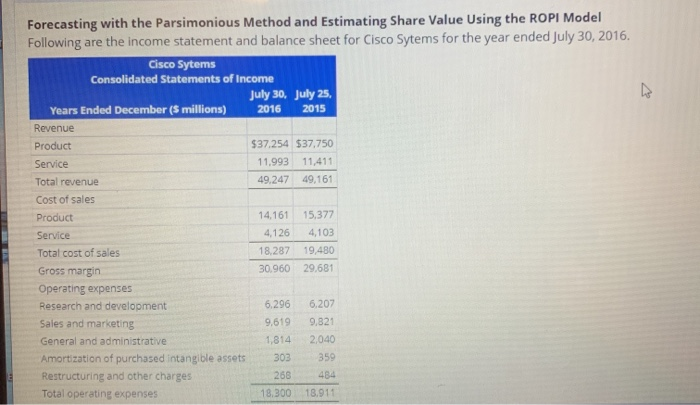

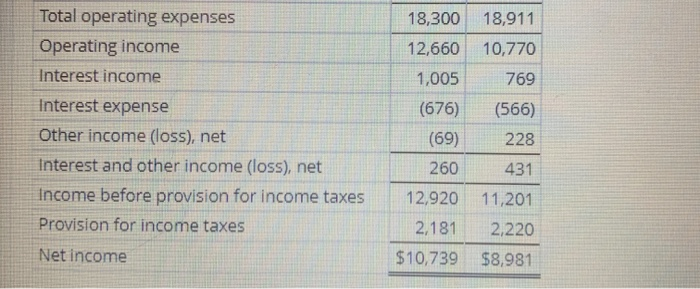

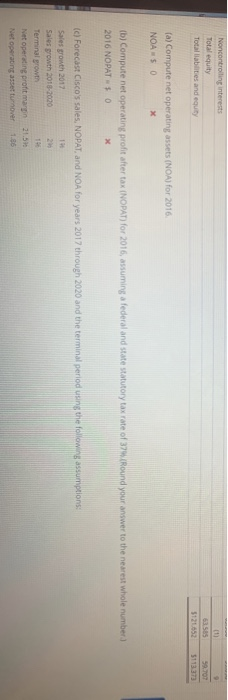

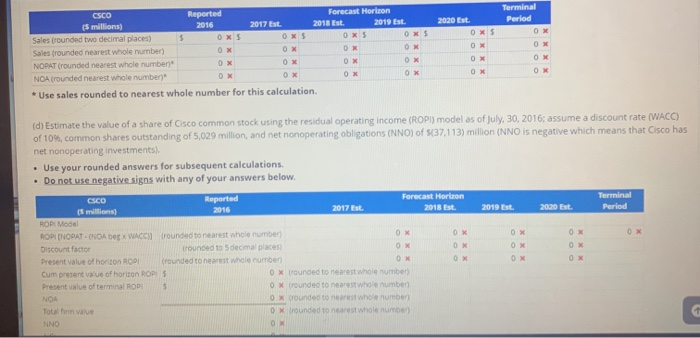

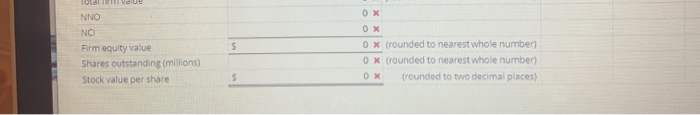

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Cisco Sytems for the year ended July 30, 2016. Cisco Sytems Consolidated Statements of Income July 30, July 25 Years Ended December (5 millions) 2016 2015 Revenue Product $37.254 $37,750 Service 11,993 11,411 Total revenue 49.247 49.161 Cost of sales Product 14,161 15.377 Service 4,126 4,103 Total cost of sales 18.287 19.480 Gross margin 30.960 29.681 Operating expenses Research and development 6.296 6,207 Sales and marketing 9,619 9.821 General and administrative 2,040 Amortization of purchased intangible assets 303 Restructuring and other charges 268 484 Total operating expenses 18.300 18.911 359 Total operating expenses Operating income Interest income Interest expense Other income (loss), net Interest and other income (loss), net Income before provision for income taxes Provision for income taxes Net income 18,300 12,660 1,005 (676) (69) 260 12,920 2,181 $10,739 18,911 10,770 769 (566) 228 431 11,201 2,220 $8,981 Cinc Sytems Inc Consolidated Balance Sheets In mans encept par value July 2016 July 25, 2015 Current Cash and cash Accounts recent ce for out o 2016 and 25.2013 56.877 53.599 Financing reces Other current assets Total current asset Property and courent et Financing recevables.net Goodwill 4491 POB Da 9 PT 335 WOODS 870 Deferred revenue o o d the par v t 50.00 por v tre one res and outstanding so share 43.592 outstanding 10. 2016 dey.2015. 19.396 Tota Schroder e Common stock and add to pu Read Accumulated other cohen nocaly Noncontro trets Tot outy 98.01 Noncontrolling interests Total equity Total abilities and equity (a) Compute net operating assets (NOA) for 2016 NOA$ 0 Round your answer to the nearest whole number (b) Compute net operating profit after tax INOPAT) for 2016, assuming a federal and state statutory tax rate of 37 2016 NOPATO (c) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions Sales growth 2017 Sales growth 2018-2020 Terminal grow Net operating prontman 21.51 et operating asset tuover 1.86 Reported Forecast Horizon 2018 Es 2019 Est. Terminal Period 2017 Est 2020 Est. 5 CSCO millons Sales rounded two decimal places) Sales grounded nearest whole number) NOPAT (rounded nearest whole numbers NOA (rounded nearest Whole number * Use sales rounded to nearest whole number for this calculation. (d) Estimate the value of a share of Cisco common stock using the residual operating income (ROPI) model as of July 30, 2016: assume a discount rate (WACC) of 10%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of 537,113) milion (NNO is negative which means that Cisco has net nonoperating investments). Use your rounded answers for subsequent calculations. Do not use negative signs with any of your answers below. 2019 2020 Est. Terminal Period CCO Reported Forecast Horizon 2017 E 2018 Est. Mode ROP INOPATINOA WACC rounded tonearest whole number Discount factor trounded to decimal places Present value of horizon Rool (rounded to nearest whole numben. Cum present value of horizon ROPS Oxfounded the whole rumban present value of terminal Rop s . NO Touten NINO 0 x OX NNO NC Firm equity value Shares outstanding (millions) Stock value per share O X (rounded to nearest whole number) O X (rounded to nearest whole number) 0X rounded to two decimal places) Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Cisco Sytems for the year ended July 30, 2016. Cisco Sytems Consolidated Statements of Income July 30, July 25 Years Ended December (5 millions) 2016 2015 Revenue Product $37.254 $37,750 Service 11,993 11,411 Total revenue 49.247 49.161 Cost of sales Product 14,161 15.377 Service 4,126 4,103 Total cost of sales 18.287 19.480 Gross margin 30.960 29.681 Operating expenses Research and development 6.296 6,207 Sales and marketing 9,619 9.821 General and administrative 2,040 Amortization of purchased intangible assets 303 Restructuring and other charges 268 484 Total operating expenses 18.300 18.911 359 Total operating expenses Operating income Interest income Interest expense Other income (loss), net Interest and other income (loss), net Income before provision for income taxes Provision for income taxes Net income 18,300 12,660 1,005 (676) (69) 260 12,920 2,181 $10,739 18,911 10,770 769 (566) 228 431 11,201 2,220 $8,981 Cinc Sytems Inc Consolidated Balance Sheets In mans encept par value July 2016 July 25, 2015 Current Cash and cash Accounts recent ce for out o 2016 and 25.2013 56.877 53.599 Financing reces Other current assets Total current asset Property and courent et Financing recevables.net Goodwill 4491 POB Da 9 PT 335 WOODS 870 Deferred revenue o o d the par v t 50.00 por v tre one res and outstanding so share 43.592 outstanding 10. 2016 dey.2015. 19.396 Tota Schroder e Common stock and add to pu Read Accumulated other cohen nocaly Noncontro trets Tot outy 98.01 Noncontrolling interests Total equity Total abilities and equity (a) Compute net operating assets (NOA) for 2016 NOA$ 0 Round your answer to the nearest whole number (b) Compute net operating profit after tax INOPAT) for 2016, assuming a federal and state statutory tax rate of 37 2016 NOPATO (c) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions Sales growth 2017 Sales growth 2018-2020 Terminal grow Net operating prontman 21.51 et operating asset tuover 1.86 Reported Forecast Horizon 2018 Es 2019 Est. Terminal Period 2017 Est 2020 Est. 5 CSCO millons Sales rounded two decimal places) Sales grounded nearest whole number) NOPAT (rounded nearest whole numbers NOA (rounded nearest Whole number * Use sales rounded to nearest whole number for this calculation. (d) Estimate the value of a share of Cisco common stock using the residual operating income (ROPI) model as of July 30, 2016: assume a discount rate (WACC) of 10%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of 537,113) milion (NNO is negative which means that Cisco has net nonoperating investments). Use your rounded answers for subsequent calculations. Do not use negative signs with any of your answers below. 2019 2020 Est. Terminal Period CCO Reported Forecast Horizon 2017 E 2018 Est. Mode ROP INOPATINOA WACC rounded tonearest whole number Discount factor trounded to decimal places Present value of horizon Rool (rounded to nearest whole numben. Cum present value of horizon ROPS Oxfounded the whole rumban present value of terminal Rop s . NO Touten NINO 0 x OX NNO NC Firm equity value Shares outstanding (millions) Stock value per share O X (rounded to nearest whole number) O X (rounded to nearest whole number) 0X rounded to two decimal places)