Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Funday Park competes with Slide World by providing a variety of rides. Funday sells tickets at $90 per person as a one-day entrance fee.

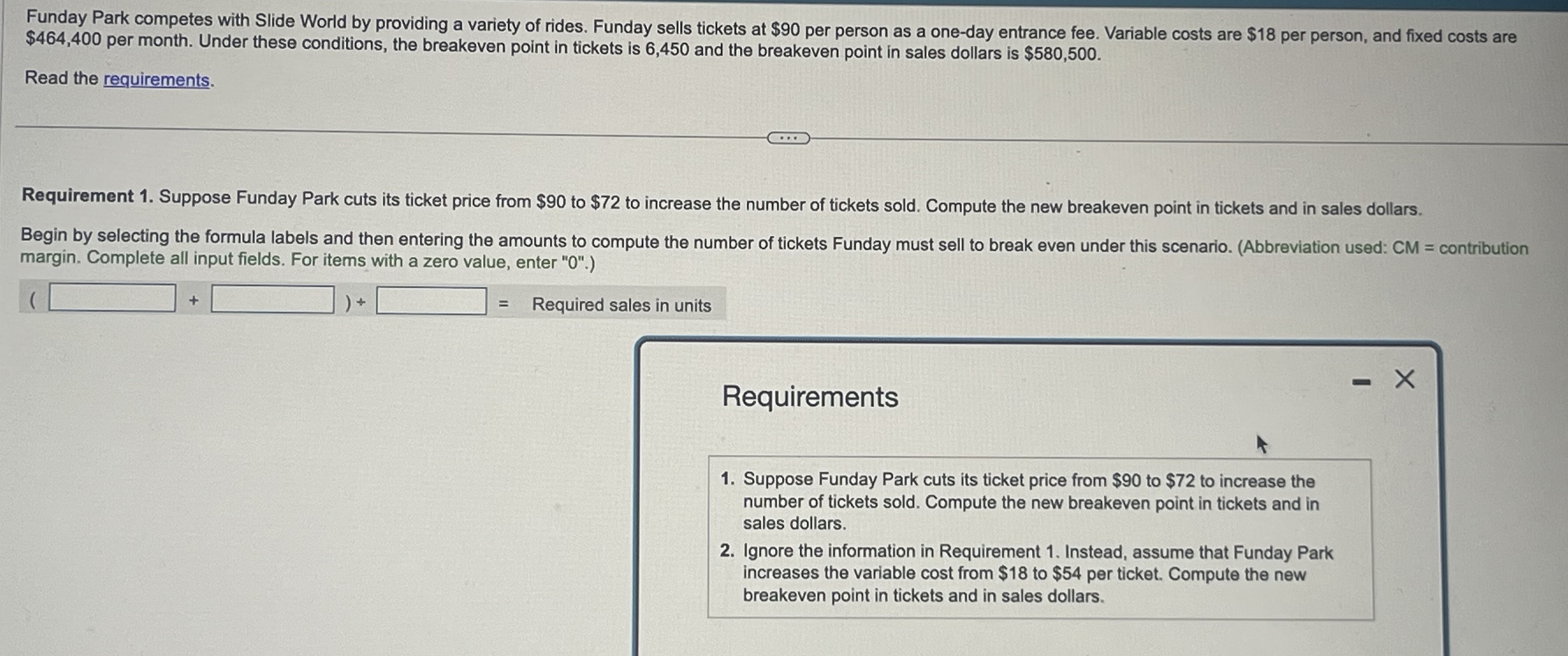

Funday Park competes with Slide World by providing a variety of rides. Funday sells tickets at $90 per person as a one-day entrance fee. Variable costs are $18 per person, and fixed costs are $464,400 per month. Under these conditions, the breakeven point in tickets is 6,450 and the breakeven point in sales dollars is $580,500. Read the requirements. Requirement 1. Suppose Funday Park cuts its ticket price from $90 to $72 to increase the number of tickets sold. Compute the new breakeven point in tickets and in sales dollars. Begin by selecting the formula labels and then entering the amounts to compute the number of tickets Funday must sell to break even under this scenario. (Abbreviation used: CM = contribution margin. Complete all input fields. For items with a zero value, enter "0".) + = Required sales in units Requirements 1. Suppose Funday Park cuts its ticket price from $90 to $72 to increase the number of tickets sold. Compute the new breakeven point in tickets and in sales dollars. 2. Ignore the information in Requirement 1. Instead, assume that Funday Park increases the variable cost from $18 to $54 per ticket. Compute the new breakeven point in tickets and in sales dollars. X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 To compute the new breakeven point in tickets and sales dollars when Funday Park cuts its ticket price from 90 to 72 we need to use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started