Answered step by step

Verified Expert Solution

Question

1 Approved Answer

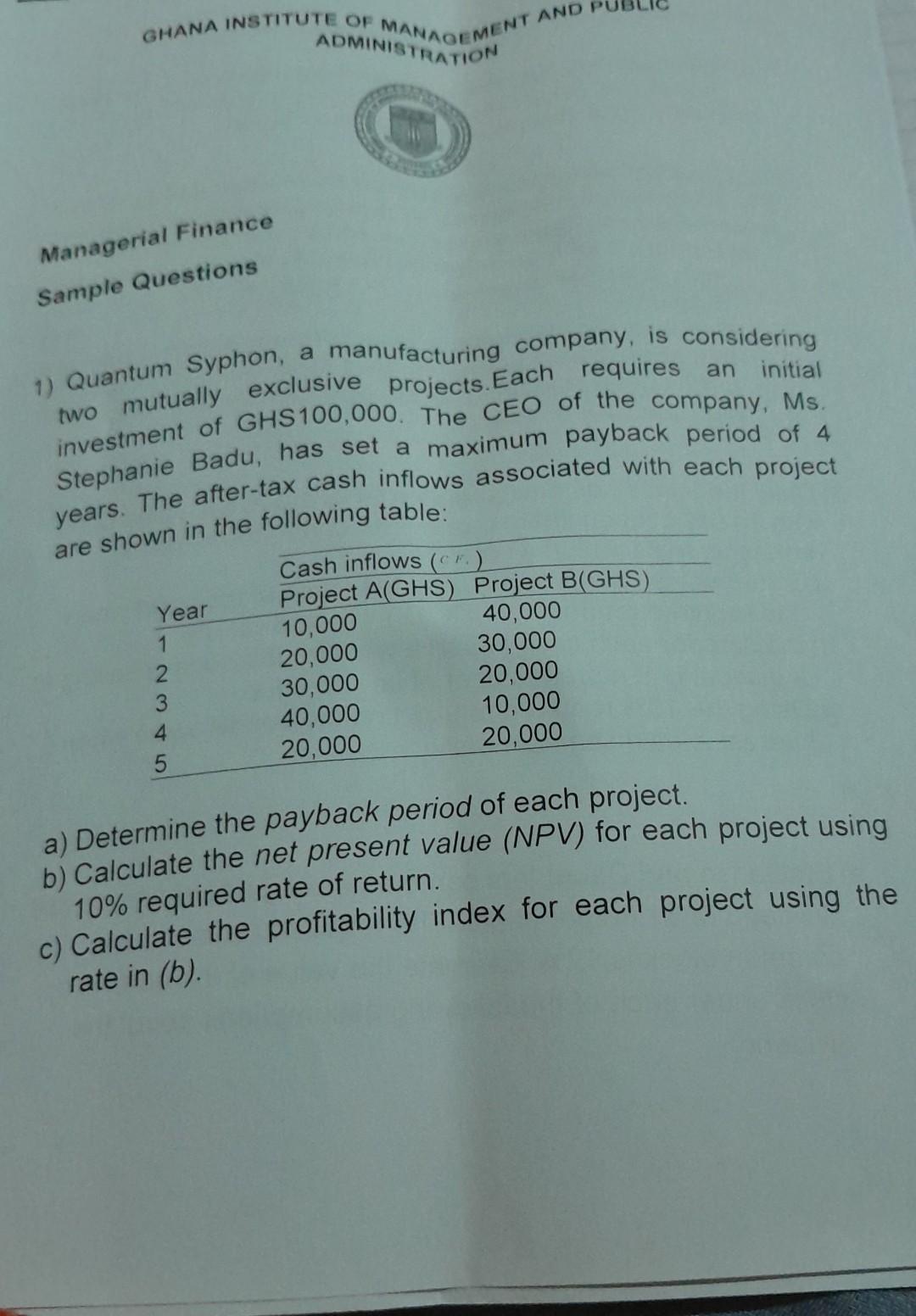

GHANA INSTITUTE OF MANAGEMENT ADMINISTRATION Managerial Finance Sample Questions initial 1) Quantum Syphon, a manufacturing company, is considering two mutually exclusive projects. Each requires an

GHANA INSTITUTE OF MANAGEMENT ADMINISTRATION Managerial Finance Sample Questions initial 1) Quantum Syphon, a manufacturing company, is considering two mutually exclusive projects. Each requires an investment of GHS100,000. The CEO of the company, Ms. Stephanie Badu, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table: Cash inflows (CF.) Year Project A(GHS) Project B(GHS) 40,000 10,000 1 30,000 20,000 2 30,000 20,000 4 40,000 10,000 5 20,000 20,000 a) Determine the payback period of each project. b) Calculate the net present value (NPV) for each project using 10% required rate of return. c) Calculate the profitability index for each project using the rate in (b). AND

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started