Answered step by step

Verified Expert Solution

Question

1 Approved Answer

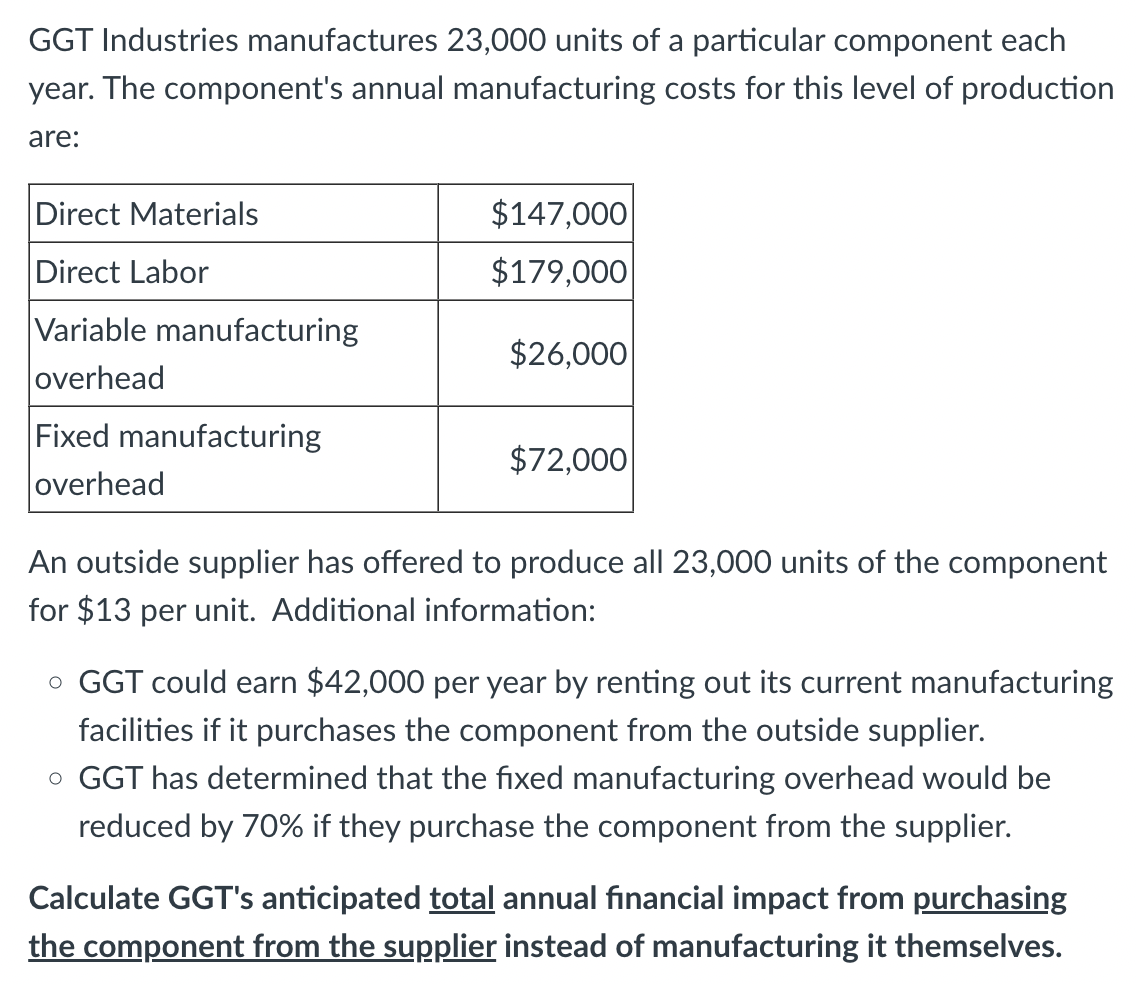

GGT Industries manufactures 23,000 units of a particular component each year. The component's annual manufacturing costs for this level of production are: Direct Materials

GGT Industries manufactures 23,000 units of a particular component each year. The component's annual manufacturing costs for this level of production are: Direct Materials $147,000 Direct Labor $179,000 Variable manufacturing $26,000 overhead Fixed manufacturing $72,000 overhead An outside supplier has offered to produce all 23,000 units of the component for $13 per unit. Additional information: GGT could earn $42,000 per year by renting out its current manufacturing facilities if it purchases the component from the outside supplier. GGT has determined that the fixed manufacturing overhead would be reduced by 70% if they purchase the component from the supplier. Calculate GGT's anticipated total annual financial impact from purchasing the component from the supplier instead of manufacturing it themselves.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started