 thousand in 2035 if this investment scheme is projected to earn 6.2% annually? The global average gasoline inflation rate is 9.09%. If a liter of premium gasoline costs PhP 45.90 on November 2020, how much would we project it to cost in May 2022? Your piggybank already has Php 6,912 worth of coins in it. You decide not open it until your birthday in May 2025. What will be the purchasing power of this money by then? What is the nominal and effective rate of a bank which offers 0.45% interest compounded monthly? 1. A lending company offers two loan programs: Program A. 10% interest rate compounded quarterly Program B. 5% interest rate compounded monthly. If you want to take a loan worth Php 50 000 payable in three years, which program would you avail? 2. Calculate the simple interest earned in a 5-month time deposit of PhP 20000 if the interest rate is 0.25% per month. 3. Find the interest earned after 5 years in a deposit worth Php 10 000 if the interest rate is 2.5% compounded monthly. 4. How much money should be invested in an account that earns 9% interest, compounded semiannually, in order to have PhP 20 000 in 5 years? 5. You are choosing between to loan offers. One incurs 5% interest compounded monthly, the other 5.1% compounded quarterly. Which one would you choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started