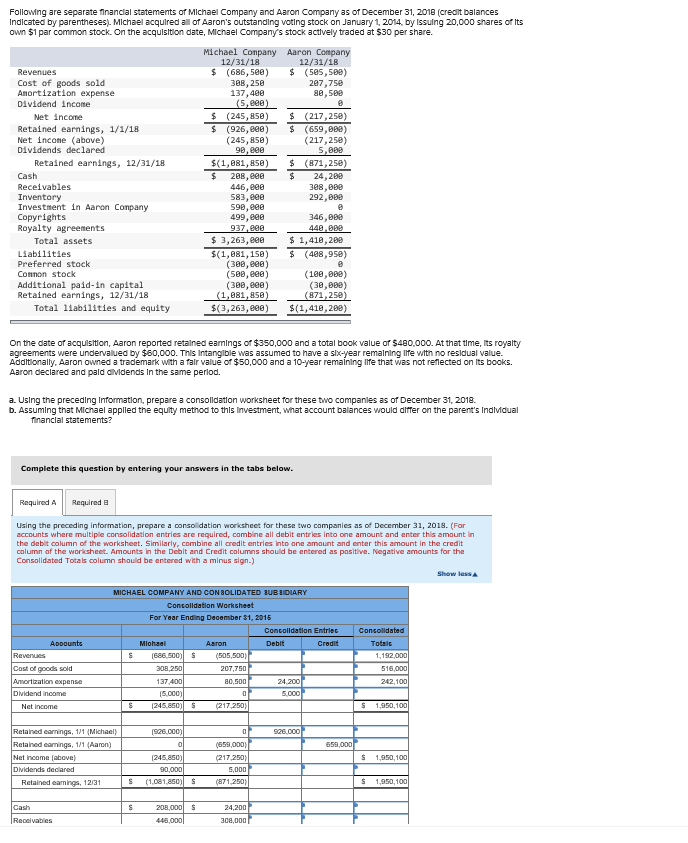

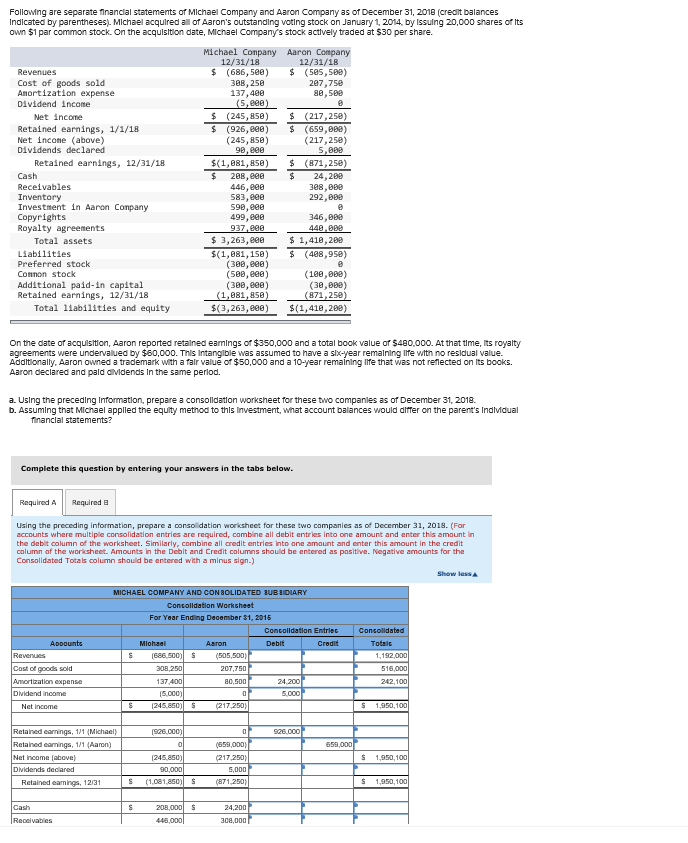

Following are separate Mnanclal statements of Michael Company and Aaron Company as of December 31, 2018 (credit balances Indlcated by parentheses) Michael acquired a of Aaron's outstanding voting stock on January 1, 2014, by Issulng 20,000 shares of its own $1 par common stock. On the acquisltlon date, Michael Company's stock actively traded at $30 per share. Michael Company Aaron Company 12/31/18 12/31/18 Revenues Cost of goods sold Amortization expense Dividend incone $ (686,580) $(505,588) 287,75e 88,588 137,480 (S,890) $(245,858) (217,258) $ (926,80) $(659,888) (217,258) Net income Retained earnings, 1/1/18 Net incone (above) Dividends declared (245,858) 98,890 S,888 Retained earnings, 12/31/18 $(1,881,858) $ (871,258) Cash Receivables Inventory Investment in Aaron Conpany Copyrights Royalty agreements 288,808 446 , 583,808 598,880 499,890 24.2a 388,88e 292,888 346,888 937 898 448-888 $1,418,28e $ 3,263,808 $(1,881,158) Total assets Liabilities Preferred stock Connon stock Additional paid-in capital Retained earnings, 12/31/18 $ (488,958) (386,808) (See,eee (308,e00) (188,888) (38,868) 1.881,858)( 871,256 Total 1iabilities and equity $(3,263,800) $(1,418,208) On the date of acquiion, Aaron reported retalned eamings of $350,000 and a total book value of $480,000. At that time, Its royaity agreements were undervalued by $60,000. This Intanglble was assumed to have a six-year remalning Ife wtth no residual value Addltionally, Aaron owned a trademark with a falr value of $50,000 and a 10-year remalning Ife that was not reflected on its books. Aaron declared and pald aMdends In the same perlod. a. Using the preceding Information, prepare a consolldation worksheet for these two companles as of December 31, 2018. b. Assuming that Michael applled the equity method to thls Investment, what account balances would differ on the parent's IndlMaual nanclal statements? Complete this question by entering your answers in the tabs below. Required A Required B using the preceding information" prepare consociation worksheet for these two companies as of December 31, 2018. For accounts where multiple consolidation ntries are required, combine all debit entries into one amount and nter this amont in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Amounts i the Debit and Credit columns should be ntered as positive. Negative amounts for the Consolidated Totals column should be entered with a minus sign.) MICHAEL COMPANY AND CON BOLIDATED 3UBOIARY For Year Ending December 31, 2015 Concolldation Entriet Totalt of goods sold 207,750 Amortizaion Dvidend income (5.000) S 1950,100 Retained eamings Retaned cearnings, 1/1 (Aaron) Net ncome (abov Dividends decared 926.000) 659,000 59,000 245 Retained eamings, 12/31 1081.85O)S (871,250 1,950,100 8000$