Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fleming Distribution is the registered name of a business, carried on by Jason Fleming as a sole proprietorship, that distributes a wide variety of health

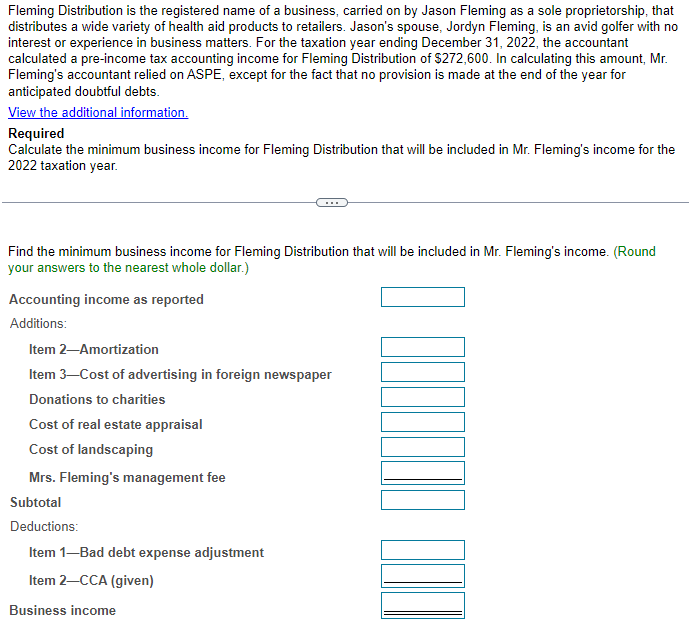

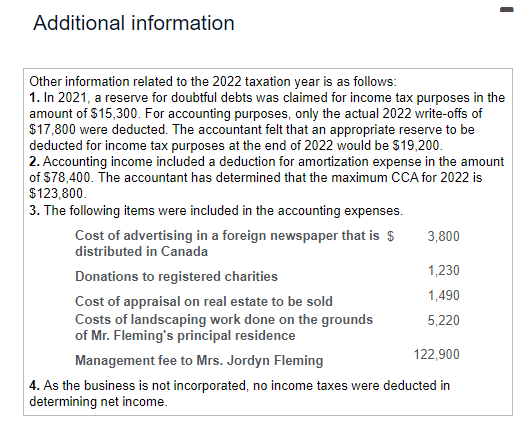

Fleming Distribution is the registered name of a business, carried on by Jason Fleming as a sole proprietorship, that distributes a wide variety of health aid products to retailers. Jason's spouse, Jordyn Fleming, is an avid golfer with no interest or experience in business matters. For the taxation year ending December 31, 2022, the accountant calculated a pre-income tax accounting income for Fleming Distribution of $272,600. In calculating this amount, Mr. Fleming's accountant relied on ASPE, except for the fact that no provision is made at the end of the year for anticipated doubtful debts. View the additional information. Required Calculate the minimum business income for Fleming Distribution that will be included in Mr. Fleming's income for the 2022 taxation year. Find the minimum business income for Fleming Distribution that will be included in Mr. Fleming's income. (Round your answers to the nearest whole dollar.) Additional information Other information related to the 2022 taxation year is as follows: 1. In 2021, a reserve for doubtful debts was claimed for income tax purposes in the amount of $15,300. For accounting purposes, only the actual 2022 write-offs of $17,800 were deducted. The accountant felt that an appropriate reserve to be deducted for income tax purposes at the end of 2022 would be $19,200. 2. Accounting income included a deduction for amortization expense in the amount of $78,400. The accountant has determined that the maximum CCA for 2022 is $123,800

Fleming Distribution is the registered name of a business, carried on by Jason Fleming as a sole proprietorship, that distributes a wide variety of health aid products to retailers. Jason's spouse, Jordyn Fleming, is an avid golfer with no interest or experience in business matters. For the taxation year ending December 31, 2022, the accountant calculated a pre-income tax accounting income for Fleming Distribution of $272,600. In calculating this amount, Mr. Fleming's accountant relied on ASPE, except for the fact that no provision is made at the end of the year for anticipated doubtful debts. View the additional information. Required Calculate the minimum business income for Fleming Distribution that will be included in Mr. Fleming's income for the 2022 taxation year. Find the minimum business income for Fleming Distribution that will be included in Mr. Fleming's income. (Round your answers to the nearest whole dollar.) Additional information Other information related to the 2022 taxation year is as follows: 1. In 2021, a reserve for doubtful debts was claimed for income tax purposes in the amount of $15,300. For accounting purposes, only the actual 2022 write-offs of $17,800 were deducted. The accountant felt that an appropriate reserve to be deducted for income tax purposes at the end of 2022 would be $19,200. 2. Accounting income included a deduction for amortization expense in the amount of $78,400. The accountant has determined that the maximum CCA for 2022 is $123,800 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started