Answered step by step

Verified Expert Solution

Question

1 Approved Answer

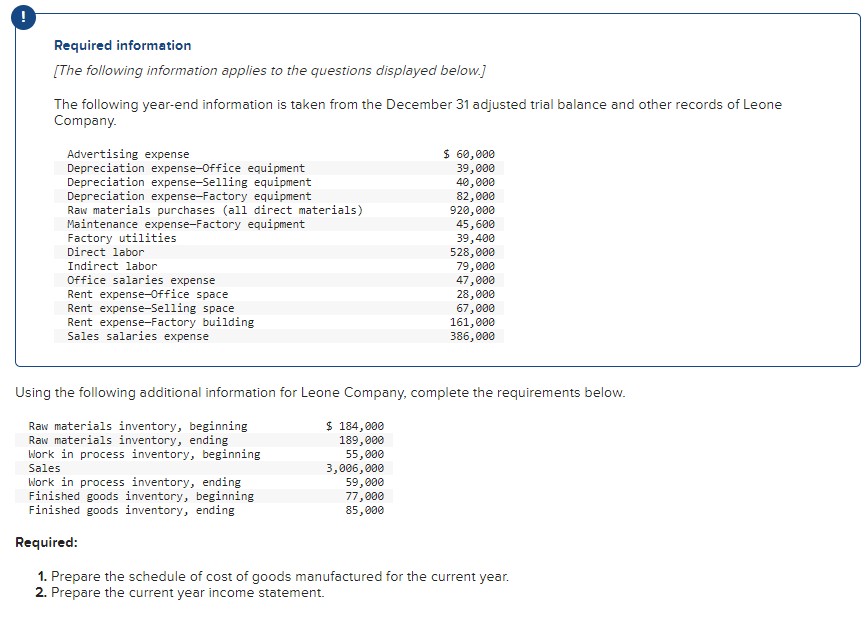

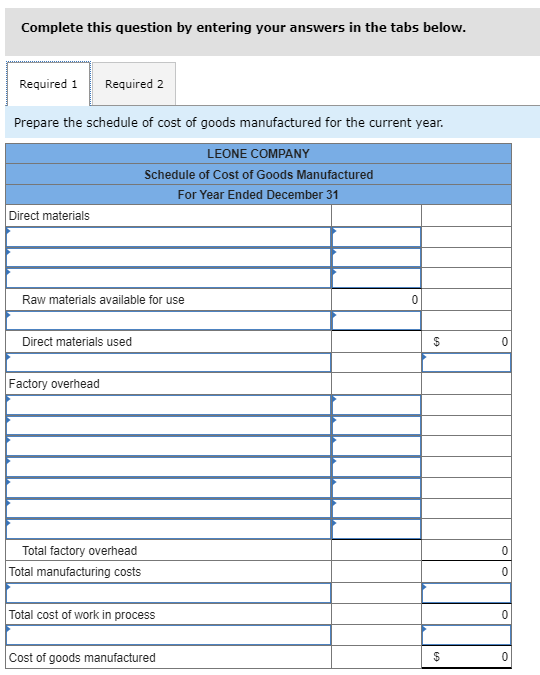

For the the top Advertising expense Depreciation expenseFactory equipment Depreciation expenseOffice equipment Depreciation expenseSelling equipment Direct labor Factory supervision Factory supplies used Factory utilities Finished

For the the top

- Advertising expense

- Depreciation expenseFactory equipment

- Depreciation expenseOffice equipment

- Depreciation expenseSelling equipment

- Direct labor

- Factory supervision

- Factory supplies used

- Factory utilities

- Finished goods, beginning

- Finished goods, ending

- Income taxes expense

- Indirect labor

- Maintenance expenseFactory equipment

- Miscellaneous production costs

- Office salaries expense

- Raw materials inventory, beginning

- Raw materials inventory, ending

- Raw materials purchases

- Rent expenseFactory building

- Rent expenseOffice space

- Rent expenseSelling space

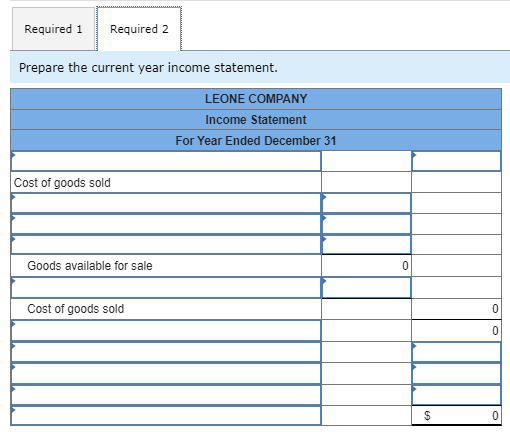

- Sales

- Sales salaries expense

- Work in process, beginning

- Work in process, ending

For the Top

- Accounts payable

- Accounts receivable, net

- Accumulated depreciationBuilding

- Accumulated depreciationFactory Equipment

- Building

- Cash

- Common stock, $10 par

- Cost of goods manufactured

- Cost of goods sold

- Depreciation expenseBuilding

- Depreciation expenseFactory Equipment

- Factory Equipment

- Factory overhead

- Factory utilities

- Finished goods inventory, beginning

- Finished goods inventory, ending

- General and administrative expenses

- Income summary

- Indirect labor

- Interest expense

- Interest revenue

- Inventory

- Land

- Merchandise inventory

- Note payable

- Organization expenses

- Paid-in capital in excess of par value, common stock

- Prepaid insurance

- Property taxesFactory

- Raw materials inventory

- Rent expense

- RepairsFactory Equipment

- Retained earnings

- Salaries expense

- Sales

- Sales discounts

- Sales returns and allowances

- Selling expenses

- Supplies

- Supplies expense

- Work in process inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started