Answered step by step

Verified Expert Solution

Question

1 Approved Answer

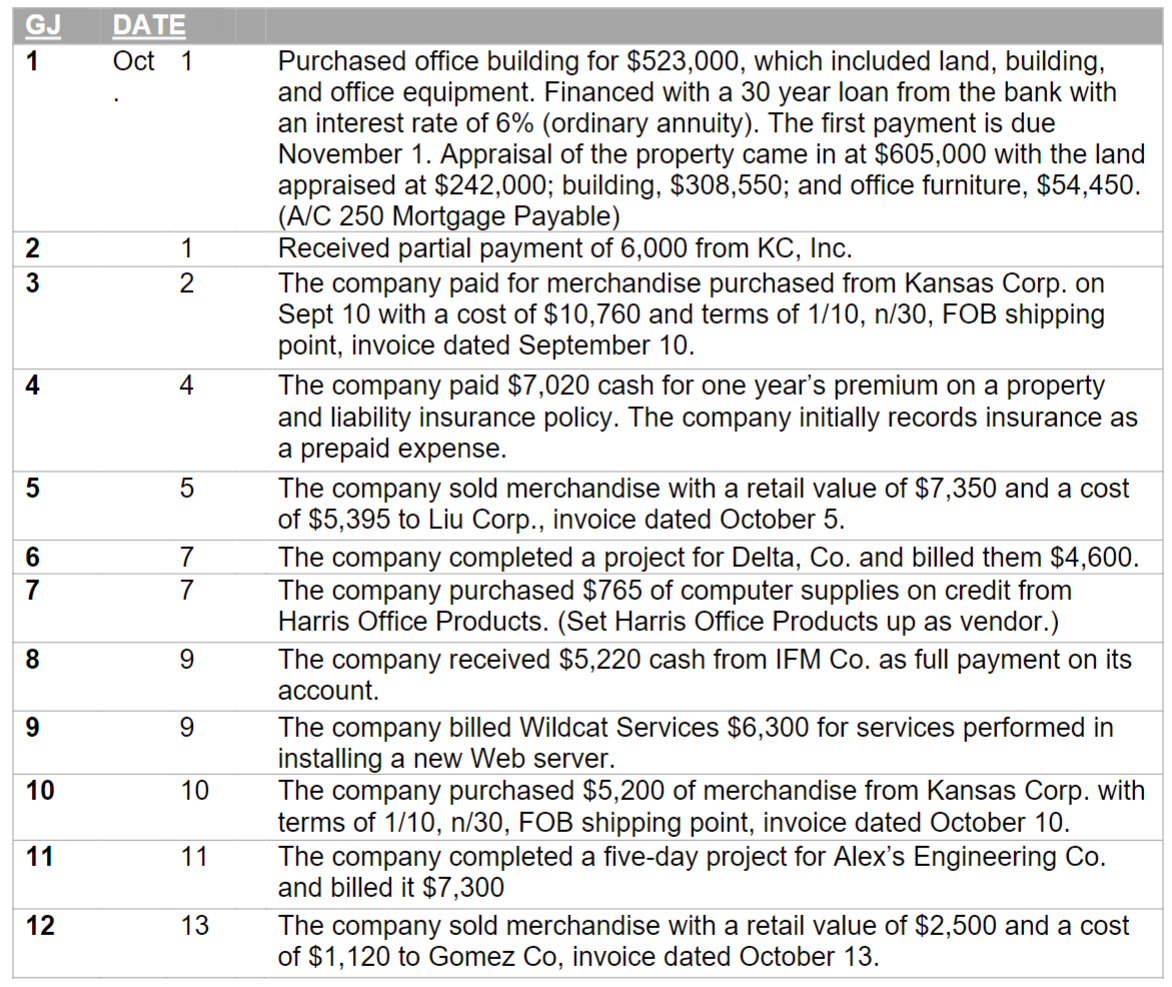

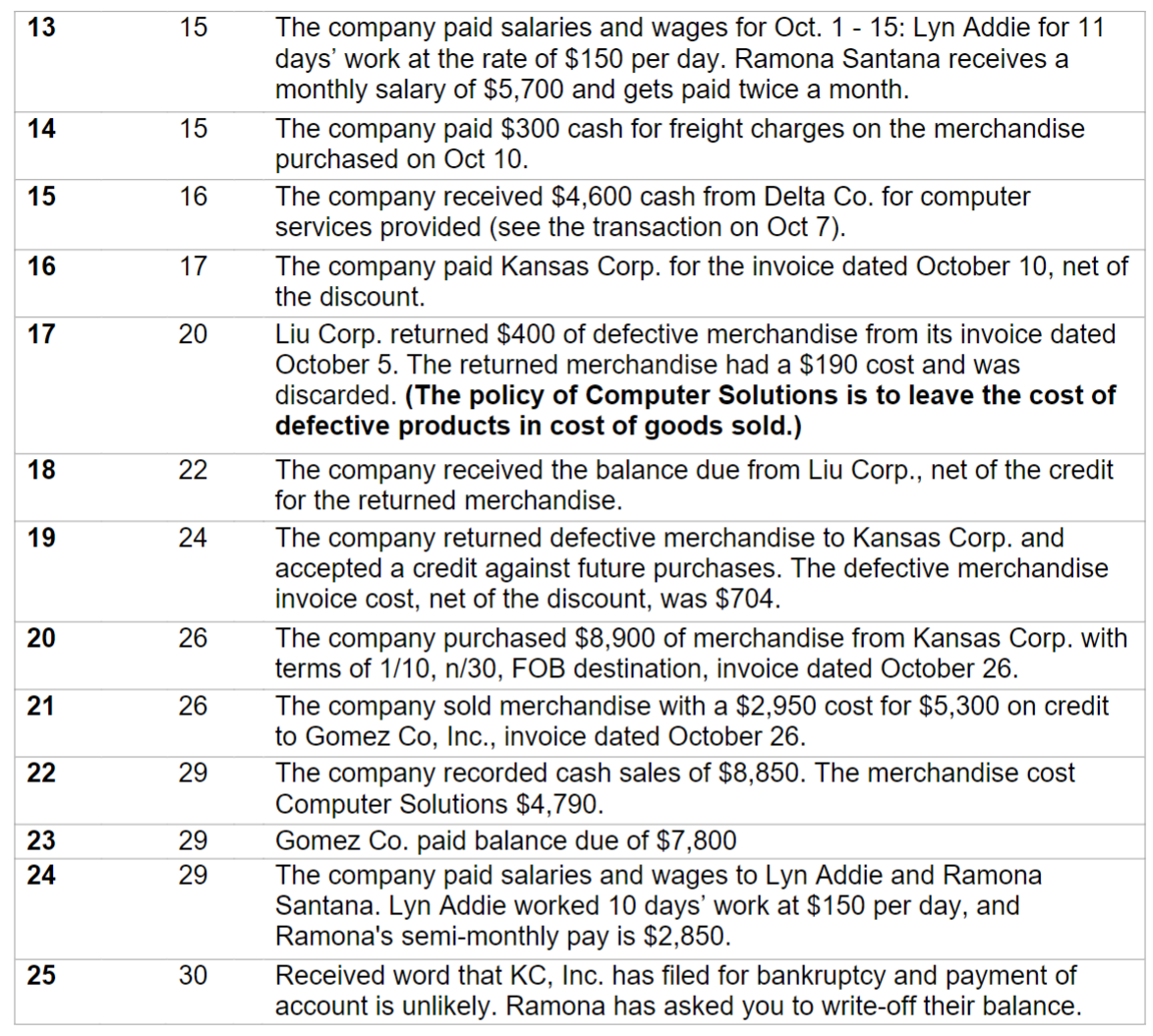

Following are the October 2022 transactions for Computer Solutions. The company extends credit terms of n/30, FOB shipping point, to all customers who purchase merchandise.

Following are the October 2022 transactions for Computer Solutions. The company extends credit terms of n/30, FOB shipping point, to all customers who purchase merchandise. Computer Solutions uses a perpetual inventory system and uses the gross method to record purchases and sales on account. Inventory is maintained using FIFO for general ledger purposes.

Required: Prepare journal entries for those transactions. Thank you!

\begin{tabular}{|c|c|c|} \hline GJ & DATE & \\ \hline 1 & \begin{tabular}{ll} Oct 1 \\ . \end{tabular} & \begin{tabular}{l} Purchased office building for $523,000, which included land, building, \\ and office equipment. Financed with a 30 year loan from the bank with \\ an interest rate of 6% (ordinary annuity). The first payment is due \\ November 1 . Appraisal of the property came in at $605,000 with the land \\ appraised at $242,000; building, $308,550; and office furniture, $54,450. \\ (A/C 250 Mortgage Payable) \end{tabular} \\ \hline 2 & 1 & Received partial payment of 6,000 from KC, Inc. \\ \hline 3 & 2 & \begin{tabular}{l} The company paid for merchandise purchased from Kansas Corp. on \\ Sept 10 with a cost of $10,760 and terms of 1/10,n/30, FOB shipping \\ point, invoice dated September 10 . \end{tabular} \\ \hline 4 & 4 & \begin{tabular}{l} The company paid $7,020 cash for one year's premium on a property \\ and liability insurance policy. The company initially records insurance as \\ a prepaid expense. \end{tabular} \\ \hline 5 & 5 & \begin{tabular}{l} The company sold merchandise with a retail value of $7,350 and a cost \\ of $5,395 to Liu Corp., invoice dated October 5 . \end{tabular} \\ \hline 6 & 7 & The company completed a project for Delta, Co. and billed them $4,600. \\ \hline 7 & 7 & \begin{tabular}{l} The company purchased $765 of computer supplies on credit from \\ Harris Office Products. (Set Harris Office Products up as vendor.) \end{tabular} \\ \hline 8 & 9 & \begin{tabular}{l} The company received $5,220 cash from IFM Co. as full payment on its \\ account. \end{tabular} \\ \hline 9 & 9 & \begin{tabular}{l} The company billed Wildcat Services $6,300 for services performed in \\ installing a new Web server. \end{tabular} \\ \hline 10 & 10 & \begin{tabular}{l} The company purchased $5,200 of merchandise from Kansas Corp. with \\ terms of 1/10,n/30, FOB shipping point, invoice dated October 10 . \end{tabular} \\ \hline 11 & 11 & \begin{tabular}{l} The company completed a five-day project for Alex's Engineering Co. \\ and billed it $7,300 \end{tabular} \\ \hline 12 & 13 & \begin{tabular}{l} The company sold merchandise with a retail value of $2,500 and a cost \\ of $1,120 to Gomez Co, invoice dated October 13 . \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline 13 & 15 & \begin{tabular}{l} The company paid salaries and wages for Oct. 1 - 15 : Lyn Addie for 11 \\ days' work at the rate of $150 per day. Ramona Santana receives a \\ monthly salary of $5,700 and gets paid twice a month. \end{tabular} \\ \hline 14 & 15 & \begin{tabular}{l} The company paid $300 cash for freight charges on the merchandise \\ purchased on Oct 10 . \end{tabular} \\ \hline 15 & 16 & \begin{tabular}{l} The company received $4,600 cash from Delta Co. for computer \\ services provided (see the transaction on Oct 7 ). \end{tabular} \\ \hline 16 & 17 & \begin{tabular}{l} The company paid Kansas Corp. for the invoice dated October 10 , net of \\ the discount. \end{tabular} \\ \hline 17 & 20 & \begin{tabular}{l} Liu Corp. returned $400 of defective merchandise from its invoice dated \\ October 5 . The returned merchandise had a $190 cost and was \\ discarded. (The policy of Computer Solutions is to leave the cost of \\ defective products in cost of goods sold.) \end{tabular} \\ \hline 18 & 22 & \begin{tabular}{l} The company received the balance due from Liu Corp., net of the credit \\ for the returned merchandise. \end{tabular} \\ \hline 19 & 24 & \begin{tabular}{l} The company returned defective merchandise to Kansas Corp. and \\ accepted a credit against future purchases. The defective merchandise \\ invoice cost, net of the discount, was $704. \end{tabular} \\ \hline 20 & 26 & \begin{tabular}{l} The company purchased $8,900 of merchandise from Kansas Corp. with \\ terms of 1/10,n/30, FOB destination, invoice dated October 26 . \end{tabular} \\ \hline 21 & 26 & \begin{tabular}{l} The company sold merchandise with a $2,950 cost for $5,300 on credit \\ to Gomez Co, Inc., invoice dated October 26 . \end{tabular} \\ \hline 22 & 29 & \begin{tabular}{l} The company recorded cash sales of $8,850. The merchandise cost \\ Computer Solutions $4,790. \end{tabular} \\ \hline 23 & 29 & Gomez Co. paid balance due of $7,800 \\ \hline 24 & 29 & \begin{tabular}{l} The company paid salaries and wages to Lyn Addie and Ramona \\ Santana. Lyn Addie worked 10 days' work at $150 per day, and \\ Ramona's semi-monthly pay is $2,850. \end{tabular} \\ \hline 25 & 30 & \begin{tabular}{l} Received word that KC, Inc. has filed for bankruptcy and payment of \\ account is unlikely. Ramona has asked you to write-off their balance. \end{tabular} \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline GJ & DATE & \\ \hline 1 & \begin{tabular}{ll} Oct 1 \\ . \end{tabular} & \begin{tabular}{l} Purchased office building for $523,000, which included land, building, \\ and office equipment. Financed with a 30 year loan from the bank with \\ an interest rate of 6% (ordinary annuity). The first payment is due \\ November 1 . Appraisal of the property came in at $605,000 with the land \\ appraised at $242,000; building, $308,550; and office furniture, $54,450. \\ (A/C 250 Mortgage Payable) \end{tabular} \\ \hline 2 & 1 & Received partial payment of 6,000 from KC, Inc. \\ \hline 3 & 2 & \begin{tabular}{l} The company paid for merchandise purchased from Kansas Corp. on \\ Sept 10 with a cost of $10,760 and terms of 1/10,n/30, FOB shipping \\ point, invoice dated September 10 . \end{tabular} \\ \hline 4 & 4 & \begin{tabular}{l} The company paid $7,020 cash for one year's premium on a property \\ and liability insurance policy. The company initially records insurance as \\ a prepaid expense. \end{tabular} \\ \hline 5 & 5 & \begin{tabular}{l} The company sold merchandise with a retail value of $7,350 and a cost \\ of $5,395 to Liu Corp., invoice dated October 5 . \end{tabular} \\ \hline 6 & 7 & The company completed a project for Delta, Co. and billed them $4,600. \\ \hline 7 & 7 & \begin{tabular}{l} The company purchased $765 of computer supplies on credit from \\ Harris Office Products. (Set Harris Office Products up as vendor.) \end{tabular} \\ \hline 8 & 9 & \begin{tabular}{l} The company received $5,220 cash from IFM Co. as full payment on its \\ account. \end{tabular} \\ \hline 9 & 9 & \begin{tabular}{l} The company billed Wildcat Services $6,300 for services performed in \\ installing a new Web server. \end{tabular} \\ \hline 10 & 10 & \begin{tabular}{l} The company purchased $5,200 of merchandise from Kansas Corp. with \\ terms of 1/10,n/30, FOB shipping point, invoice dated October 10 . \end{tabular} \\ \hline 11 & 11 & \begin{tabular}{l} The company completed a five-day project for Alex's Engineering Co. \\ and billed it $7,300 \end{tabular} \\ \hline 12 & 13 & \begin{tabular}{l} The company sold merchandise with a retail value of $2,500 and a cost \\ of $1,120 to Gomez Co, invoice dated October 13 . \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline 13 & 15 & \begin{tabular}{l} The company paid salaries and wages for Oct. 1 - 15 : Lyn Addie for 11 \\ days' work at the rate of $150 per day. Ramona Santana receives a \\ monthly salary of $5,700 and gets paid twice a month. \end{tabular} \\ \hline 14 & 15 & \begin{tabular}{l} The company paid $300 cash for freight charges on the merchandise \\ purchased on Oct 10 . \end{tabular} \\ \hline 15 & 16 & \begin{tabular}{l} The company received $4,600 cash from Delta Co. for computer \\ services provided (see the transaction on Oct 7 ). \end{tabular} \\ \hline 16 & 17 & \begin{tabular}{l} The company paid Kansas Corp. for the invoice dated October 10 , net of \\ the discount. \end{tabular} \\ \hline 17 & 20 & \begin{tabular}{l} Liu Corp. returned $400 of defective merchandise from its invoice dated \\ October 5 . The returned merchandise had a $190 cost and was \\ discarded. (The policy of Computer Solutions is to leave the cost of \\ defective products in cost of goods sold.) \end{tabular} \\ \hline 18 & 22 & \begin{tabular}{l} The company received the balance due from Liu Corp., net of the credit \\ for the returned merchandise. \end{tabular} \\ \hline 19 & 24 & \begin{tabular}{l} The company returned defective merchandise to Kansas Corp. and \\ accepted a credit against future purchases. The defective merchandise \\ invoice cost, net of the discount, was $704. \end{tabular} \\ \hline 20 & 26 & \begin{tabular}{l} The company purchased $8,900 of merchandise from Kansas Corp. with \\ terms of 1/10,n/30, FOB destination, invoice dated October 26 . \end{tabular} \\ \hline 21 & 26 & \begin{tabular}{l} The company sold merchandise with a $2,950 cost for $5,300 on credit \\ to Gomez Co, Inc., invoice dated October 26 . \end{tabular} \\ \hline 22 & 29 & \begin{tabular}{l} The company recorded cash sales of $8,850. The merchandise cost \\ Computer Solutions $4,790. \end{tabular} \\ \hline 23 & 29 & Gomez Co. paid balance due of $7,800 \\ \hline 24 & 29 & \begin{tabular}{l} The company paid salaries and wages to Lyn Addie and Ramona \\ Santana. Lyn Addie worked 10 days' work at $150 per day, and \\ Ramona's semi-monthly pay is $2,850. \end{tabular} \\ \hline 25 & 30 & \begin{tabular}{l} Received word that KC, Inc. has filed for bankruptcy and payment of \\ account is unlikely. Ramona has asked you to write-off their balance. \end{tabular} \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started