Answered step by step

Verified Expert Solution

Question

1 Approved Answer

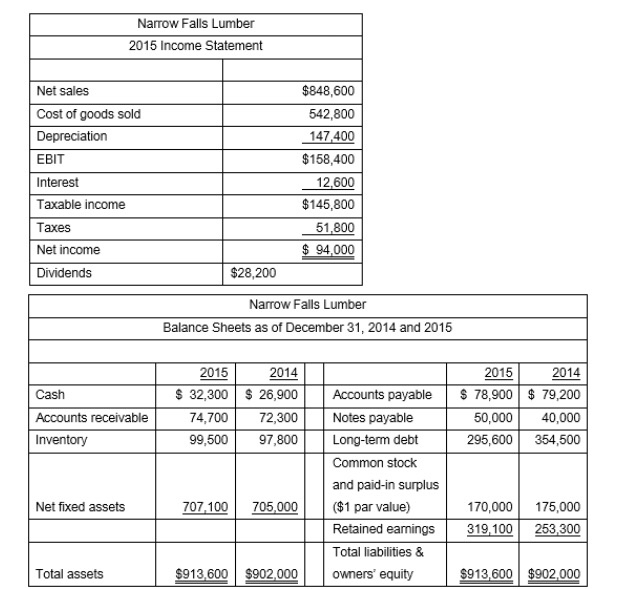

For the following problems (29-36), use the data from the Narrow Falls Lumber's Income Statement and Balance Sheet, please refer to attached photo. 29. Calculate

For the following problems (29-36), use the data from the Narrow Falls Lumber's Income Statement and Balance Sheet, please refer to attached photo.

29. Calculate working capital for:

2014:_____________________ 2015:_____________________

30. Calculate the current ratio for:

2014:_____________________ 2015:_____________________

31. Calculate the quick ratio for:

2014:_____________________ 2015:_____________________

32. Calculate the total assets turnover for

2015:_____________________

33. Calculate the total debt ratio for

2015:_____________________

34. Calculate the Days' sales in inventory for

2015:_____________________

(hint, you must first calculate the inventory turnover)

35. What is the equity multiplier for 2015?

A. 1.71

B. 1.87

C. 1.44

D. 1.82

E. 1.92

36. What are the values for the three components of the DuPont identity for 2015?

A. 11.08%; .9289; 1.8679

B. 11.08%; 1.0765; 1.8679

C. 11.08%; .9289; .5354

D. 7.75%; 1.0765; .5354

E. 7.75%; 1.0765; 1.8679

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started