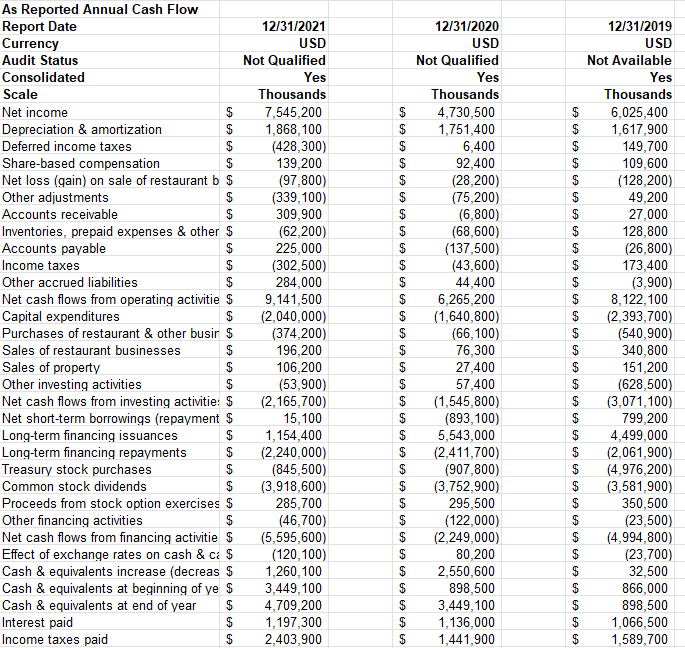

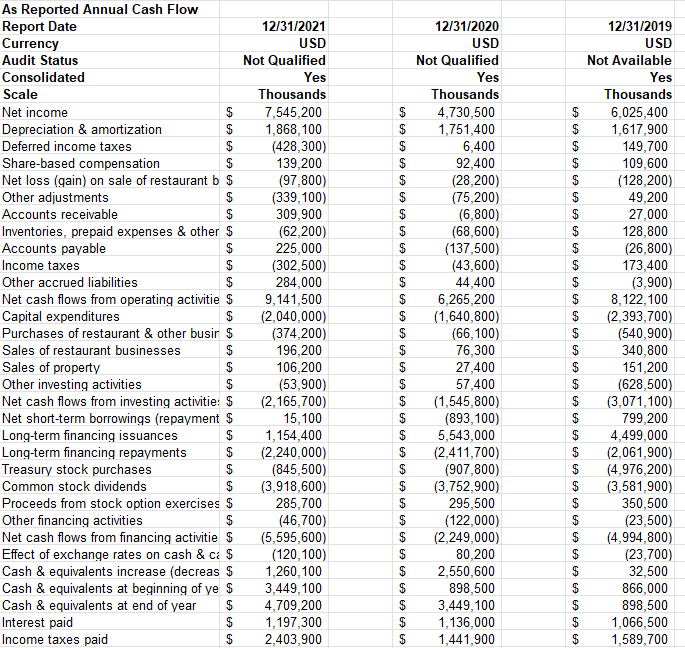

formulate simple cash flow for all three years and Net Operating Cash Flow

$ $ $ $ $ uuuuuuu $ $ $ $ A A As Reported Annual Cash Flow Report Date Currency Audit Status Consolidated Scale Net income $ Depreciation & amortization $ Deferred income taxes $ Share-based compensation $ Net loss (gain) on sale of restaurant b $ Other adjustments $ Accounts receivable $ Inventories, prepaid expenses & other $ Accounts payable $ Income taxes $ Other accrued liabilities $ Net cash flows from operating activitie $ Capital expenditures $ Purchases of restaurant & other busir $ Sales of restaurant businesses $ Sales of property $ Other investing activities $ Net cash flows from investing activitie: $ Net short-term borrowings (repayment $ Long-term financing issuances $ Long-term financing repayments $ Treasury stock purchases $ Common stock dividends $ Proceeds from stock option exercises $ Other financing activities $ Net cash flows from financing activities Effect of exchange rates on cash & ca $ Cash & equivalents increase (decreas $ Cash & equivalents at beginning of ye $ Cash & equivalents at end of year $ Interest paid $ Income taxes paid $ 12/31/2021 USD Not Qualified Yes Thousands 7,545,200 1,868, 100 (428,300) 139,200 (97,800) (339, 100) 309,900 (62,200) 225,000 (302,500) 284,000 9,141,500 (2,040,000) (374,200) 196,200 106,200 (53,900) (2,165,700) 15,100 1,154,400 (2,240,000) (845,500) (3,918,600) 285,700 (46,700) (5,595,600) (120,100) 1,260,100 3,449, 100 4,709,200 1,197,300 2,403,900 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 12/31/2020 USD Not Qualified Yes Thousands 4,730,500 1,751,400 6,400 92,400 (28,200) (75,200) (6,800) (68,600) (137,500) (43,600) 44,400 6,265,200 (1,640,800) (66,100) 76,300 27,400 57,400 (1,545,800) (893,100) 5,543,000 (2,411,700) (907 800) (3,752,900) 295,500 (122,000) (2,249,000) 80,200 2,550,600 898,500 3,449,100 1,136,000 1,441,900 $ $ $ $ $ $ $ $ 12/31/2019 USD Not Available Yes Thousands 6,025,400 1,617,900 149,700 109,600 (128,200) 49,200 27,000 128,800 (26,800) 173,400 (3,900) 8,122, 100 (2,393,700) (540,900) 340,800 151,200 (628,500) (3,071,100) 799,200 4,499,000 (2,061,900) (4,976,200) (3,581,900) 350,500 (23,500) (4,994,800) (23,700) 32,500 866,000 898,500 1,066,500 1,589,700 $ $ $ $ $ $ $ $ $ $ $ $ $ $ uuuuuuu $ $ $ $ A A As Reported Annual Cash Flow Report Date Currency Audit Status Consolidated Scale Net income $ Depreciation & amortization $ Deferred income taxes $ Share-based compensation $ Net loss (gain) on sale of restaurant b $ Other adjustments $ Accounts receivable $ Inventories, prepaid expenses & other $ Accounts payable $ Income taxes $ Other accrued liabilities $ Net cash flows from operating activitie $ Capital expenditures $ Purchases of restaurant & other busir $ Sales of restaurant businesses $ Sales of property $ Other investing activities $ Net cash flows from investing activitie: $ Net short-term borrowings (repayment $ Long-term financing issuances $ Long-term financing repayments $ Treasury stock purchases $ Common stock dividends $ Proceeds from stock option exercises $ Other financing activities $ Net cash flows from financing activities Effect of exchange rates on cash & ca $ Cash & equivalents increase (decreas $ Cash & equivalents at beginning of ye $ Cash & equivalents at end of year $ Interest paid $ Income taxes paid $ 12/31/2021 USD Not Qualified Yes Thousands 7,545,200 1,868, 100 (428,300) 139,200 (97,800) (339, 100) 309,900 (62,200) 225,000 (302,500) 284,000 9,141,500 (2,040,000) (374,200) 196,200 106,200 (53,900) (2,165,700) 15,100 1,154,400 (2,240,000) (845,500) (3,918,600) 285,700 (46,700) (5,595,600) (120,100) 1,260,100 3,449, 100 4,709,200 1,197,300 2,403,900 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 12/31/2020 USD Not Qualified Yes Thousands 4,730,500 1,751,400 6,400 92,400 (28,200) (75,200) (6,800) (68,600) (137,500) (43,600) 44,400 6,265,200 (1,640,800) (66,100) 76,300 27,400 57,400 (1,545,800) (893,100) 5,543,000 (2,411,700) (907 800) (3,752,900) 295,500 (122,000) (2,249,000) 80,200 2,550,600 898,500 3,449,100 1,136,000 1,441,900 $ $ $ $ $ $ $ $ 12/31/2019 USD Not Available Yes Thousands 6,025,400 1,617,900 149,700 109,600 (128,200) 49,200 27,000 128,800 (26,800) 173,400 (3,900) 8,122, 100 (2,393,700) (540,900) 340,800 151,200 (628,500) (3,071,100) 799,200 4,499,000 (2,061,900) (4,976,200) (3,581,900) 350,500 (23,500) (4,994,800) (23,700) 32,500 866,000 898,500 1,066,500 1,589,700 $ $ $ $ $ $ $ $ $