Flint Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Buffalo Medical Center for a period of 10 years. The normal selling price of the machine is $523,245, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $15,000. The hospital will pay rents of $63,400 at the beginning of each year. Flint incurred costs of $258,000 in manufacturing the machine and $14,900 in legal fees directly related to the signing of the lease. Flint has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Buffalo Medical Center has an incremental borrowing rate of 5% and an expected residual value at the end of the lease of $10,000.

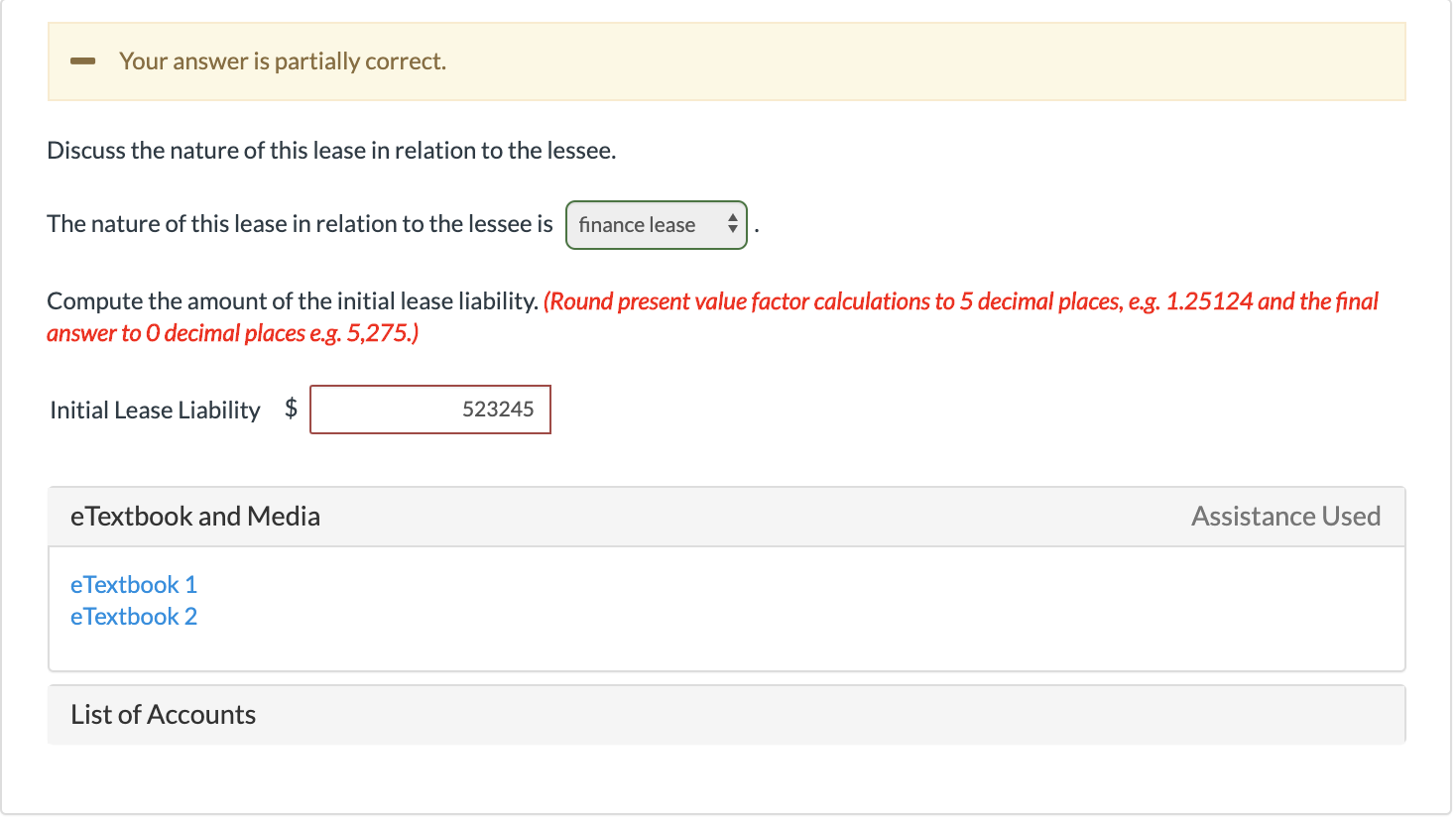

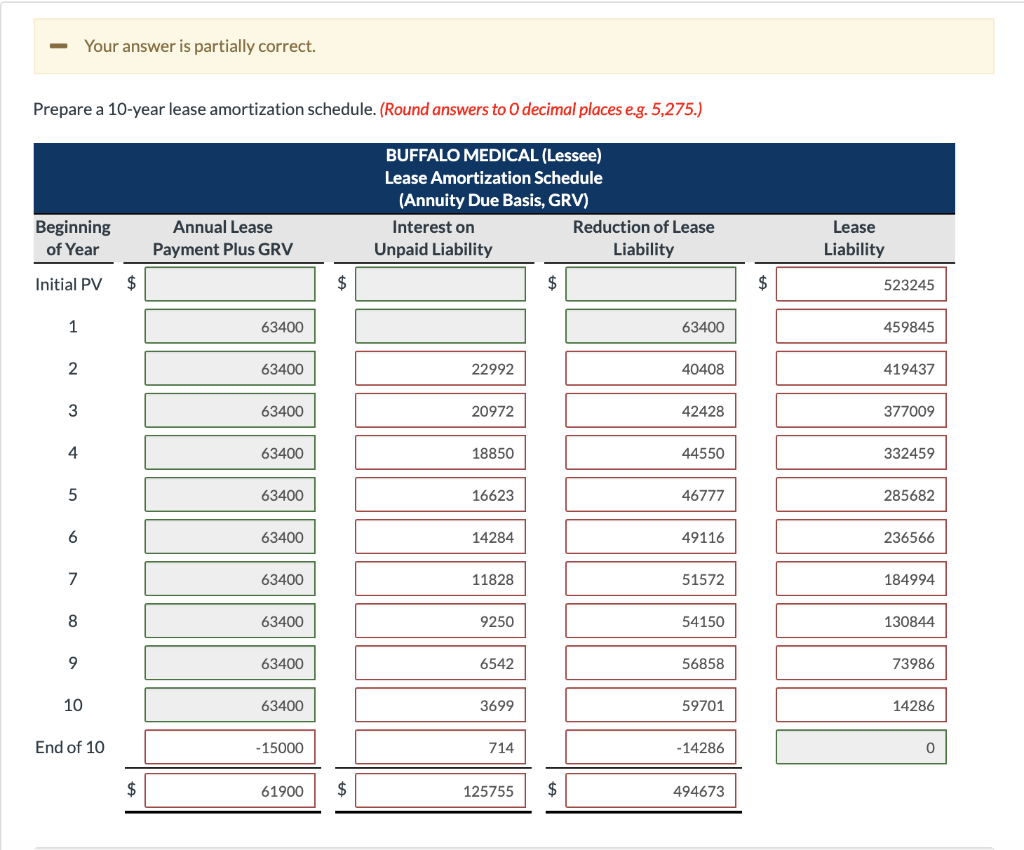

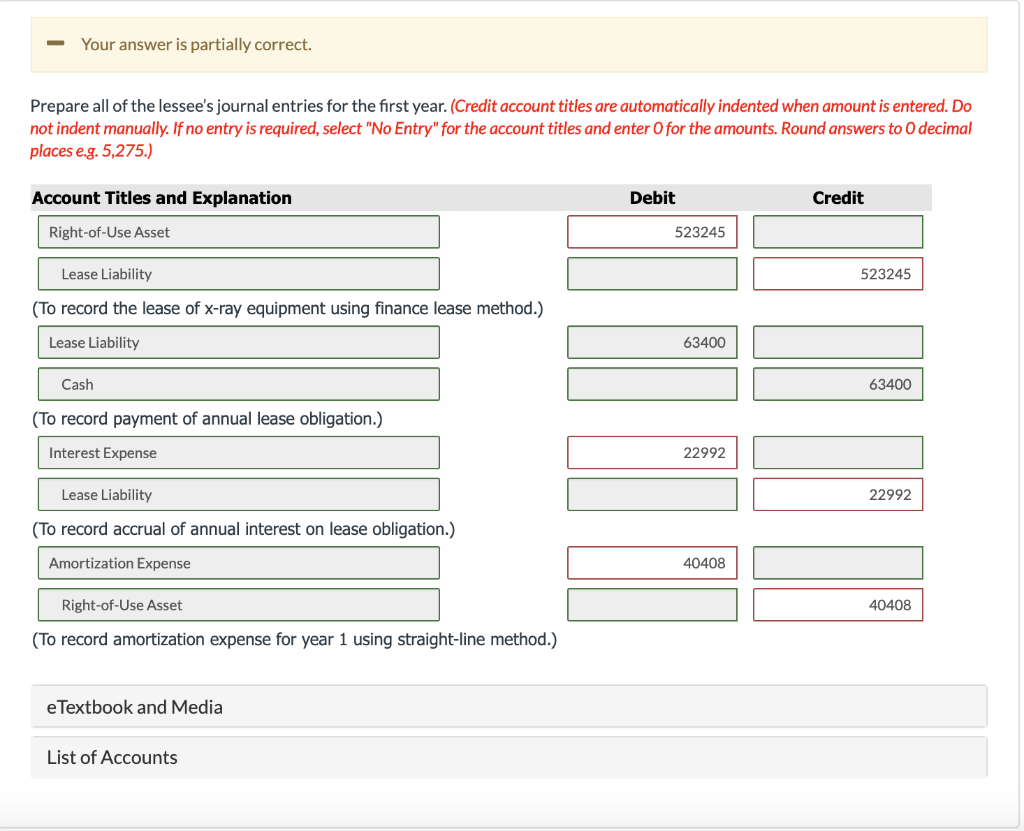

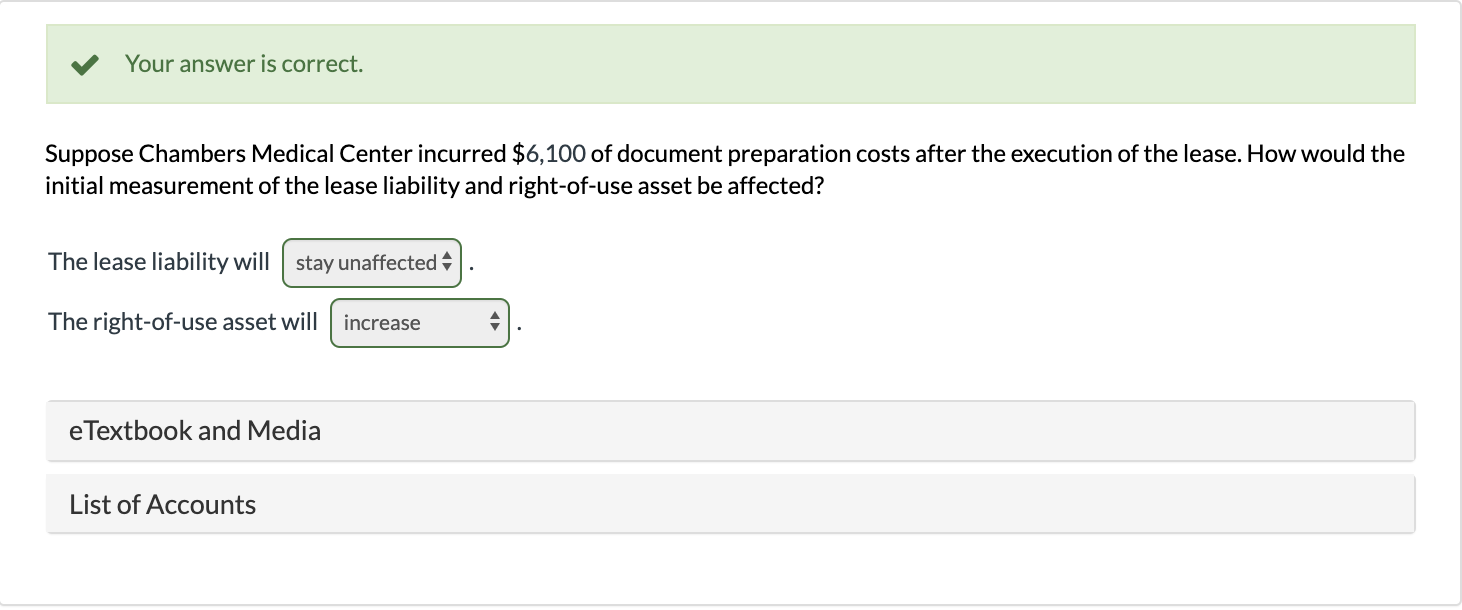

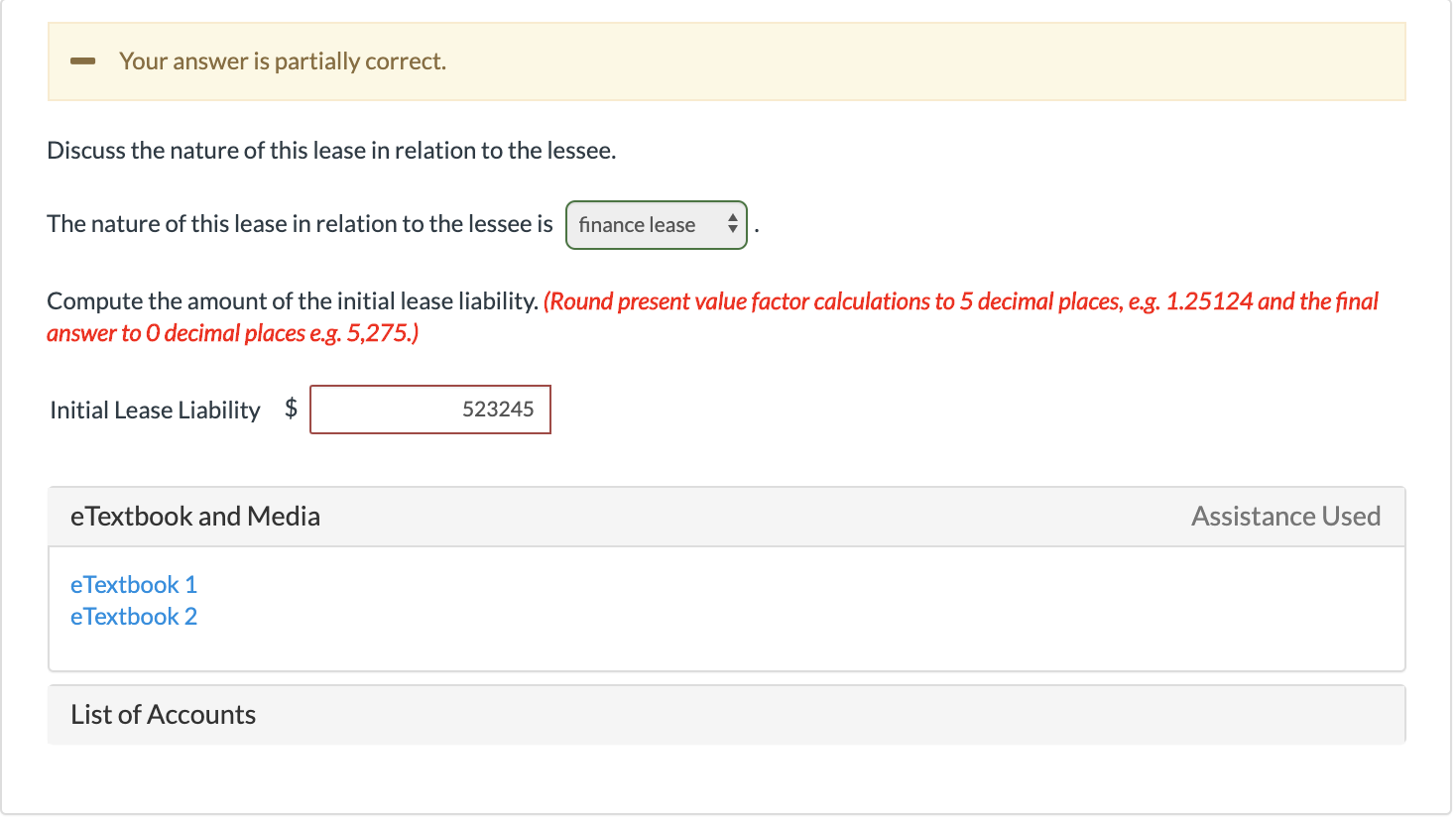

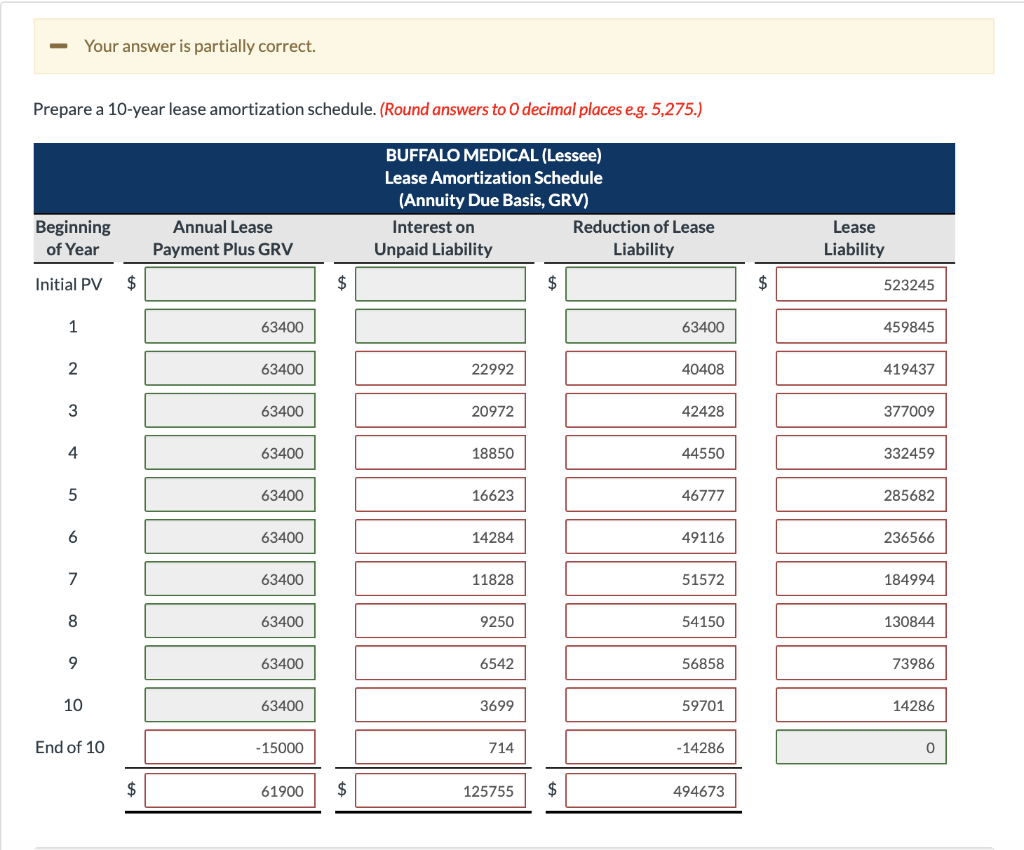

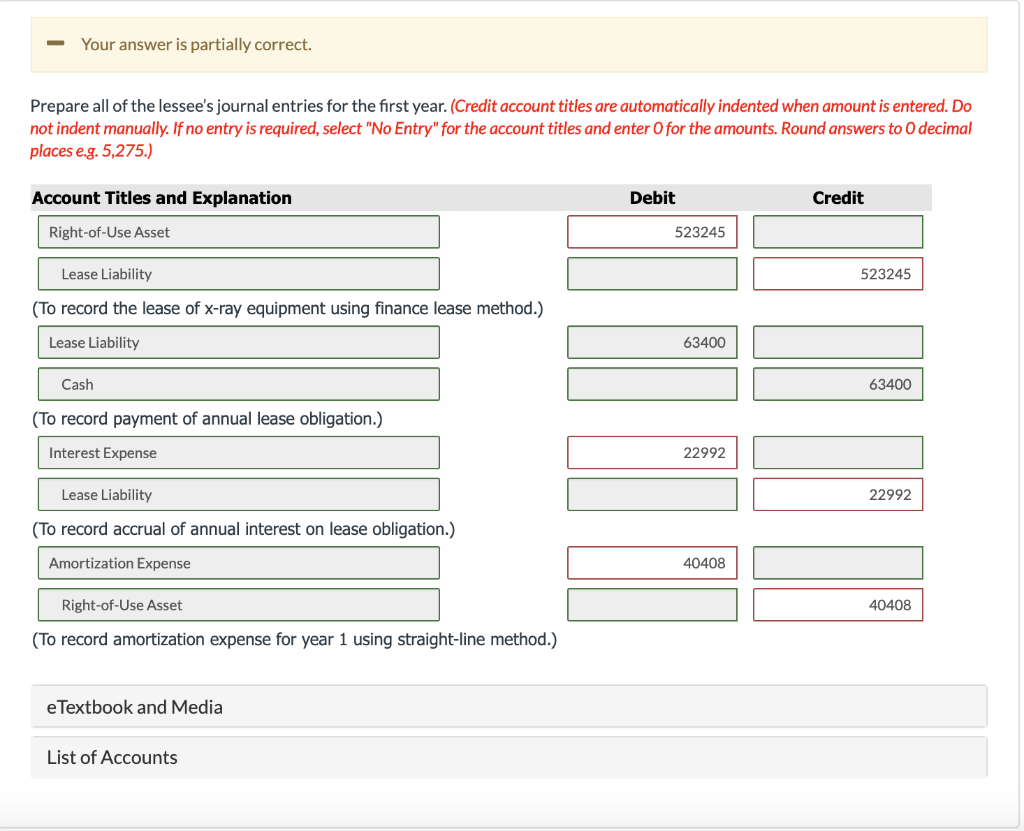

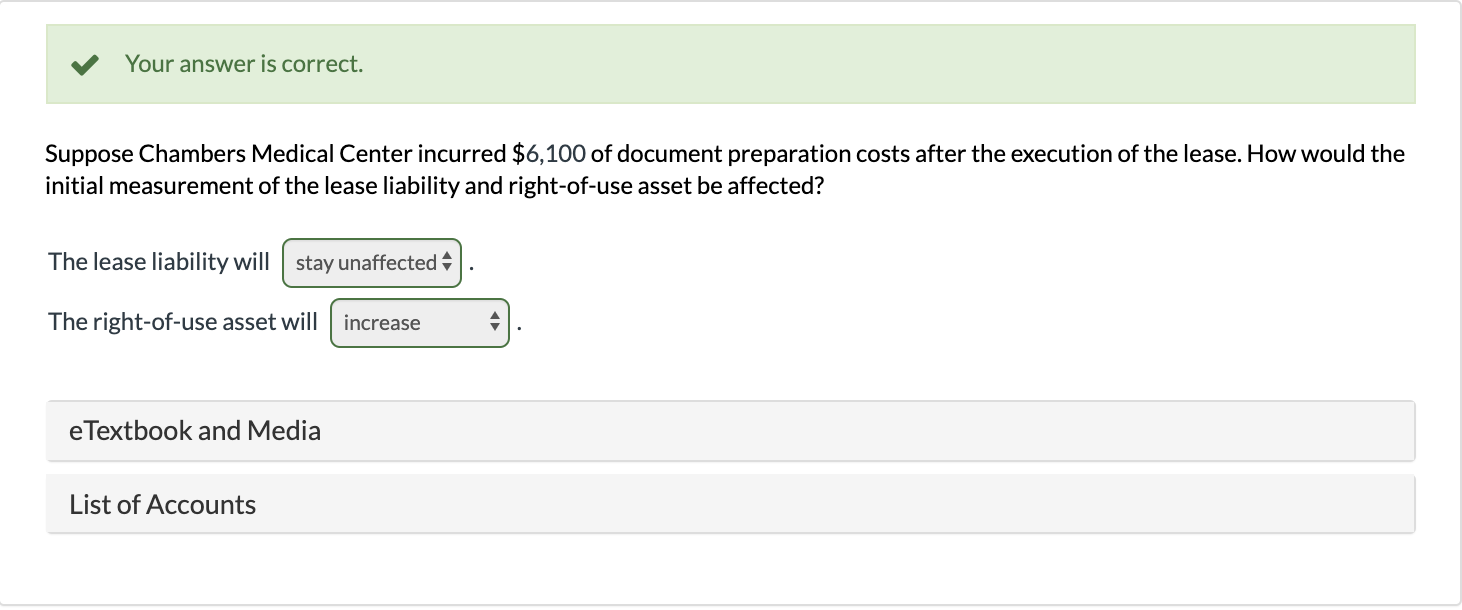

Your answer is partially correct. Discuss the nature of this lease in relation to the lessee. The nature of this lease in relation to the lessee is finance lease : Compute the amount of the initial lease liability. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 5,275.) Initial Lease Liability 523245 e Textbook and Media Assistance Used e Textbook 1 e Textbook 2 List of Accounts - Your answer is partially correct. Prepare a 10-year lease amortization schedule. (Round answers to O decimal places e.g. 5,275.) BUFFALO MEDICAL (Lessee) Lease Amortization Schedule (Annuity Due Basis, GRV) Interest on Reduction of Lease Unpaid Liability Liability Beginning of Year Annual Lease Payment Plus GRV Lease Liability Initial PV $ 523245 63400 63400 459845 63400 22992 40408 419437 63400 20972 42428 377009 63400 18850 44550 332459 63400 16623 46777 285682 63400 14284 49116 236566 63400 11828 51572 184994 63400 9250 54150 130844 63400 6542 56858 73986 63400 3699 59701 14286 End of 10 - 15000 714 - 14286 61900 125755 494673 - Your answer is partially correct. Prepare all of the lessee's journal entries for the first year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to 0 decimal places e.g. 5,275.) Account Titles and Explanation Credit Debit 523245 Right-of-Use Asset Lease Liability 523245 (To record the lease of x-ray equipment using finance lease method.) Lease Liability 63400 Cash 63400 (To record payment of annual lease obligation.) Interest Expense 22992 Lease Liability 22992 (To record accrual of annual interest on lease obligation.) Amortization Expense 40408 Right-of-Use Asset 40408 (To record amortization expense for year 1 using straight-line method.) e Textbook and Media List of Accounts Your answer is correct. Suppose Chambers Medical Center incurred $6,100 of document preparation costs after the execution of the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? The lease liability will stay unaffected The right-of-use asset will increase e Textbook and Media List of Accounts