Answered step by step

Verified Expert Solution

Question

1 Approved Answer

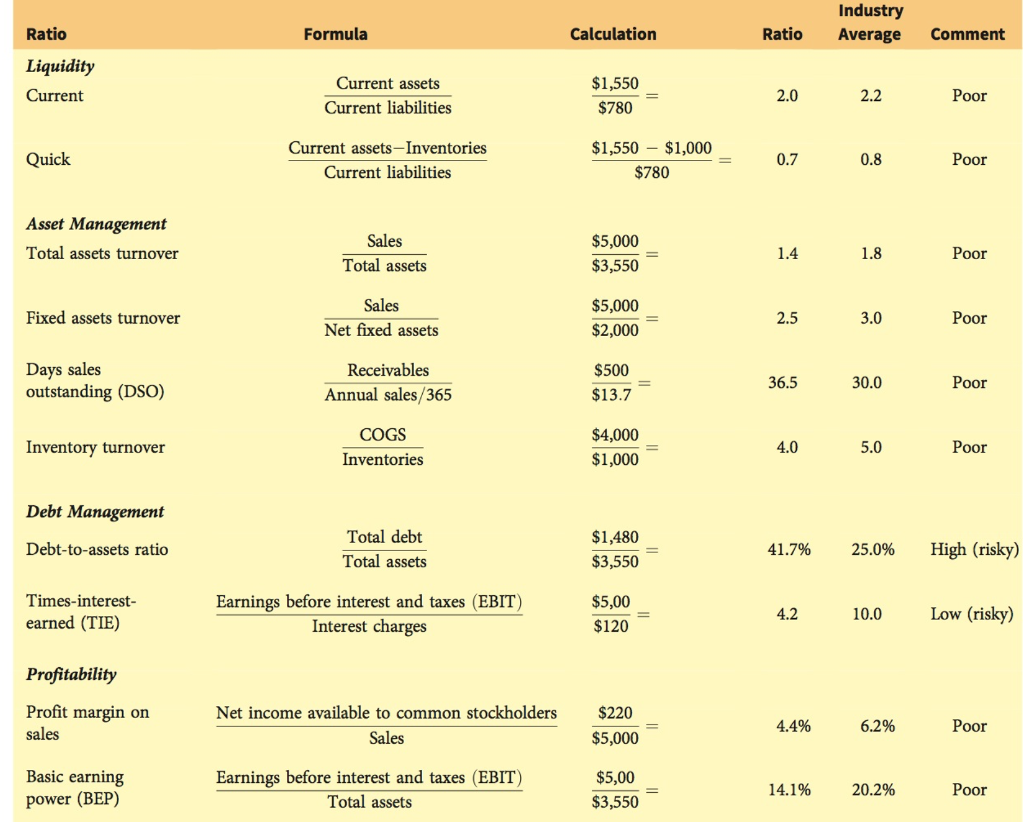

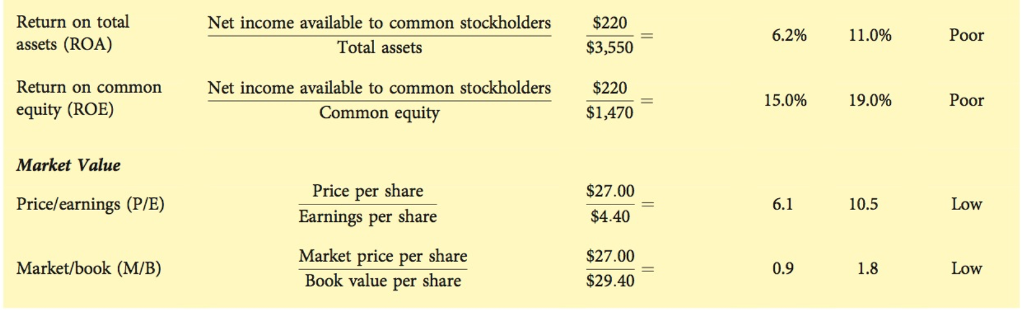

For the PepsiCo company, retrieve the annual report. Prepare a ratio analysis for the example ratios in the image below. The ratio analysis should cover

For the PepsiCo company, retrieve the annual report.

Prepare a ratio analysis for the example ratios in the image below. The ratio analysis should cover a 2 year period. Compare ratios to that of the industry average or a competitor.

Conclusion: did the change in stock piece reflect the ratio analysis?

Industry Ratio Liquidity Current Formula Calculation Ratio Average Comment Current assets Current liabilities $1,550 $780 2.0 2.2 Poor Current assets-Inventories Current liabilities $1,550 $1,000 Quick 0.7 0.8 Poor $780 Asset Management Total assets turnover $5,000 $3,550 $5,000 $2,000 $500 $13.7 $4,000 $1,000 Sales 1.4 1.8 Poor Total assets Sales Net fixed assets Fixed assets turnover 2.5 3.0 Poor Days sales outstanding (DSO) Receivables Annual sales/365 COGS Inventories 36.5 30.0 Poor Inventory turnover 4.0 5.0 Poor Debt Management Total debt Total assets $1,480 $3,550 Debt-to-assets ratio 41.7% 25.0% High (risky) Earnings before interest and taxes (EBIT) Interest charges Times-interest- earned (TIE) Profitability Profit margin on $5,00 $120 4.2 10.0 Low (risky) Net income available to common stockholders Sales $220 $5,000 $5,00 $3,550 4.4% 6.2% Poor sales Earnings before interest and taxes (EBIT) Total assets Basic earning 14.1% 20.2% Poor power (BEP)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started