Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FOR THESE THREE PROBLEMS CAN YOU PLEASE CLEARLY GIVE ME THE SOLUTION USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE FINANCIAL

FOR THESE THREE PROBLEMS CAN YOU PLEASE CLEARLY GIVE ME THE SOLUTION USING THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE FINANCIAL CALCULATOR FUNCTION THANK YOU SO MUCH

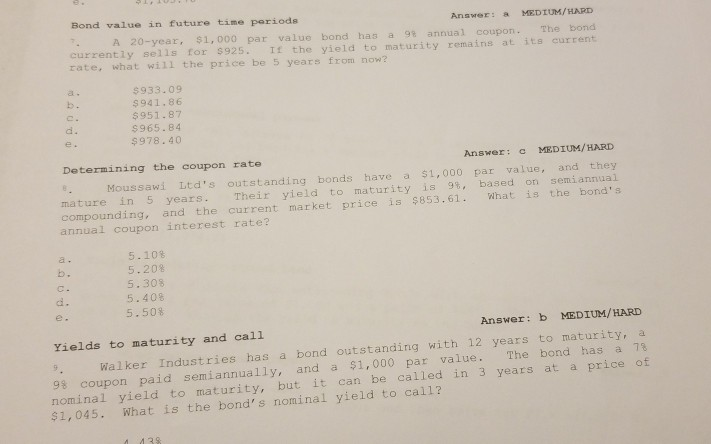

Bond value in future time periods Anawer: a MEDIUM/HARD A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for 925. f the yield to maturity remains at its current rate, what will the price be 5 years from now? $933.09 $941.86 $951.87 $965.84 $978.40 b. d. Determining the coupon rate Answer: MEDIUM/HARD Moussawi Ltd's outstanding bonds have a $1,000 par value, and they mature in 5 years. Their yield to maturity is 9%, based on semiannual compounding, and the current market price is 853.61. What is the bond's annual coupon interest rate? a- b. C. 5.10% 5.20% 5.30% 5.40 5.50% e. Answer: b MEDIUM/HARD with 12 years to maturity, a 98 coupon paid semiannually, and a $1,000 par value The bond has a 78 Yields to maturity and cal1 Walker Industries has a bond outstanding but it can be called in 3 years at a price of nominal yield to maturity, $1,045. What is the bond's nominal yield to callStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started