- For the year ended 12/31/2006, prepare a schedule that shows the cash flows received from PlexMedia from the contract.

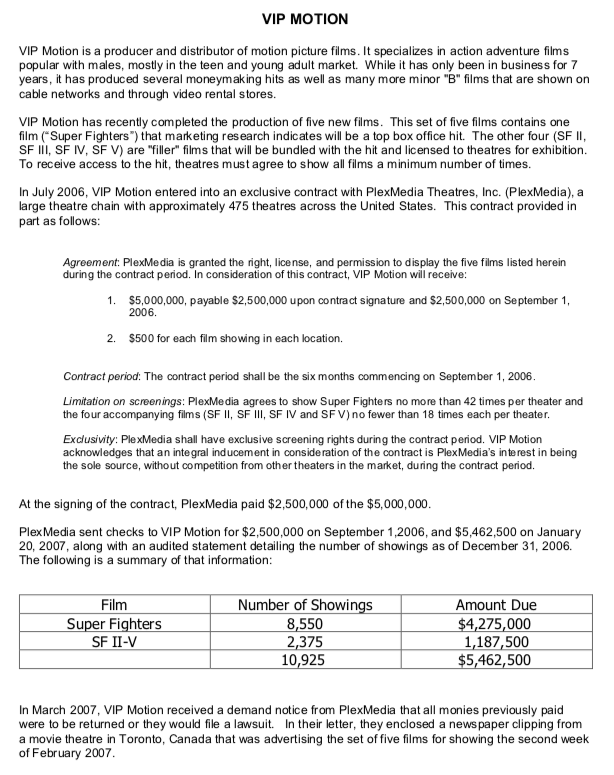

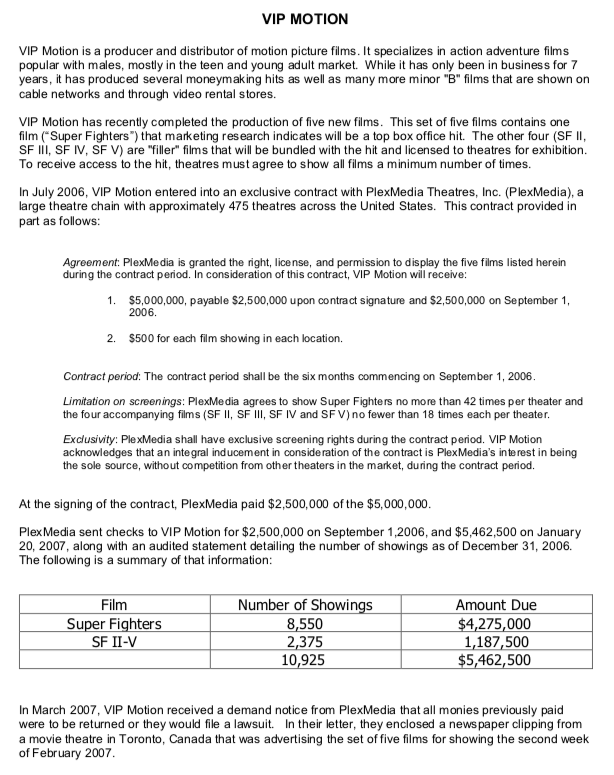

1 VIP MOTION VIP Motion is a producer and distributor of motion picture films. It specializes in action adventure films popular with males, mostly in the teen and young adult market. While it has only been in business for 7 years, it has produced several moneymaking hits as well as many more minor "B" films that are shown on cable networks and through video rental stores VIP Motion has recently completed the production of five new films. This set of five films contains one film Super Fighters") that marketing research indicates will be a top box office hit. The other four (SF II SF III, SF IV, SF V) are "filler" films that will be bundled with the hit and licensed to theatres for exhibition. To receive access to the hit, theatres must agree to show all films a minimum number of times In July 2006, VIP Motion entered into an exclusive contract with PlexMedia Theatres, Inc. (PlexMedia), a large theatre chain with approximately 475 theatres across the United States. This contract provided in part as follows Agreement: PlexMedia is granted the right, license, and permission to display the five films listed herein during the contract period. In consideration of this contract, VIP Motion will receive $5,000,000, payable $2,500,000 upon contract signature and $2,500,000 on September 1 2006. 2. $500 for each film showing in each location. Contract period: The contract period shall be the six months commencing on September 1, 2006 Limitation on screenings: PlexMedia agrees to show Super Fighters no more than 42 times per theater and the four accompanying films (S, S, SF IV and SFV) no fewer than 18 times each per theater. Exclusivity: PlexMedia shall have exclusive screening rights during the contract period. VIP Motion acknowledges that an integral inducement in conside ration of the contract is Plex Media's interest in being the sole source, without competition from other theaters in the market, during the contract period. At the signing of the contract, PlexMedia paid $2,500,000 of the $5,000,000 PlexMedia sent checks to VIP Motion for $2,500,000 on September 1,2006, and $5,462,500 on January 20, 2007, along with an audited statement detailing the number of showings as of December 31, 2006. The following is a summary of that information Film Super Fighters SF II-V Number of Showings Amount Due $4,275,000 1,187,500 $5,462,500 8,550 2,375 10,925 In March 2007, VIP Motion received a demand notice from PlexMedia that all monies previously paid were to be returned or they would file a lawsuit. In their letter, they enclosed a news paper clipping from a movie theatre in Toronto, Canada that was advertising the set of five films for showing the second week of February 2007 Statement of Financial Ac counting Concepts Statement 5. Recognition and Measurement in Financial Statements of Business Enterprises Financial Accounting Standards Board GUIDANCE IN APPLYING CRITERIA TO COMPONENTS OF EARNINGS CON5, Par. 78 78. This section discusses the need for and provides further guidance in applying the fundamental criteria in recognizing components of earnings. Changes in net assets are recognized as components of earnings if they qualify under the guidance in paragraphs 83-87. Certain changes in net assets (discussed in paragraphs 42-44 and 49-51) that meet the four fundamental recognition criteria just described may qualify for recognition in comprehensive income even though they do not qualify for recognition as components of earnings based on that guidance CON5, Par. 79 79. Further guidance in applying the recognition criteria to components of earnings is necessary because of the widely acknowledged importance of information about earnings and its components asa primary measure of performance for a period. The perfomance measured is that of the entity, not necessarily that of its management, and includes the recognized effects upon the entity of events and circumstances both within and beyond the control of the entity and its management.48 The widely acknowledged importance of earnings information leads to guidance intended in part to provide more stringent requirements for recognizing components of earnings than for recognizing other changes in assets or liabilities CON5, Par. 80 80 As noted in paragraph 36, earnings measures the extent to which asset inflows (revenues and gains) associated with substantially completed cash-to-cash cycles exceed asset outflows (expenses and losses) associated, directly or indirectly, with the same cycles. Guidance for recognizing components of earnings is concerned with identifying which cycles are substantially complete and with associating particular revenues, gains, expenses, and losses with those cycles CON5, Par. 81 81 n assessing the prospect that as yet uncompleted transactions will be concluded successfully, a degree of skepticism is often warranted. Moreover, as a reaction to uncertainty, more stringent requirements historically have been imposed for recognizing revenues and gains than for recognizing expenses and losses, and those conservative reactions influence the guidance for applying the recognition criteria to components of earnings CON5, Par. 82 82 The guidance stated here is intended to summarize key considerations in a form useful for guidance for future standard setting- guidance which also is consistent with the vast bulk of current practice. The following paragraphs provide guidance separately for recognition of revenues and gains and for expenses and losses as components of earnings Revenues and Gains CON5, Par. 83 83. Further guidance for recognition of revenues and gains is intended to provide an acceptable level of assurance of the existence and amounts of revenues and gains before they are recognized. Revenues and gains of an enterprise during a period are generally measured by the exchange values of the assets (goods or services) or liabilities involved, and recognition involves consideration of two factors (a) being realized or realiz able and (b) being earned, with sometimes one and sometimes the other being the more important consideration Realized or realizable. Revenues and gains generally are not recognized until realized or realizable. Revenues and gains are realized when products (goods or services), merchandise, or other assets are exchanged for cash or claims to cash. Revenues and gains are realizable when related assets received or held are readily convertible to known amounts of cash or claims to cash. Readily convertible assets have (i) interchangeable (fungible) units and (i) quoted prices available in an active market that can rapidly absorb the quantity held by the entity without significantly affecting the price 2 Earned. Revenues are not recognized until earned. An entity's revenue-earning activities involve delivering or producing goods, rendering services, or other activities that cons titute its ongoing major or central operations and revenues are considered to have been earned when the entity has substantially accomplished what it must do to be entitled to the benefits represented by the revenues. Gains commonly result from transactions and other events that involve no "earning process," and for recognizing gains, being earned is generally less significant than being realized or realizable