Answered step by step

Verified Expert Solution

Question

1 Approved Answer

first blank: low/high second blank: more/less Distribution decisions are complicated and involve the understanding of critical strategic factors that affect the policy and value of

first blank: low/high

first blank: low/high

second blank: more/less

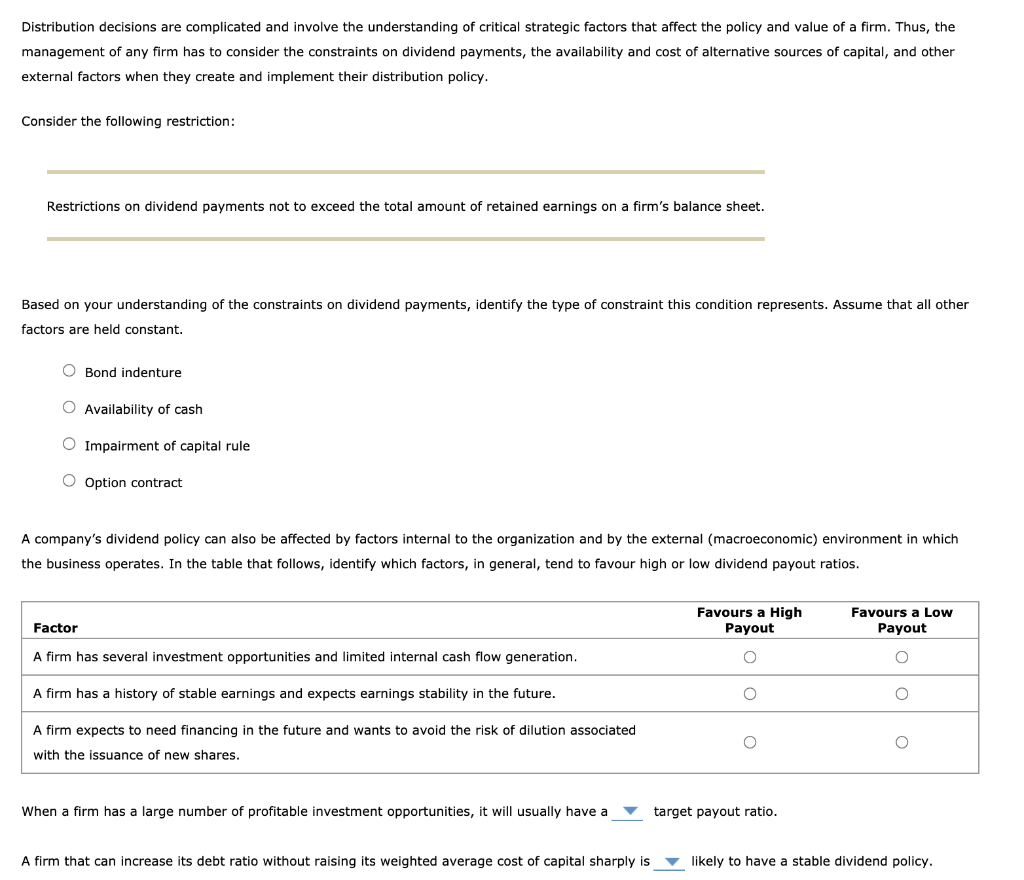

Distribution decisions are complicated and involve the understanding of critical strategic factors that affect the policy and value of a firm. Thus, the management of any firm has to consider the constraints on dividend payments, the availability and cost of alternative sources of capital, and other external factors when they create and implement their distribution policy. Consider the following restriction: Restrictions on dividend payments not to exceed the total amount of retained earnings on a firm's balance sheet. Based on your understanding of the constraints on dividend payments, identify the type of constraint this condition represents. Assume that all other factors are held constant. O Bond indenture Availability of cash O Impairment of capital rule O Option contract A company's dividend policy can also be affected by factors internal to the organization and by the external (macroeconomic) environment in which the business operates. In the table that follows, identify which factors, in general, tend to favour high or low dividend payout ratios. Factor Favours a High Payout Favours a Low Payout A firm has several investment opportunities and limited internal cash flow generation. O A firm has a history of stable earnings and expects earnings stability in the future. O O A firm expects to need financing in the future and wants to avoid the risk of dilution associated O O with the issuance of new shares. When a firm has a large number of profitable investment opportunities, it will usually have a target payout ratio. A firm that can increase its debt ratio without raising its weighted average cost of capital sharply is likely to have a stable dividend policy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started