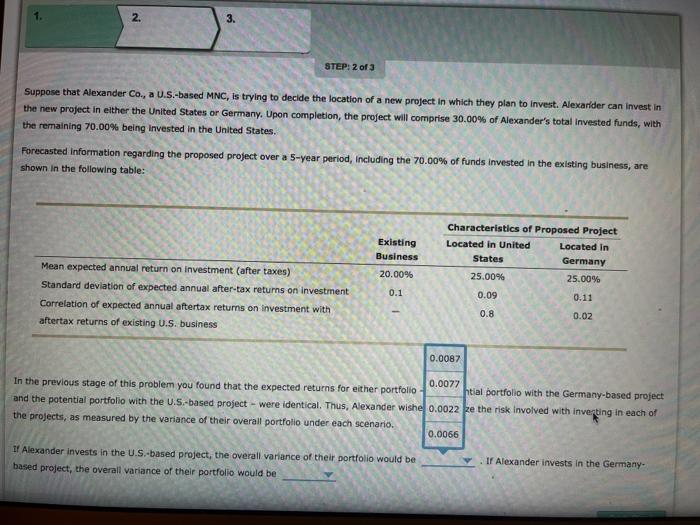

first blank options:

0.0087

0.0077

0.0022

0.0066

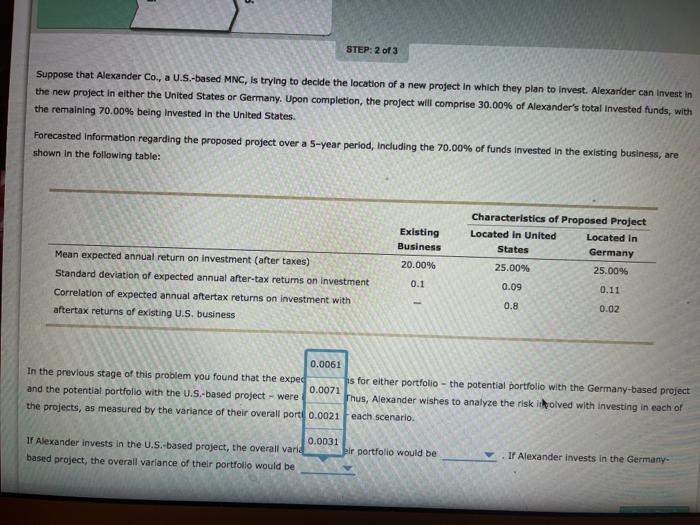

second blank options:

0.0061

0.0071

0.0021

0.0031

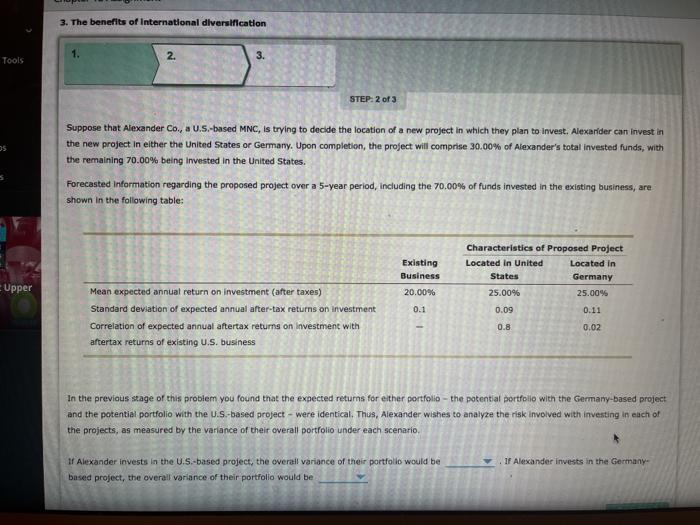

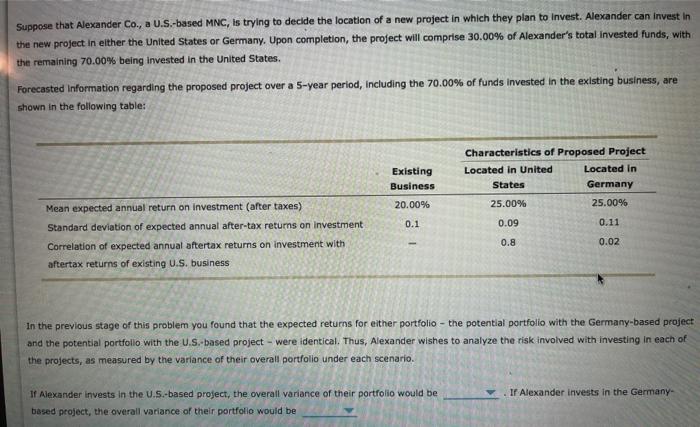

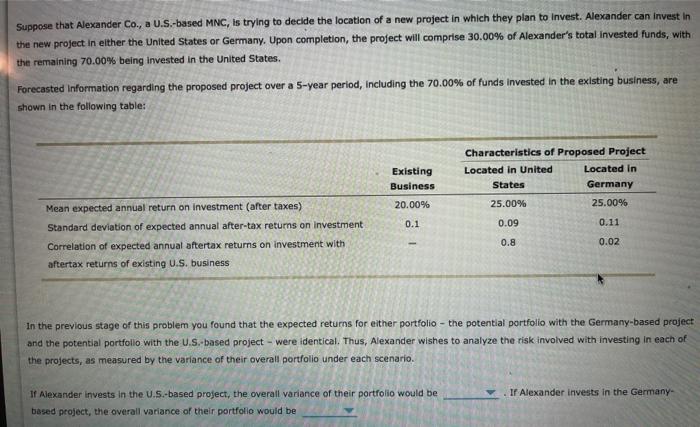

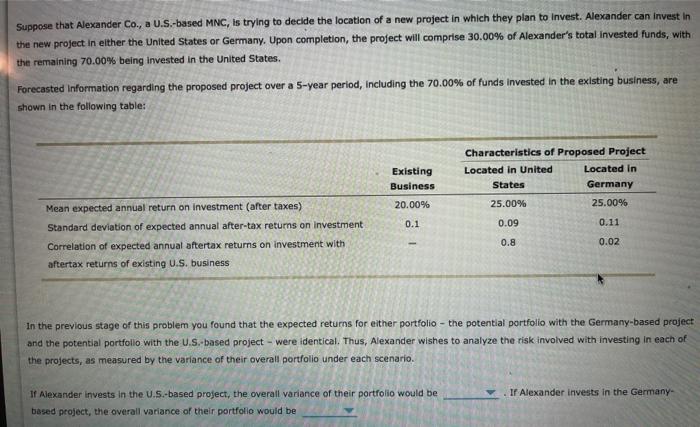

3. The benefits of International diversification 1. Tools 2. 3. STEP 2 of 3 Suppose that Alexander Co., a U.S.-based MNC, Is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States. Forecasted Information regarding the proposed project over a 5-year period, including the 70.00% of funds invested in the existing business, are shown in the following table: Existing Business 20.00% 0.1 Upper Characteristics of Proposed Project Located in United Located in States Germany 25.00% 25.00% 0.09 0.11 Mean expected annual return on investment after taxes) Standard deviation of expected annual after-tax returns on investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 0.8 0.02 In the previous stage of this problem you found that the expected returns for either portfolio - the potential portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were identical. Thus, Alexander wishes to analyze the risk involved with investing in each of the projects, as measured by the variance of their overall portfolio under each scenario If Alexander invests in the Germany If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be based project, the overall variance of their portfolio would be 2. 3. STEP: 2 of 3 Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States. Forecasted Information regarding the proposed project over a 5-year period, including the 70.00% of funds invested in the existing business, are shown in the following table: Existing Business Characteristics of Proposed Project Located in United Located in States Germany 25.00% 25.00% 0.09 0.11 Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 20.00% 0.1 0.8 0.02 0.0087 0.0072 In the previous stage of this problem you found that the expected returns for either portfolio htial portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were identical. Thus, Alexander wishe 0.0022 ze the risk involved with inventing in each of the projects, as measured by the variance of their overall portfolio under each scenario. 0.0066 If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be based project, the overall variance of their portfolio would be . If Alexander invests in the Germany- STEP: 2 of 3 Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can Invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States. Forecasted Information regarding the proposed project over a 5-year period, including the 70.00% of funds invested in the existing business, are shown in the following table: Existing Business 20.00% Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on Investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business Characteristics of Proposed Project Located in United Located in States Germany 25.00% 25.00% 0.09 0.11 0.1 0.8 0.02 0.0061 In the previous stage of this problem you found that the exped is for either portfolio - the potential portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were 0.0071 Thus, Alexander wishes to analyze the risk isolved with investing in each of the projects, as measured by the variance of their overall port 0.0021 each scenario. 0.0031 If Alexander invests in the U.S.-based project, the overall vard bir portfolio would be based project, the overall variance of their portfolio would be If Alexander invests in the Germany Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 30.00% of Alexander's total invested funds, with the remaining 70.00% being invested in the United States Forecasted Information regarding the proposed project over a 5-year period, including the 70.00% of funds invested in the existing business, are shown in the following table: Existing Business Characteristics of Proposed Project Located in United Located in States Germany 25.00% 25.00% 20.00% 0.1 0.09 0.11 Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on Investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 0.8 0.02 In the previous stage of this problem you found that the expected returns for either portfolio - the potential portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were identical. Thus, Alexander wishes to analyze the risk involved with investing in each of the projects, as measured by the variance of their overall portfolio under each scenario. Ir Alexander invests in the Germany If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be based project, the overall variance of their portfolio would be