Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From the annual 2 0 1 9 report of Cool Coupons, Inc. : Note: Use negative signs with your answers, when appropriate. Note: Select

From the annual report of Cool Coupons, Inc. : Note: Use negative signs with your answers, when appropriate.

Note: Select NA as your answer if a part of the accounting equation is not affected.

Note: Round answers to the nearest dollar. Note: Use negative signs with your answers, when appropriate.

Note: Select NA as your answer if a part of the accounting equation is not affected.

Note: Round answers to the nearest dollar.

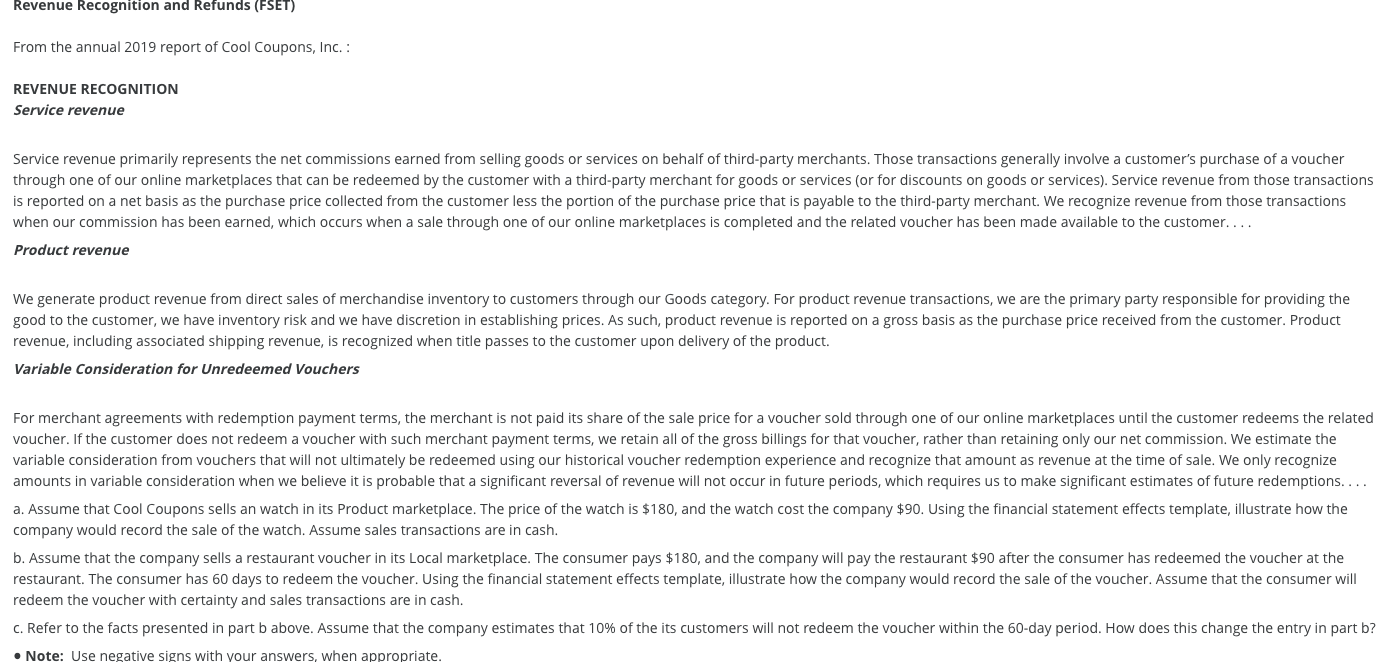

REVENUE RECOGNITION

Service revenue

Service revenue primarily represents the net commissions earned from selling goods or services on behalf of thirdparty merchants. Those transactions generally involve a customer's purchase of a voucher

through one of our online marketplaces that can be redeemed by the customer with a thirdparty merchant for goods or services or for discounts on goods or services Service revenue from those transactions

is reported on a net basis as the purchase price collected from the customer less the portion of the purchase price that is payable to the thirdparty merchant. We recognize revenue from those transactions

when our commission has been earned, which occurs when a sale through one of our online marketplaces is completed and the related voucher has been made available to the customer.

Product revenue

We generate product revenue from direct sales of merchandise inventory to customers through our Goods category. For product revenue transactions, we are the primary party responsible for providing the

good to the customer, we have inventory risk and we have discretion in establishing prices. As such, product revenue is reported on a gross basis as the purchase price received from the customer. Product

revenue, including associated shipping revenue, is recognized when title passes to the customer upon delivery of the product.

Variable Consideration for Unredeemed Vouchers

For merchant agreements with redemption payment terms, the merchant is not paid its share of the sale price for a voucher sold through one of our online marketplaces until the customer redeems the related

voucher. If the customer does not redeem a voucher with such merchant payment terms, we retain all of the gross billings for that voucher, rather than retaining only our net commission. We estimate the

variable consideration from vouchers that will not ultimately be redeemed using our historical voucher redemption experience and recognize that amount as revenue at the time of sale. We only recognize

amounts in variable consideration when we believe it is probable that a significant reversal of revenue will not occur in future periods, which requires us to make significant estimates of future redemptions.

a Assume that Cool Coupons sells an watch in its Product marketplace. The price of the watch is $ and the watch cost the company $ Using the financial statement effects template, illustrate how the

company would record the sale of the watch. Assume sales transactions are in cash.

b Assume that the company sells a restaurant voucher in its Local marketplace. The consumer pays $ and the company will pay the restaurant $ after the consumer has redeemed the voucher at the

restaurant. The consumer has days to redeem the voucher. Using the financial statement effects template, illustrate how the company would record the sale of the voucher. Assume that the consumer will

redeem the voucher with certainty and sales transactions are in cash.

c Refer to the facts presented in part b above. Assume that the company estimates that of the its customers will not redeem the voucher within the day period. How does this change the entry in part b

Note: Use negative signs with your answers, when appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started