Answered step by step

Verified Expert Solution

Question

1 Approved Answer

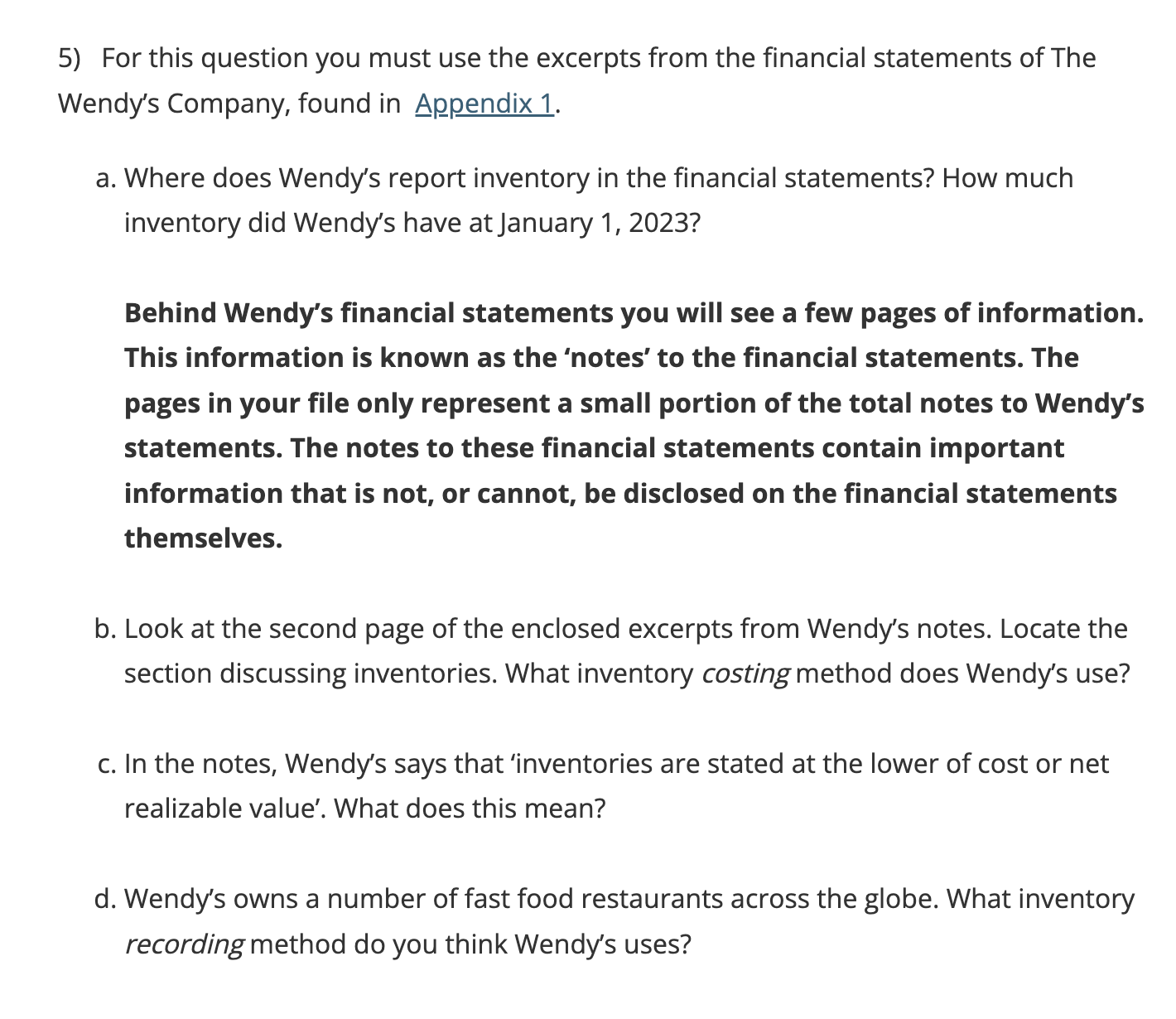

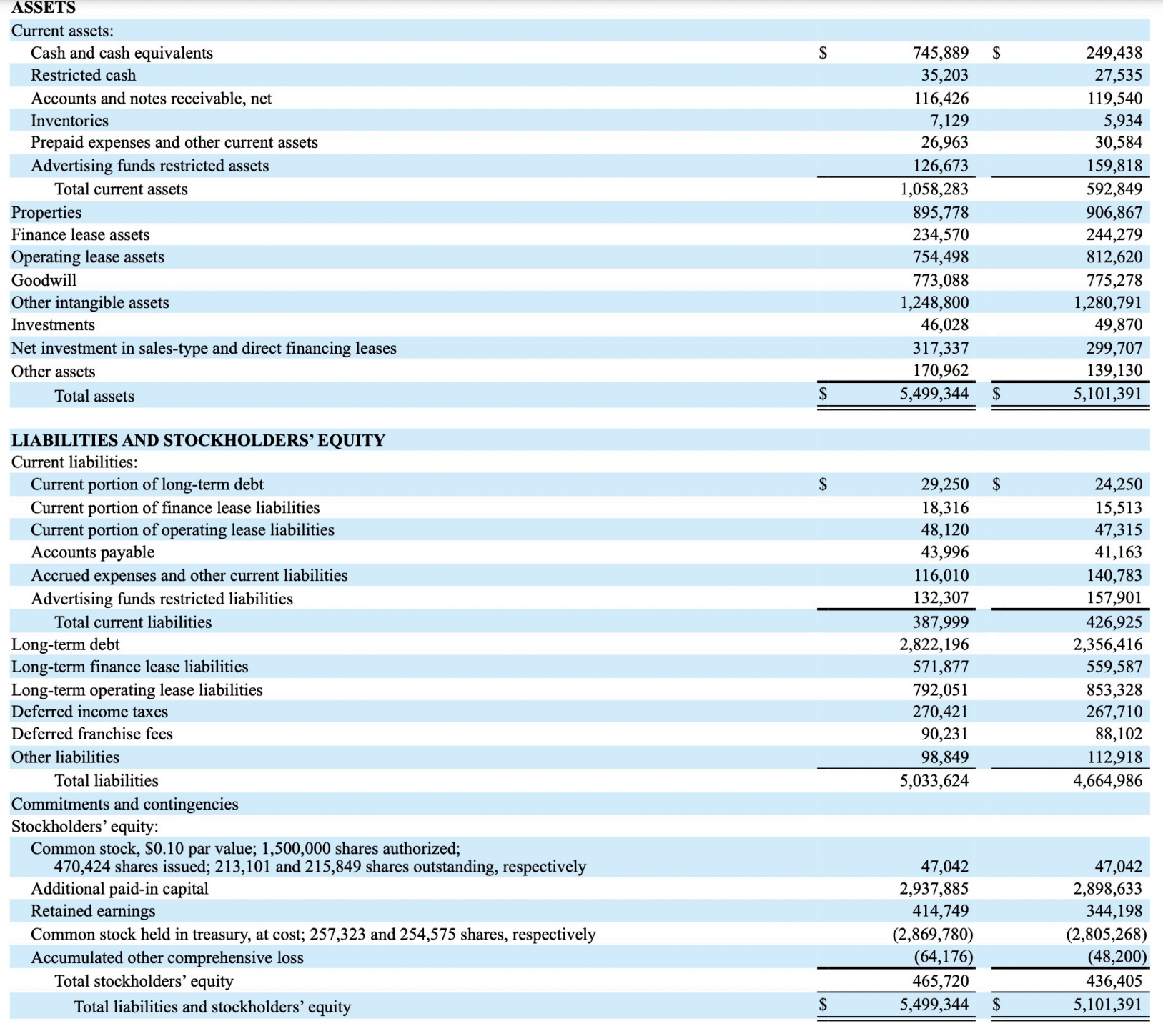

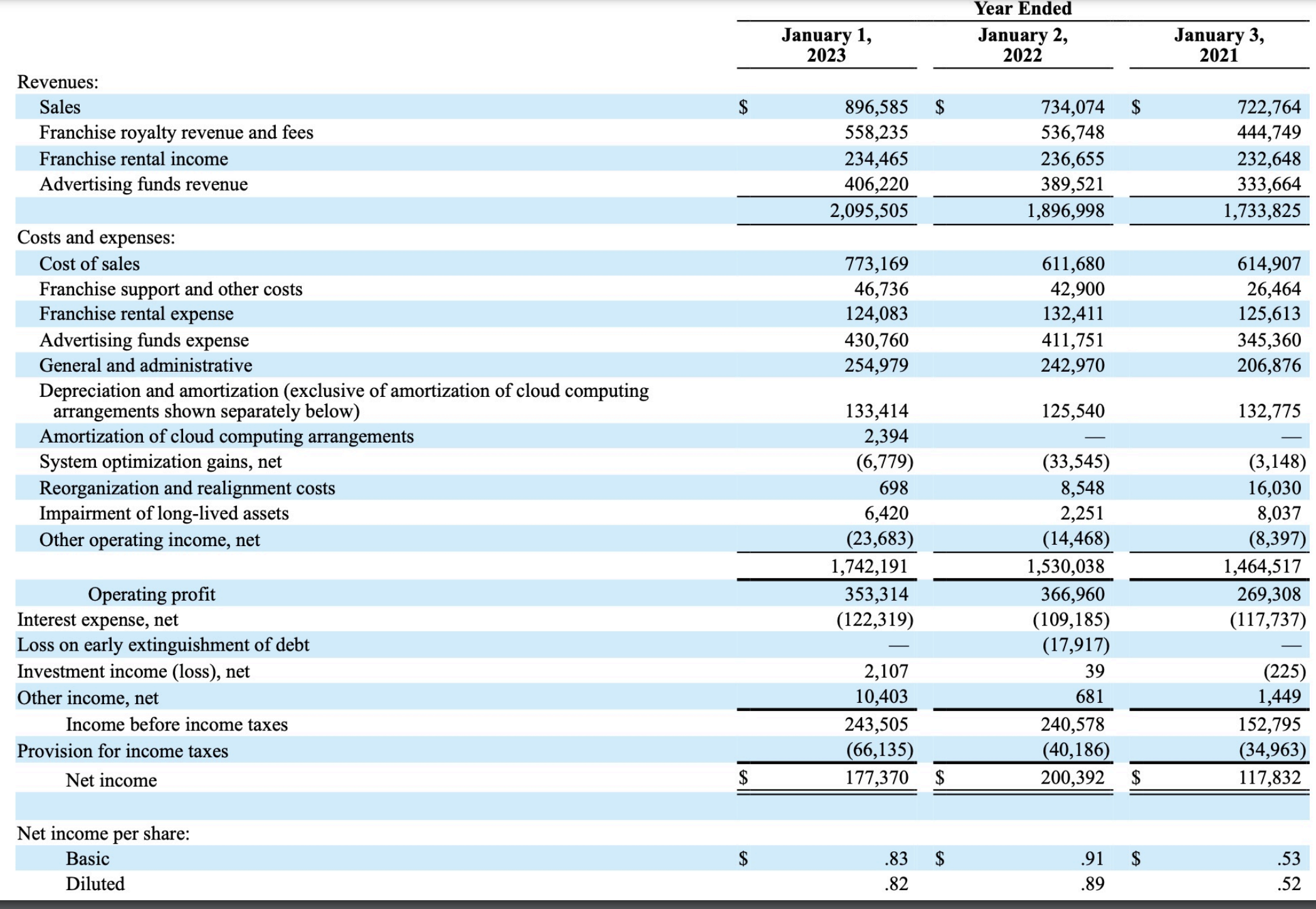

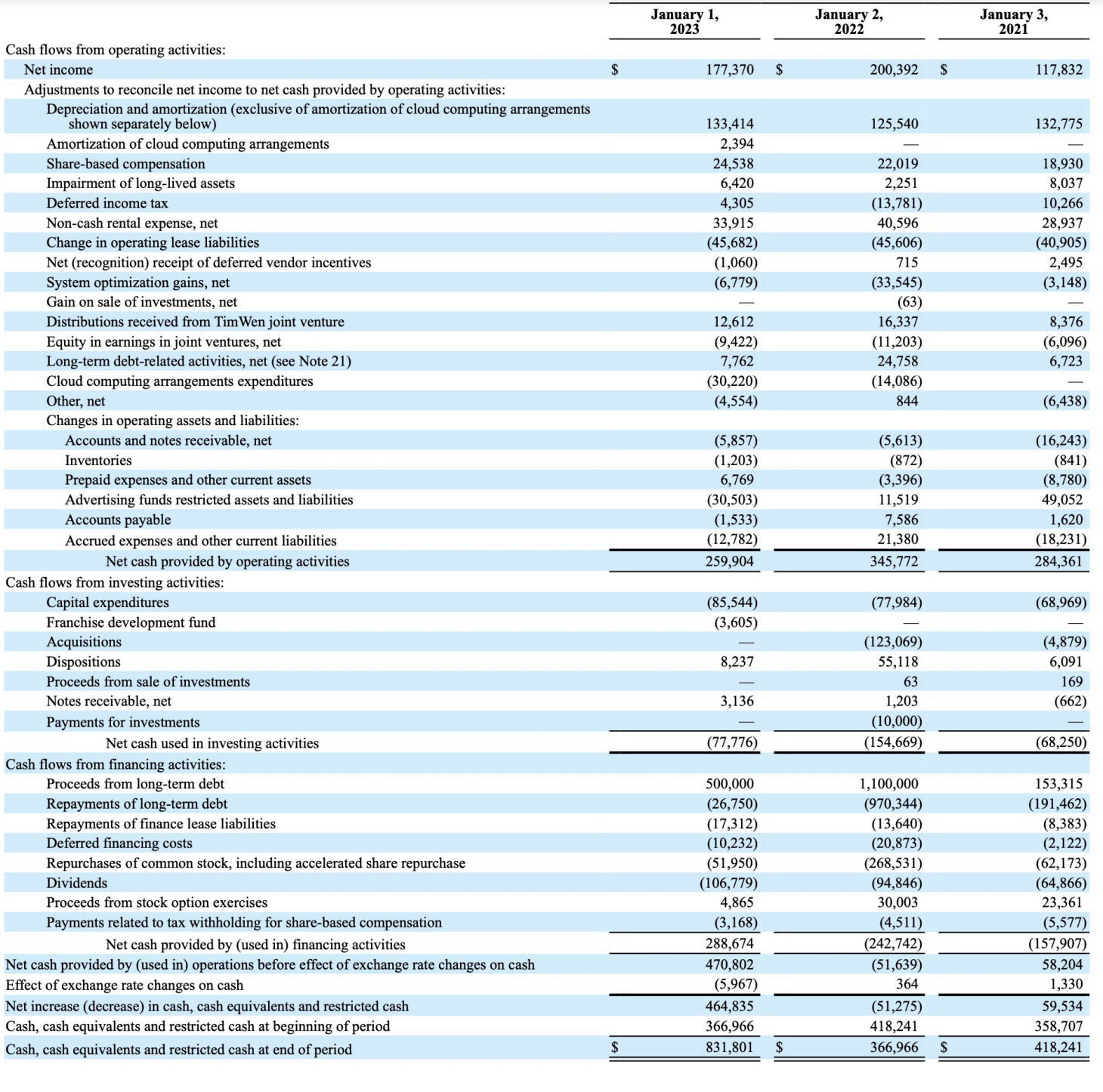

For this question you must use the excerpts from the financial statements of The Vendy's Company, found in Appendix 1. a. Where does Wendy's report

For this question you must use the excerpts from the financial statements of The Vendy's Company, found in Appendix 1. a. Where does Wendy's report inventory in the financial statements? How much inventory did Wendy's have at January 1, 2023? Behind Wendy's financial statements you will see a few pages of information. This information is known as the 'notes' to the financial statements. The pages in your file only represent a small portion of the total notes to Wendy's statements. The notes to these financial statements contain important information that is not, or cannot, be disclosed on the financial statements themselves. b. Look at the second page of the enclosed excerpts from Wendy's notes. Locate the section discussing inventories. What inventory costing method does Wendy's use? c. In the notes, Wendy's says that 'inventories are stated at the lower of cost or net realizable value'. What does this mean? d. Wendy's owns a number of fast food restaurants across the globe. What inventory recording method do you think Wendy's uses? \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Revenues: } & \multicolumn{6}{|c|}{ Year Ended } \\ \hline & \multicolumn{2}{|r|}{January1,2023} & \multicolumn{2}{|c|}{January2,2022} & \multicolumn{2}{|r|}{January3,2021} \\ \hline Sales & $ & 896,585 & $ & 734,074 & $ & 722,764 \\ \hline Franchise royalty revenue and fees & & 558,235 & & 536,748 & & 444,749 \\ \hline Franchise rental income & & 234,465 & & 236,655 & & 232,648 \\ \hline \multirow[t]{2}{*}{ Advertising funds revenue } & & 406,220 & & 389,521 & & 333,664 \\ \hline & & 2,095,505 & & 1,896,998 & & 1,733,825 \\ \hline \multicolumn{7}{|l|}{ Costs and expenses: } \\ \hline Cost of sales & & 773,169 & & 611,680 & & 614,907 \\ \hline Franchise support and other costs & & 46,736 & & 42,900 & & 26,464 \\ \hline Franchise rental expense & & 124,083 & & 132,411 & & 125,613 \\ \hline Advertising funds expense & & 430,760 & & 411,751 & & 345,360 \\ \hline General and administrative & & 254,979 & & 242,970 & & 206,876 \\ \hline Depreciationandamortization(exclusiveofamortizationofcloudcomputingarrangementsshownseparatelybelow) & & 133,414 & & 125,540 & & 132,775 \\ \hline Amortization of cloud computing arrangements & & 2,394 & & - & & - \\ \hline System optimization gains, net & & (6,779) & & (33,545) & & (3,148) \\ \hline Reorganization and realignment costs & & 698 & & 8,548 & & 16,030 \\ \hline Impairment of long-lived assets & & 6,420 & & 2,251 & & 8,037 \\ \hline \multirow[t]{2}{*}{ Other operating income, net } & & (23,683) & & (14,468) & & (8,397) \\ \hline & & 1,742,191 & & 1,530,038 & & 1,464,517 \\ \hline Operating profit & & 353,314 & & 366,960 & & 269,308 \\ \hline Interest expense, net & & (122,319) & & (109,185) & & (117,737) \\ \hline Loss on early extinguishment of debt & & - & & (17,917) & & - \\ \hline Investment income (loss), net & & 2,107 & & 39 & & (225) \\ \hline Other income, net & & 10,403 & & 681 & & 1,449 \\ \hline Income before income taxes & & 243,505 & & 240,578 & & 152,795 \\ \hline Provision for income taxes & & (66,135) & & (40,186) & & (34,963) \\ \hline Net income & $ & 177,370 & $ & 200,392 & $ & 117,832 \\ \hline \multicolumn{7}{|l|}{ Net income per share: } \\ \hline Basic & $ & .83 & $ & .91 & $ & .53 \\ \hline Diluted & & .82 & & .89 & & .52 \\ \hline \end{tabular} ASSETS \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $ & 745,889 & $ & 249,438 \\ \hline Restricted cash & & 35,203 & & 27,535 \\ \hline Accounts and notes receivable, net & & 116,426 & & 119,540 \\ \hline Inventories & & 7,129 & & 5,934 \\ \hline Prepaid expenses and other current assets & & 26,963 & & 30,584 \\ \hline Advertising funds restricted assets & & 126,673 & & 159,818 \\ \hline Total current assets & & 1,058,283 & & 592,849 \\ \hline Properties & & 895,778 & & 906,867 \\ \hline Finance lease assets & & 234,570 & & 244,279 \\ \hline Operating lease assets & & 754,498 & & 812,620 \\ \hline Goodwill & & 773,088 & & 775,278 \\ \hline Other intangible assets & & 1,248,800 & & 1,280,791 \\ \hline Investments & & 46,028 & & 49,870 \\ \hline Net investment in sales-type and direct financing leases & & 317,337 & & 299,707 \\ \hline Other assets & & 170,962 & & 139,130 \\ \hline Total assets & $ & 5,499,344 & $ & 5,101,391 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{5}{|l|}{ Current liabilities: } \\ \hline Current portion of long-term debt & $ & 29,250 & $ & 24,250 \\ \hline Current portion of finance lease liabilities & & 18,316 & & 15,513 \\ \hline Current portion of operating lease liabilities & & 48,120 & & 47,315 \\ \hline Accounts payable & & 43,996 & & 41,163 \\ \hline Accrued expenses and other current liabilities & & 116,010 & & 140,783 \\ \hline Advertising funds restricted liabilities & & 132,307 & & 157,901 \\ \hline Total current liabilities & & 387,999 & & 426,925 \\ \hline Long-term debt & & 2,822,196 & & 2,356,416 \\ \hline Long-term finance lease liabilities & & 571,877 & & 559,587 \\ \hline Long-term operating lease liabilities & & 792,051 & & 853,328 \\ \hline Deferred income taxes & & 270,421 & & 267,710 \\ \hline Deferred franchise fees & & 90,231 & & 88,102 \\ \hline Other liabilities & & 98,849 & & 112,918 \\ \hline Total liabilities & & 5,033,624 & & 4,664,986 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.10parvalue;1,500,000sharesauthorized;470,424sharesissued;213,101and215,849sharesoutstanding,respectively & & 47,042 & & 47,042 \\ \hline Additional paid-in capital & & 2,937,885 & & 2,898,633 \\ \hline Retained earnings & & 414,749 & & 344,198 \\ \hline Common stock held in treasury, at cost; 257,323 and 254,575 shares, respectively & & (2,869,780) & & (2,805,268) \\ \hline Accumulated other comprehensive loss & & (64,176) & & (48,200) \\ \hline Total stockholders' equity & & 465,720 & & 436,405 \\ \hline Total liabilities and stockholders' equity & $ & 5,499,344 & $ & 5,101,391 \\ \hline \end{tabular}

For this question you must use the excerpts from the financial statements of The Vendy's Company, found in Appendix 1. a. Where does Wendy's report inventory in the financial statements? How much inventory did Wendy's have at January 1, 2023? Behind Wendy's financial statements you will see a few pages of information. This information is known as the 'notes' to the financial statements. The pages in your file only represent a small portion of the total notes to Wendy's statements. The notes to these financial statements contain important information that is not, or cannot, be disclosed on the financial statements themselves. b. Look at the second page of the enclosed excerpts from Wendy's notes. Locate the section discussing inventories. What inventory costing method does Wendy's use? c. In the notes, Wendy's says that 'inventories are stated at the lower of cost or net realizable value'. What does this mean? d. Wendy's owns a number of fast food restaurants across the globe. What inventory recording method do you think Wendy's uses? \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Revenues: } & \multicolumn{6}{|c|}{ Year Ended } \\ \hline & \multicolumn{2}{|r|}{January1,2023} & \multicolumn{2}{|c|}{January2,2022} & \multicolumn{2}{|r|}{January3,2021} \\ \hline Sales & $ & 896,585 & $ & 734,074 & $ & 722,764 \\ \hline Franchise royalty revenue and fees & & 558,235 & & 536,748 & & 444,749 \\ \hline Franchise rental income & & 234,465 & & 236,655 & & 232,648 \\ \hline \multirow[t]{2}{*}{ Advertising funds revenue } & & 406,220 & & 389,521 & & 333,664 \\ \hline & & 2,095,505 & & 1,896,998 & & 1,733,825 \\ \hline \multicolumn{7}{|l|}{ Costs and expenses: } \\ \hline Cost of sales & & 773,169 & & 611,680 & & 614,907 \\ \hline Franchise support and other costs & & 46,736 & & 42,900 & & 26,464 \\ \hline Franchise rental expense & & 124,083 & & 132,411 & & 125,613 \\ \hline Advertising funds expense & & 430,760 & & 411,751 & & 345,360 \\ \hline General and administrative & & 254,979 & & 242,970 & & 206,876 \\ \hline Depreciationandamortization(exclusiveofamortizationofcloudcomputingarrangementsshownseparatelybelow) & & 133,414 & & 125,540 & & 132,775 \\ \hline Amortization of cloud computing arrangements & & 2,394 & & - & & - \\ \hline System optimization gains, net & & (6,779) & & (33,545) & & (3,148) \\ \hline Reorganization and realignment costs & & 698 & & 8,548 & & 16,030 \\ \hline Impairment of long-lived assets & & 6,420 & & 2,251 & & 8,037 \\ \hline \multirow[t]{2}{*}{ Other operating income, net } & & (23,683) & & (14,468) & & (8,397) \\ \hline & & 1,742,191 & & 1,530,038 & & 1,464,517 \\ \hline Operating profit & & 353,314 & & 366,960 & & 269,308 \\ \hline Interest expense, net & & (122,319) & & (109,185) & & (117,737) \\ \hline Loss on early extinguishment of debt & & - & & (17,917) & & - \\ \hline Investment income (loss), net & & 2,107 & & 39 & & (225) \\ \hline Other income, net & & 10,403 & & 681 & & 1,449 \\ \hline Income before income taxes & & 243,505 & & 240,578 & & 152,795 \\ \hline Provision for income taxes & & (66,135) & & (40,186) & & (34,963) \\ \hline Net income & $ & 177,370 & $ & 200,392 & $ & 117,832 \\ \hline \multicolumn{7}{|l|}{ Net income per share: } \\ \hline Basic & $ & .83 & $ & .91 & $ & .53 \\ \hline Diluted & & .82 & & .89 & & .52 \\ \hline \end{tabular} ASSETS \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $ & 745,889 & $ & 249,438 \\ \hline Restricted cash & & 35,203 & & 27,535 \\ \hline Accounts and notes receivable, net & & 116,426 & & 119,540 \\ \hline Inventories & & 7,129 & & 5,934 \\ \hline Prepaid expenses and other current assets & & 26,963 & & 30,584 \\ \hline Advertising funds restricted assets & & 126,673 & & 159,818 \\ \hline Total current assets & & 1,058,283 & & 592,849 \\ \hline Properties & & 895,778 & & 906,867 \\ \hline Finance lease assets & & 234,570 & & 244,279 \\ \hline Operating lease assets & & 754,498 & & 812,620 \\ \hline Goodwill & & 773,088 & & 775,278 \\ \hline Other intangible assets & & 1,248,800 & & 1,280,791 \\ \hline Investments & & 46,028 & & 49,870 \\ \hline Net investment in sales-type and direct financing leases & & 317,337 & & 299,707 \\ \hline Other assets & & 170,962 & & 139,130 \\ \hline Total assets & $ & 5,499,344 & $ & 5,101,391 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{5}{|l|}{ Current liabilities: } \\ \hline Current portion of long-term debt & $ & 29,250 & $ & 24,250 \\ \hline Current portion of finance lease liabilities & & 18,316 & & 15,513 \\ \hline Current portion of operating lease liabilities & & 48,120 & & 47,315 \\ \hline Accounts payable & & 43,996 & & 41,163 \\ \hline Accrued expenses and other current liabilities & & 116,010 & & 140,783 \\ \hline Advertising funds restricted liabilities & & 132,307 & & 157,901 \\ \hline Total current liabilities & & 387,999 & & 426,925 \\ \hline Long-term debt & & 2,822,196 & & 2,356,416 \\ \hline Long-term finance lease liabilities & & 571,877 & & 559,587 \\ \hline Long-term operating lease liabilities & & 792,051 & & 853,328 \\ \hline Deferred income taxes & & 270,421 & & 267,710 \\ \hline Deferred franchise fees & & 90,231 & & 88,102 \\ \hline Other liabilities & & 98,849 & & 112,918 \\ \hline Total liabilities & & 5,033,624 & & 4,664,986 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.10parvalue;1,500,000sharesauthorized;470,424sharesissued;213,101and215,849sharesoutstanding,respectively & & 47,042 & & 47,042 \\ \hline Additional paid-in capital & & 2,937,885 & & 2,898,633 \\ \hline Retained earnings & & 414,749 & & 344,198 \\ \hline Common stock held in treasury, at cost; 257,323 and 254,575 shares, respectively & & (2,869,780) & & (2,805,268) \\ \hline Accumulated other comprehensive loss & & (64,176) & & (48,200) \\ \hline Total stockholders' equity & & 465,720 & & 436,405 \\ \hline Total liabilities and stockholders' equity & $ & 5,499,344 & $ & 5,101,391 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started