Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For purposes of determining filing status, which of the following is not a requirement for a married taxpayer to be treated as unmarried at the

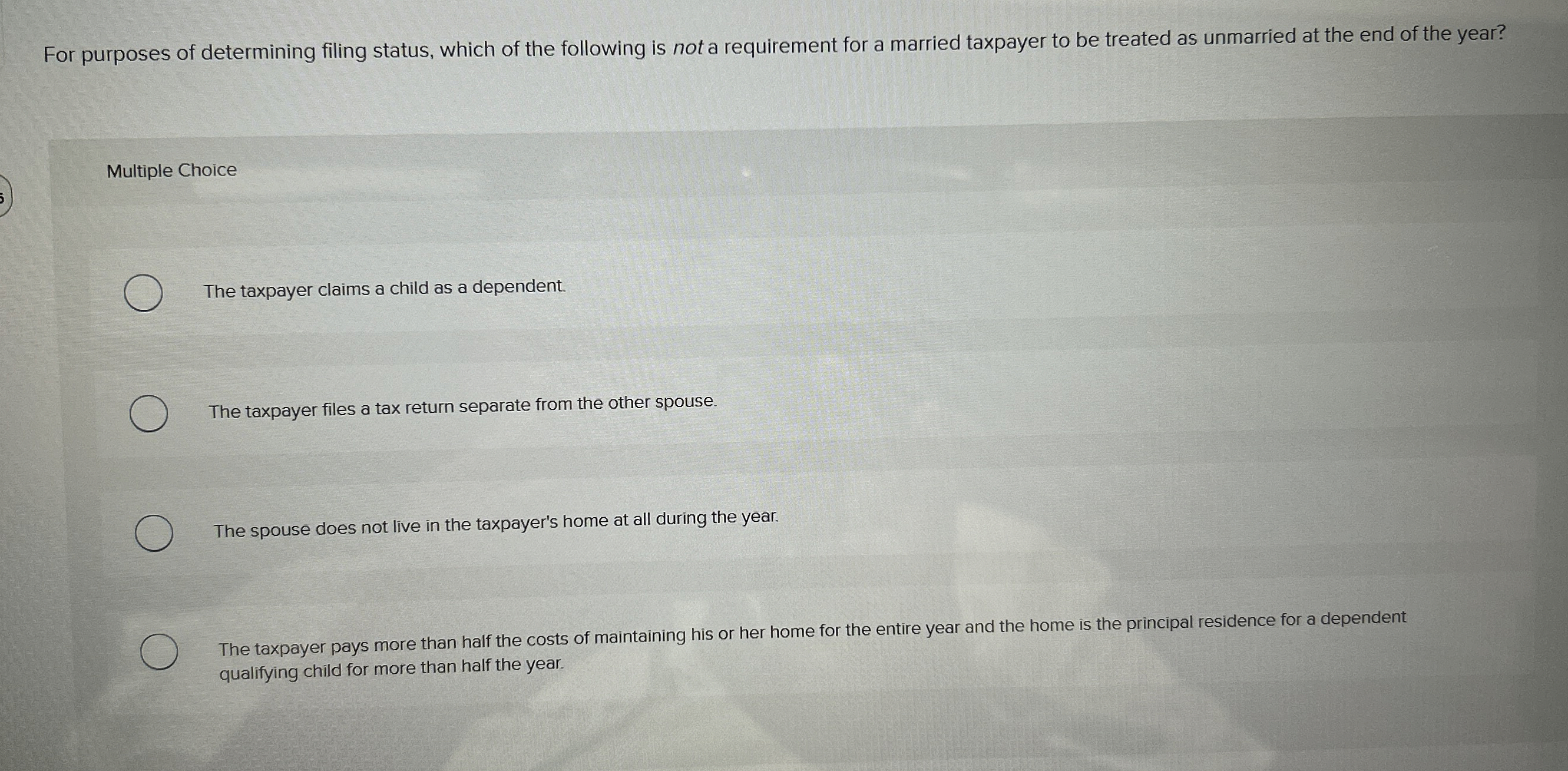

For purposes of determining filing status, which of the following is not a requirement for a married taxpayer to be treated as unmarried at the end of the year?

Multiple Choice

The taxpayer claims a child as a dependent.

The taxpayer files a tax return separate from the other spouse.

The spouse does not live in the taxpayer's home at all during the year.

The taxpayer pays more than half the costs of maintaining his or her home for the entire year and the home is the principal residence for a dependent qualifying child for more than half the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started