Question

Following are selected balance sheet accounts of Novak Bros. Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from

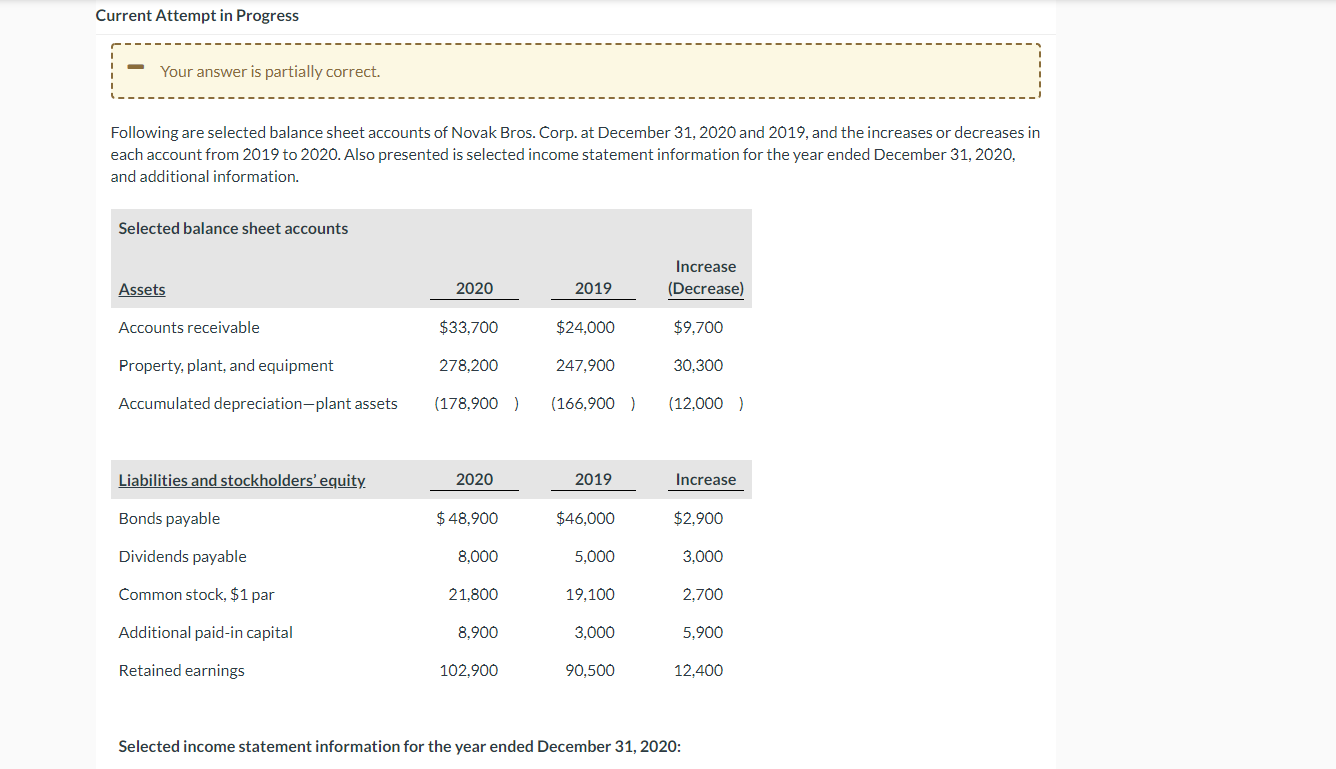

Following are selected balance sheet accounts of Novak Bros. Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information.

| Selected balance sheet accounts | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Assets | 2020 | 2019 | Increase (Decrease) | ||||||

| Accounts receivable | $33,700 | $24,000 | $9,700 | ||||||

| Property, plant, and equipment | 278,200 | 247,900 | 30,300 | ||||||

| Accumulated depreciationplant assets | (178,900 | ) | (166,900 | ) | (12,000 | ) | |||

| Liabilities and stockholders equity | 2020 | 2019 | Increase | ||||||

| Bonds payable | $ 48,900 | $46,000 | $2,900 | ||||||

| Dividends payable | 8,000 | 5,000 | 3,000 | ||||||

| Common stock, $1 par | 21,800 | 19,100 | 2,700 | ||||||

| Additional paid-in capital | 8,900 | 3,000 | 5,900 | ||||||

| Retained earnings | 102,900 | 90,500 | 12,400 | ||||||

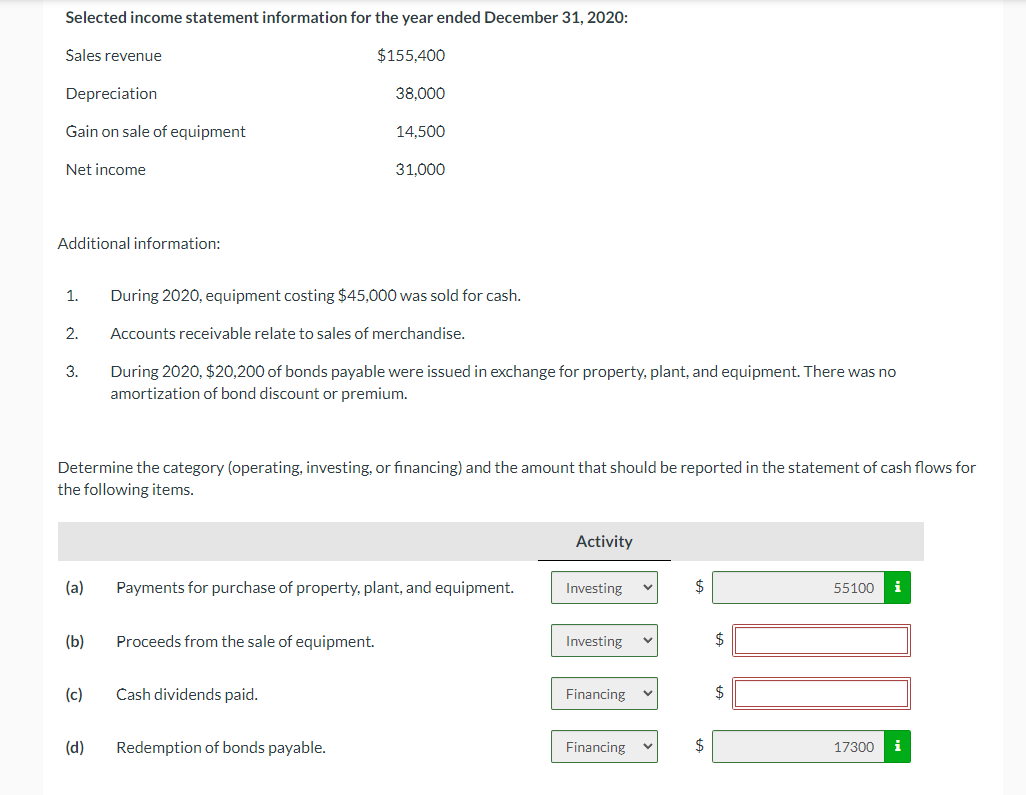

| Selected income statement information for the year ended December 31, 2020: | |||||||||

| Sales revenue | $155,400 | ||||||||

| Depreciation | 38,000 | ||||||||

| Gain on sale of equipment | 14,500 | ||||||||

| Net income | 31,000 | ||||||||

Additional information:

| 1. | During 2020, equipment costing $45,000 was sold for cash. | |

| 2. | Accounts receivable relate to sales of merchandise. | |

| 3. | During 2020, $20,200 of bonds payable were issued in exchange for property, plant, and equipment. There was no amortization of bond discount or premium. |

Determine the category (operating, investing, or financing) and the amount that should be reported in the statement of cash flows for the following items.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started