Question

Fuji Software, Inc., has the following two projects. Year 0 1 Project A -10000 6500 4000 2 Project B -12000 7000 4000 3 1800

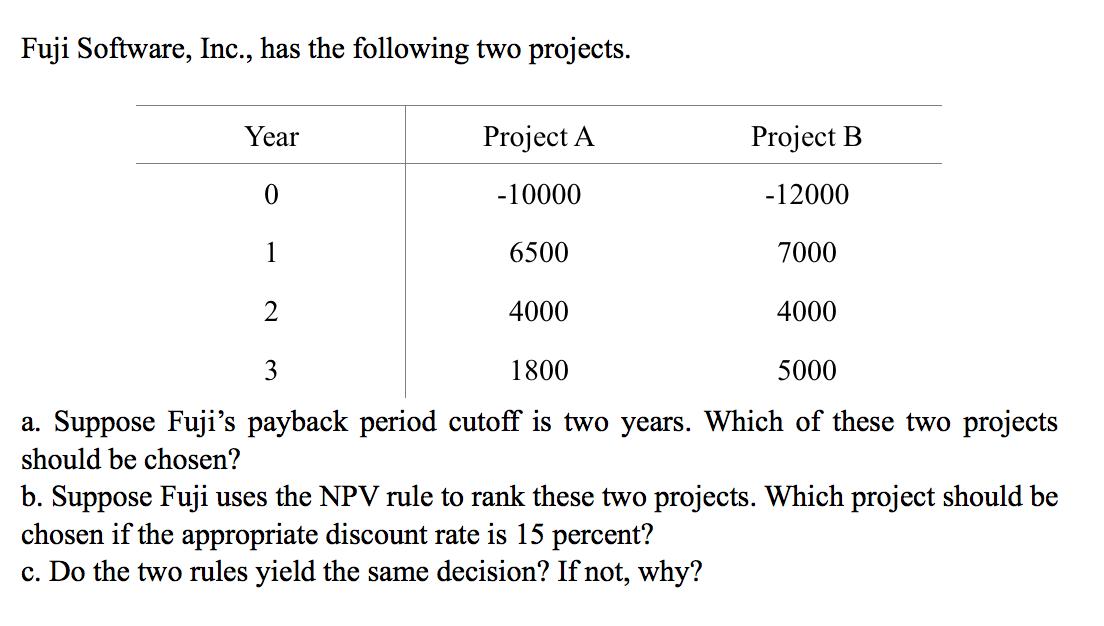

Fuji Software, Inc., has the following two projects. Year 0 1 Project A -10000 6500 4000 2 Project B -12000 7000 4000 3 1800 5000 a. Suppose Fuji's payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose Fuji uses the NPV rule to rank these two projects. Which project should be chosen if the appropriate discount rate is 15 percent? c. Do the two rules yield the same decision? If not, why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine which project should be chosen based on the payback period cutoff we need to calculate the payback period for each project The payback ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th Edition

1260772381, 978-1260772388

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App