Answered step by step

Verified Expert Solution

Question

1 Approved Answer

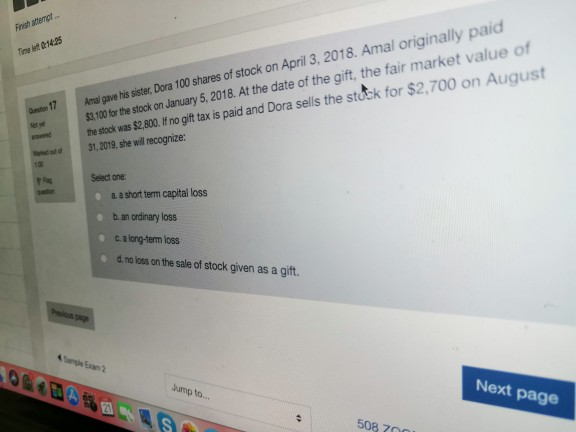

Finish attempt 14:25 Timele Darsten 17 Amal gave his sister, Dora 100 shares of stock on April 3, 2018. Amal originally paid 53.100 for the

Finish attempt 14:25 Timele Darsten 17 Amal gave his sister, Dora 100 shares of stock on April 3, 2018. Amal originally paid 53.100 for the stock on January 5, 2018. At the date of the gift, the fair market value of the stock was $2,800. If no gift tax is paid and Dora sells the stok for $2,700 on August 31, 2019, she will recognize: Select one e a short term capital loss b. an ordinary loss c. a long-term loss do loss on the sale of stock given as a gift. Swop to... Next page 508 700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started