Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for number 1 calculate the internal rate value single payback period and draw a cash flow diagram A company owns a water disposal system for

for number 1 calculate the internal rate value single payback period and draw a cash flow diagram

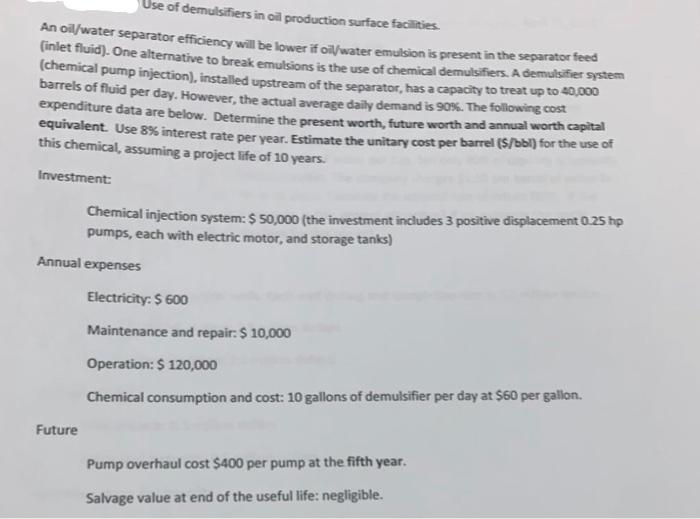

A company owns a water disposal system for produced water in oil fields. This company provides injection service to neighbor operating companies. The water disposal system is composed of 3 water injection wells, a water pumping station with 3 pumps, and a water treatment facility. The disposal system has a capacity of injecting 10,000 barrels of water per day, but only 80% of capacity is currently used. The below data are available for this project. The company charges $1.50 per barrel of water for the water disposal service. Project life is 10 years. Calculate the internal rate of return (IRR). If the company MARR is 20% interest rate per year, is this project attractive? If so, estimate the single payback period. Draw a cash flow diagram for this project. Capital Investment There are three disposal wells. Each well drilling and completion cost is 3.0 million dollars Water treatment system: 2.5 million dollars Water pumping station: 2.0 million dollars Annual expenses Maintenance: 0.5 million dollars Labor and materials: 0.5 million dollars Future expenses and benefits Pump overhauls at 5th year: 0.3 million dollars per pump Salvage value at the end of the project life: 1 million dollars Use of demulsifiers in oil production surface facilities An oil/water separator efficiency will be lower if oil water emulsion is present in the separator feed (inlet fluid). One alternative to break emulsions is the use of chemical demulsifiers. A demulsifier system (chemical pump injection), installed upstream of the separator, has a capacity to treat up to 40,000 barrels of fluid per day. However, the actual average daily demand is 90%. The following cost expenditure data are below. Determine the present worth, future worth and annual worth capital equivalent. Use 8% interest rate per year. Estimate the unitary cost per barrel (S/bb1) for the use of this chemical, assuming a project life of 10 years. Investment: Chemical injection system: $ 50,000 (the investment includes 3 positive displacement 0.25 hp pumps, each with electric motor, and storage tanks) Annual expenses Electricity: $ 600 Maintenance and repair: $ 10,000 Operation: $ 120,000 Chemical consumption and cost: 10 gallons of demulsifier per day at $60 per gallon. Future Pump overhaul cost $400 per pump at the fifth year. Salvage value at end of the useful life: negligible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started