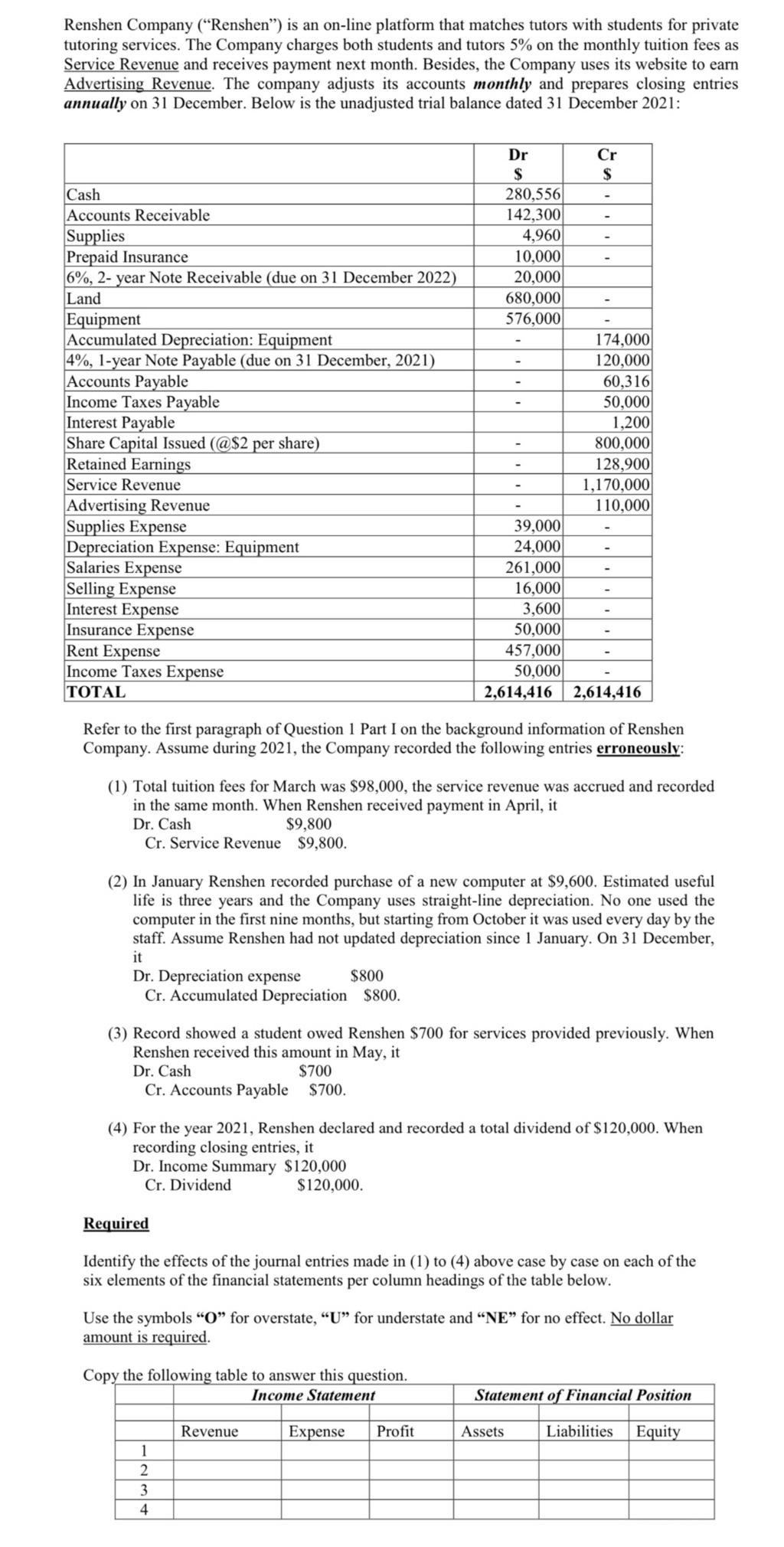

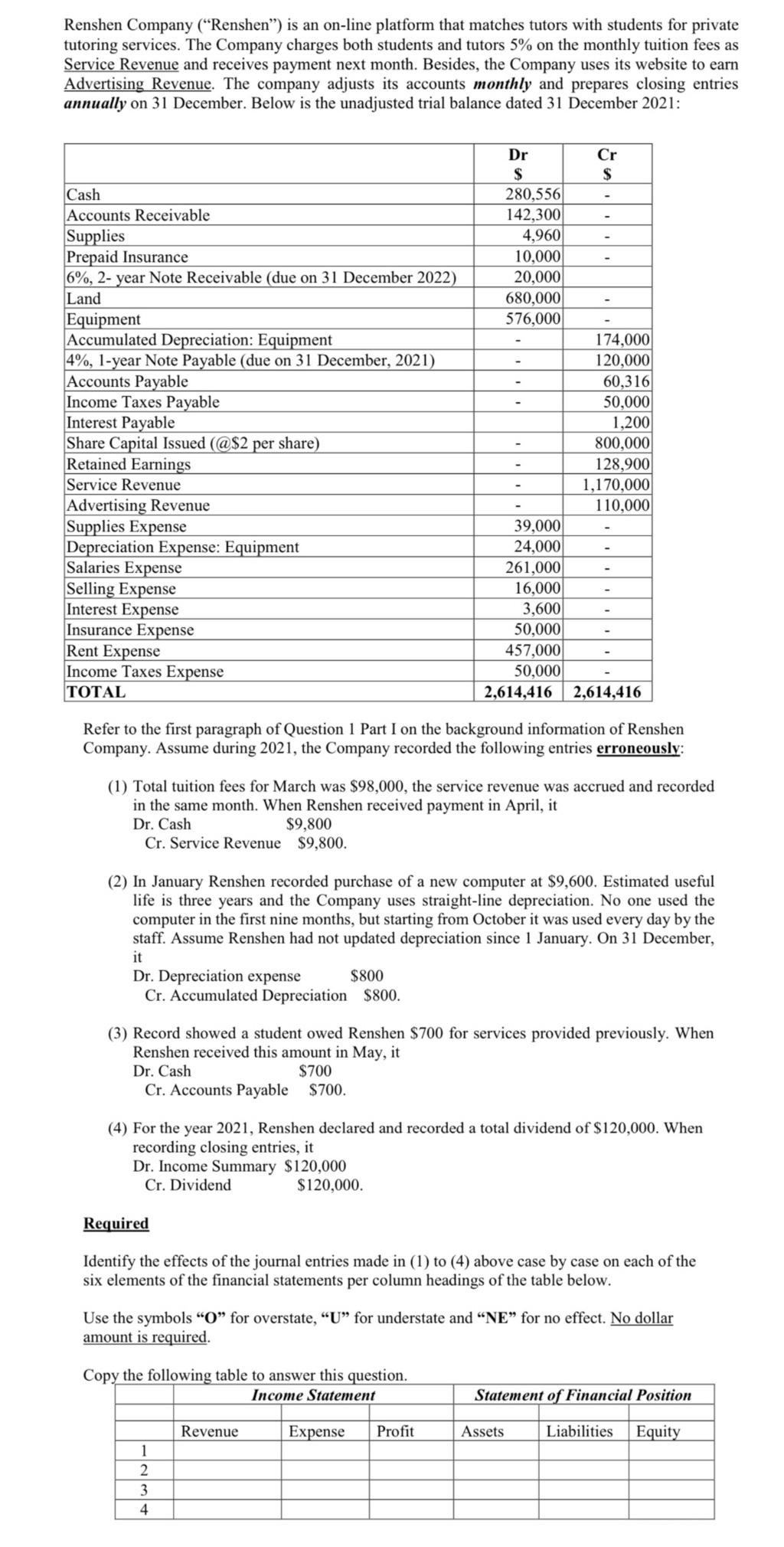

Renshen Company (Renshen) is an on-line platform that matches tutors with students for private tutoring services. The Company charges both students and tutors 5% on the monthly tuition fees as Service Revenue and receives payment next month. Besides, the Company uses its website to earn Advertising Revenue. The company adjusts its accounts monthly and prepares closing entries annually on 31 December. Below is the unadjusted trial balance dated 31 December 2021: Cash Accounts Receivable Supplies Prepaid Insurance 6%, 2- year Note Receivable (due on 31 December 2022) Land Equipment Accumulated Depreciation: Equipment 4%, 1-year Note Payable (due on 31 December, 2021) Accounts Payable Income Taxes Payable Interest Payable Share Capital Issued (@$2 per share) Retained Earnings Service Revenue Advertising Revenue Supplies Expense Depreciation Expense: Equipment Salaries Expense Selling Expense Interest Expense Insurance Expense Rent Expense Income Taxes Expense TOTAL Dr Cr $ $ 280,556 142,300 4,960 10,000 20,000 680,000 576,000 174,000 120,000 60,316 50,000 1.200 800,000 128,900 1,170,000 110,000 39,000 24,000 261,000 16,000 3,600 50,000 457,000 50,000 2,614,416 2,614,416 Refer to the first paragraph of Question 1 Part I on the background information of Renshen Company. Assume during 2021, the Company recorded the following entries erroneously: (1) Total tuition fees for March was $98,000, the service revenue was accrued and recorded in the same month. When Renshen received payment in April, it Dr. Cash $9,800 Cr. Service Revenue $9,800. (2) In January Renshen recorded purchase of a new computer at $9,600. Estimated useful life is three years and the Company uses straight-line depreciation. No one used the computer in the first nine months, but starting from October it was used every day by the staff. Assume Renshen had not updated depreciation since 1 January. On 31 December, it Dr. Depreciation expense $800 Cr. Accumulated Depreciation $800. (3) Record showed a student owed Renshen $700 for services provided previously. When Renshen received this amount in May, it Dr. Cash $700 Cr. Accounts Payable $700. (4) For the year 2021, Renshen declared and recorded a total dividend of $120,000. When recording closing entries, it Dr. Income Summary $120,000 Cr. Dividend $120,000. Required Identify the effects of the journal entries made in (1) to (4) above case by case on each of the six elements of the financial statements per column headings of the table below. Use the symbols O for overstate, U for understate and NE for no effect. No dollar amount is required Copy the following table to answer this question. Income Statement Statement of Financial Position Revenue Expense Profit Assets Liabilities Equity 1 2 3 4