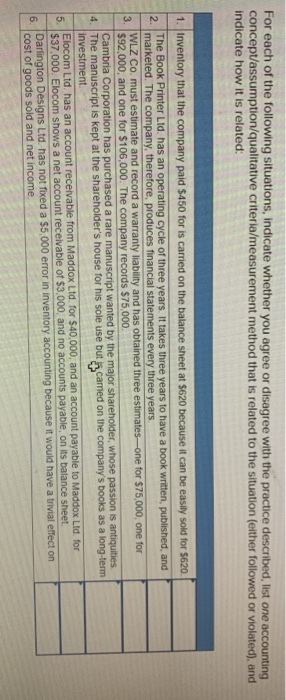

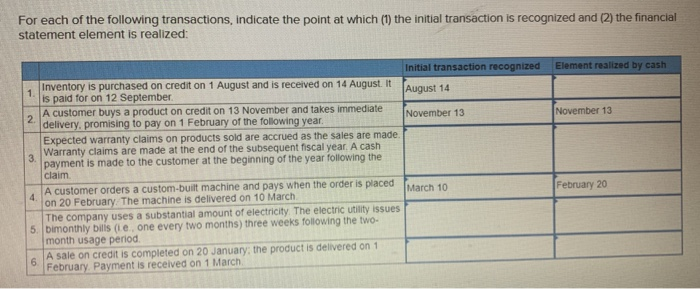

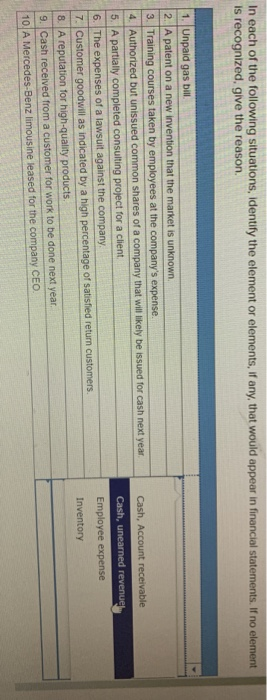

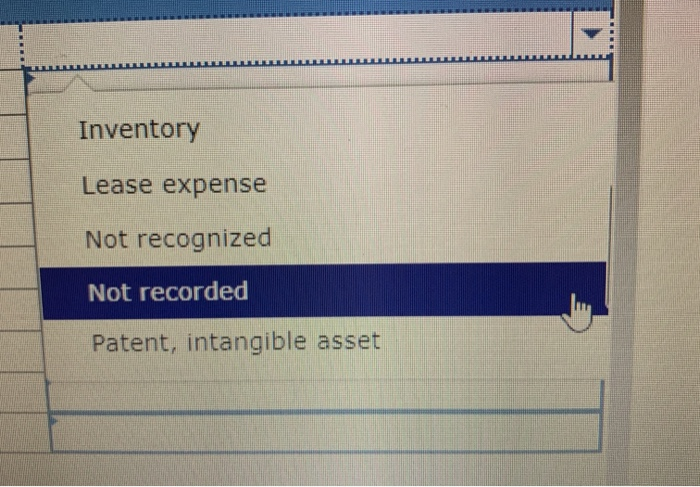

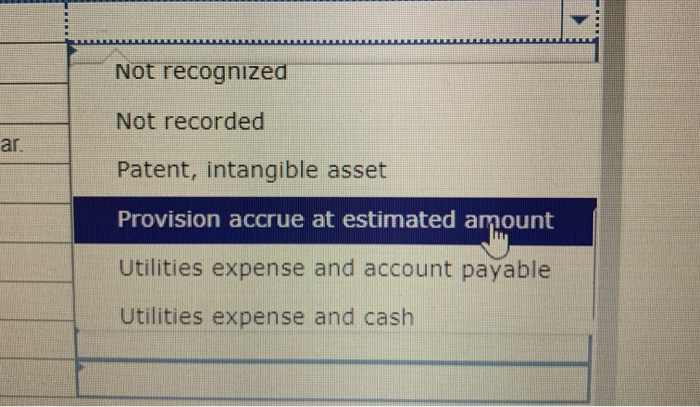

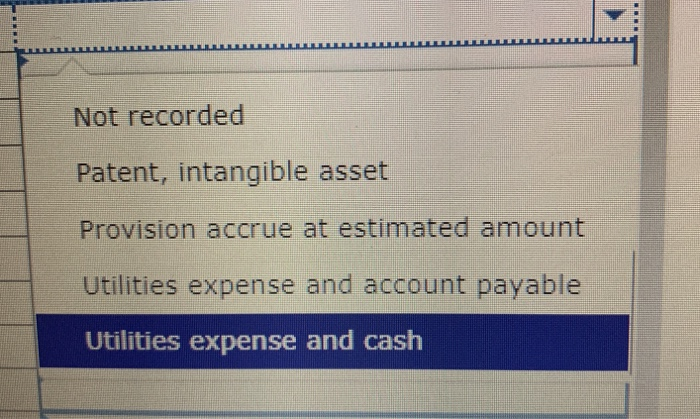

For each of the following situations, indicate whether you agree or disagree with the practice described, list one accounting concept/assumption/qualitative criteria/measurement method that is related to the situation (either followed or violated), and indicate how it is related: 1. Inventory that the company paid $450 for is carried on the balance sheet at $620 because it can be easily sold for $620. The Book Printer Ltd. has an operating cycle of three years It takes three years to have a book written, published, and 2. marketed. The company, therefore, produces financial statements every three years. WLZ Co. must estimate and record a warranty liability and has obtained three estimates-one for $75,000, one for 3 $92,000, and one for $106,000. The company records $75,000 Cambria Corporation has purchased a rare manuscript wanted by the major shareholder, whose passion is antiquities 4 The manuscript is kept at the shareholder's house for his sole use but investment camed on the company's books as a long-term Elocom Ltd. has an account receivable from Maddox Ltd. for $40,000, and an account payable to Maddox Ltd. for 5 $37,000. Elocom shows a net account receivable of $3,000, and no accounts payable, on its balance sheet. Darlington Designs Ltd. has not fixed a $5,000 error in inventory accounting because it would have a trivial effect on 6 Cost of goods sold and net income For each of the following transactions, indicate the point at which (1) the initial transaction is recognized and (2) the financial statement element is realized: Initial transaction recognized Element realized by cash Inventory is purchased on credit on 1 August and is received on 14 August. It 1 is paid for on 12 September August 14 A customer buys a product on credit on 13 November and takes immediate 2 delivery, promising to pay on 1 February of the following year November 13 November 13 Expected warranty claims on products sold are accrued as the sales are made. Warranty claims are made at the end of the subsequent fiscal year. A cash 3 payment is made to the customer at the beginning of the year following the claim A customer orders a custom-built machine and pays when the order is placed 4. on 20 February The machine is delivered on 10 March. March 10 February 20 The company uses a substantial amount of electricity The electric utility issues 5 bimonthly bills (Le, one every two months) three weeks following the two- month usage period A sale on credit is completed on 20 January; the product is delivered on 1 6 February Payment is received on 1 March. In each of the following situations, identify the element or elements, if any, that would appear in financial statements. If no element is recognized, give the reason. 1. Unpaid gas bill. 2. A patent on a new invention that the market is unknown. 3. Training courses taken by employees at the company's expense. 4 Authorized but unissued common shares of a company that will likely be issued for cash next year Cash, Account receivable 5 A partially completed consulting project for a client 6. The expenses of a lawsuit against the company Cash, unearned revenue Employee expense 7. Customer goodwill as indicated by a high percentage of satisfied return customers. Inventory 8. A reputation for high-quality products. 9 Cash received from a customer for work to be done next year 10 A Mercedes-Benz limousine leased for the company CEO. Inventory Lease expense Not recognized Not recorded Patent, intangible asset Not recognized Not recorded ar. Patent, intangible asset Provision aCccrue at estimated amount Utilities expense and account payable Utilities expense and cash Not recorded Patent, intangible asset Provision accrue at estimated amount Utilities expense and account payable Utilities expense and cash