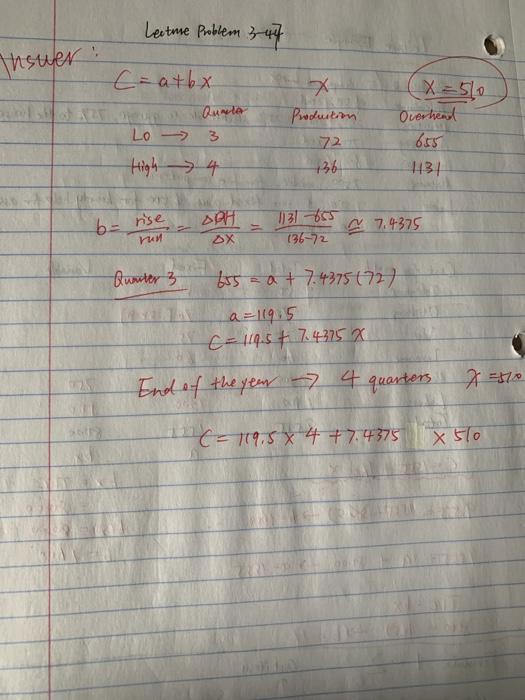

First two photos are questions. Third and forth are example answer for similar qs like that. Thanks!

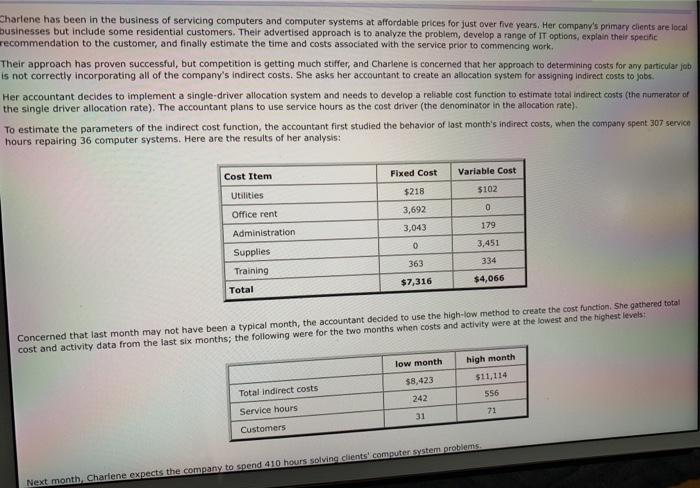

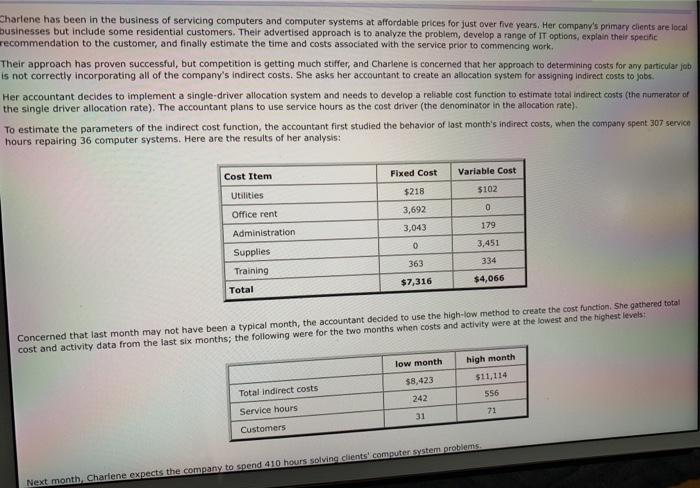

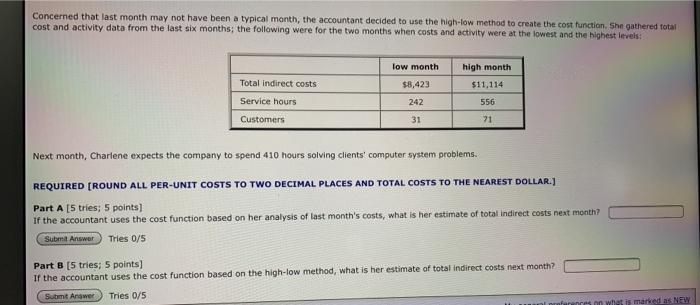

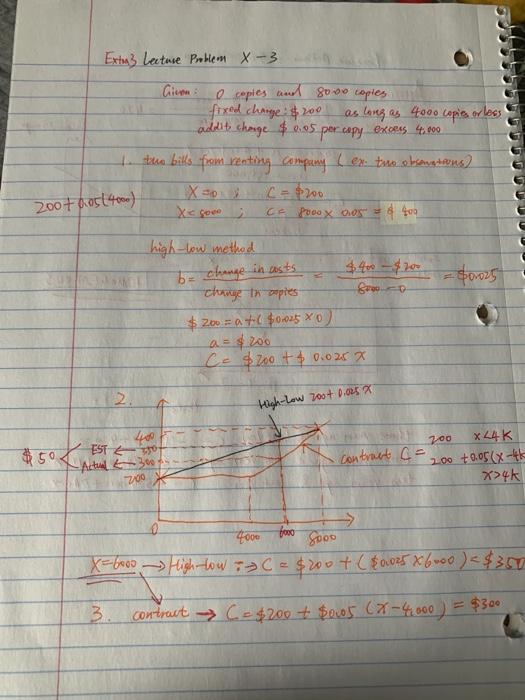

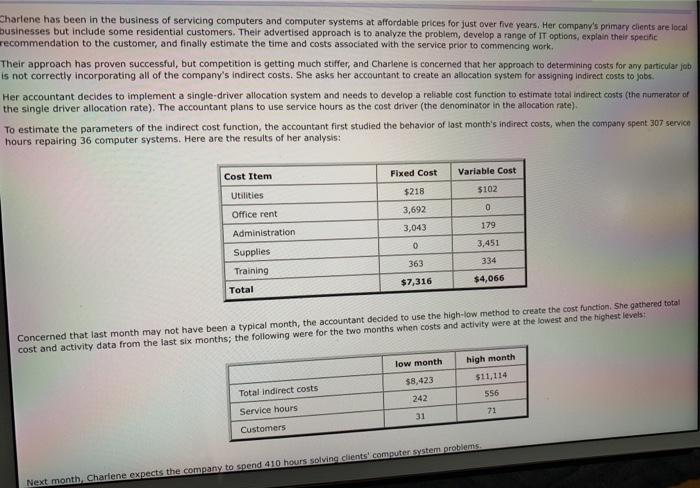

Charlene has been in the business of servicing computers and computer systems at affordable prices for just over five years. Her company's primary clients are local businesses but include some residential customers. Their advertised approach is to analyze the problem, develop a range of IT options, explain their specific recommendation to the customer, and finally estimate the time and costs associated with the service prior to commencing work. Their approach has proven successful, but competition is getting much stiffer, and Charlene is concerned that her approach to determining costs for any particular job is not correctly incorporating all of the company's Indirect costs. She asks her accountant to create an allocation system for assigning Indirect costs to jobs. Her accountant decides to implement a single-driver allocation system and needs to develop a reliable cost function to estimate total indirect costs (the numerater of the single driver allocation rate). The accountant plans to use service hours as the cost driver (the denominator in the allocation rate). To estimate the parameters of the indirect cost function, the accountant first studied the behavior of last month's indirect costs, when the company spent 307 service hours repairing 36 computer systems. Here are the results of her analysis: Cost Item Fixed Cost Variable Cost $218 $102 Utilities 0 Office rent 3,692 3,043 179 Administration 0 3,451 363 Supplies Training Total 334 $4,066 $7,316 Concerned that last month may not have been a typical month, the accountant decided to use the high-low method to create the cost function. She gathered total cost and activity data from the last six months; the following were for the two months when costs and activity were at the lowest and the highest levels low month $8,423 high month $11,114 556 Total Indirect costs Service hours 242 71 Customers Next month, Charlene expects the company to spend 410 hours solving clients' computer system problems Concerned that last month may not have been a typical month, the accountant decided to use the high-low method to create the cost function. She gathered total cost and activity data from the last six months; the following were for the two months when costs and activity were at the lowest and the highest levels: low month high month $11,114 Total Indirect costs Service hours Customers $8,423 242 556 31 71 Next month, Charlene expects the company to spend 410 hours solving clients' computer system problems. REQUIRED (ROUND ALL PER-UNIT COSTS TO TWO DECIMAL PLACES AND TOTAL COSTS TO THE NEAREST DOLLAR.) Part A [5 tries; 5 points) If the accountant uses the cost function based on her analysis of last month's costs, what is her estimate of total Indirect costs next month? Subma Answer Tries 0/5 Part B [5 tries; 5 points) If the accountant uses the cost function based on the high-low method, what is her estimate of total indirect costs next month? Sumt Anawet Tries 0/5 on what marked as NEW 200+ 05 (40) Exten3 Lecture Problem X-3 Cion o copies and 80.00 copies fixed charge $200 as long as 4000 copies or less addit change $ 0.05 perupy excess 4.800 4 dla bilsifiom renting company ex: te eksowatons) X=0 C = $200 > 4k 700 4ove foro Sooo X=6000 High-low C = $200+ ($0.025 X6000)