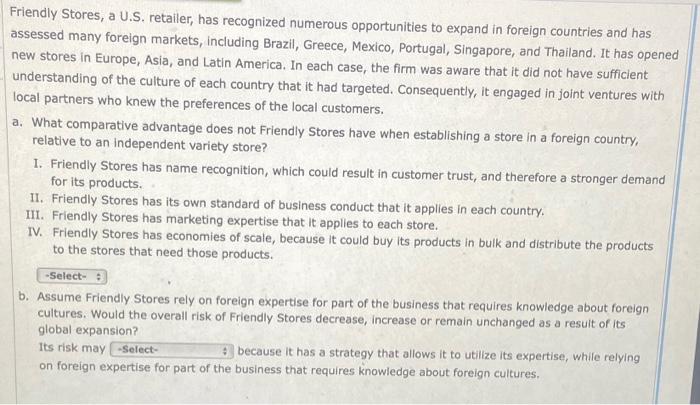

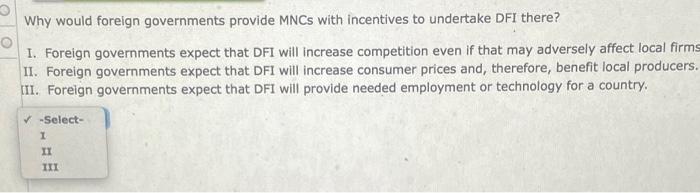

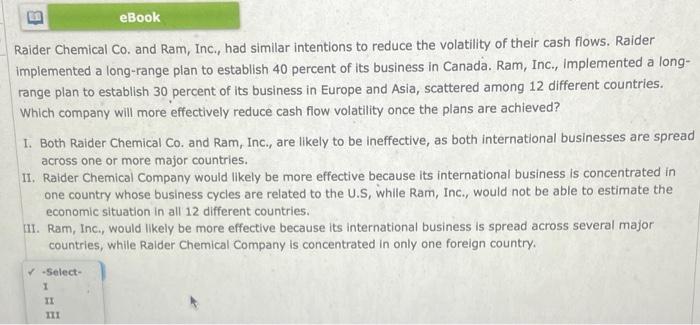

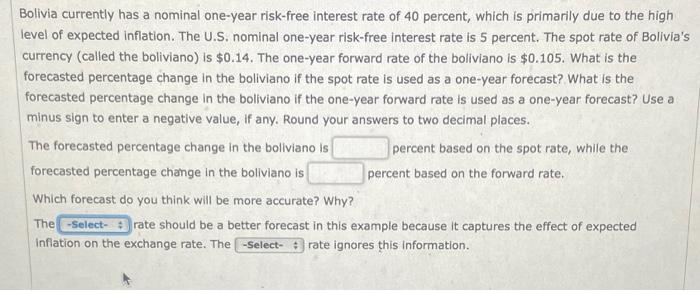

Friendly Stores, a U.S. retailer, has recognized numerous opportunities to expand in foreign countries and has assessed many foreign markets, including Brazil, Greece, Mexico, Portugal, Singapore, and Thailand. It has opened new stores in Europe, Asia, and Latin America. In each case, the firm was aware that it did not have sufficient understanding of the culture of each country that it had targeted. Consequently, it engaged in joint ventures with local partners who knew the preferences of the local customers. a. What comparative advantage does not Friendly Stores have when establishing a store in a foreign country, relative to an independent variety store? 1. Friendly Stores has name recognition, which could result in customer trust, and therefore a stronger demand for its products. II. Friendly Stores has its own standard of business conduct that it applies in each country. III. Friendly Stores has marketing expertise that it applies to each store. IV. Friendly Stores has economies of scale, because it could buy its products in bulk and distribute the products to the stores that need those products. -Select- b. Assume Friendly Stores rely on foreign expertise for part of the business that requires knowledge about foreign cultures. Would the overall risk of Friendly Stores decrease, increase or remain unchanged as a result of its global expansion? Its risk may -Select- because it has a strategy that allows it to utilize its expertise, while relying on foreign expertise for part of the business that requires knowledge about foreign cultures. Why would foreign governments provide MNCs with incentives to undertake DFI there? O I. Foreign governments expect that DFI will increase competition even if that may adversely affect local firms II. Foreign governments expect that DFI will increase consumer prices and, therefore, benefit local producers. III. Foreign governments expect that DFI will provide needed employment or technology for a country. -Select- 1 II III eBook Raider Chemical Co. and Ram, Inc., had similar intentions to reduce the volatility of their cash flows. Raider implemented a long-range plan to establish 40 percent of its business in Canada. Ram, Inc., Implemented a long- range plan to establish 30 percent of its business in Europe and Asia, scattered among 12 different countries. Which company will more effectively reduce cash flow volatility once the plans are achieved? I. Both Raider Chemical Co. and Ram, Inc., are likely to be ineffective, as both international businesses are spread across one or more major countries. II. Raider Chemical Company would likely be more effective because its international business is concentrated in one country whose business cycles are related to the US, while Ram, Inc., would not be able to estimate the economic situation in all 12 different countries. III. Ram, Inc., would likely be more effective because its international business is spread across several major countries, while Raider Chemical Company is concentrated in only one foreign country, -Select- 1 II 111 Bolivia currently has a nominal one-year risk-free interest rate of 40 percent, which is primarily due to the high level of expected inflation. The U.S. nominal one-year risk-free interest rate is 5 percent. The spot rate of Bolivia's currency (called the boliviano) is $0.14. The one-year forward rate of the boliviano is $0.105. What is the forecasted percentage change in the boliviano if the spot rate is used as a one-year forecast? What is the forecasted percentage change in the boliviano if the one-year forward rate is used as a one-year forecast? Use a minus sign to enter a negative value, If any. Round your answers to two decimal places. The forecasted percentage change in the boliviano is percent based on the spot rate, while the forecasted percentage change in the boliviano is percent based on the forward rate. Which forecast do you think will be more accurate? Why? The-Select-rate should be a better forecast in this example because it captures the effect of expected inflation on the exchange rate. The -Select-rate ignores this information