Answered step by step

Verified Expert Solution

Question

1 Approved Answer

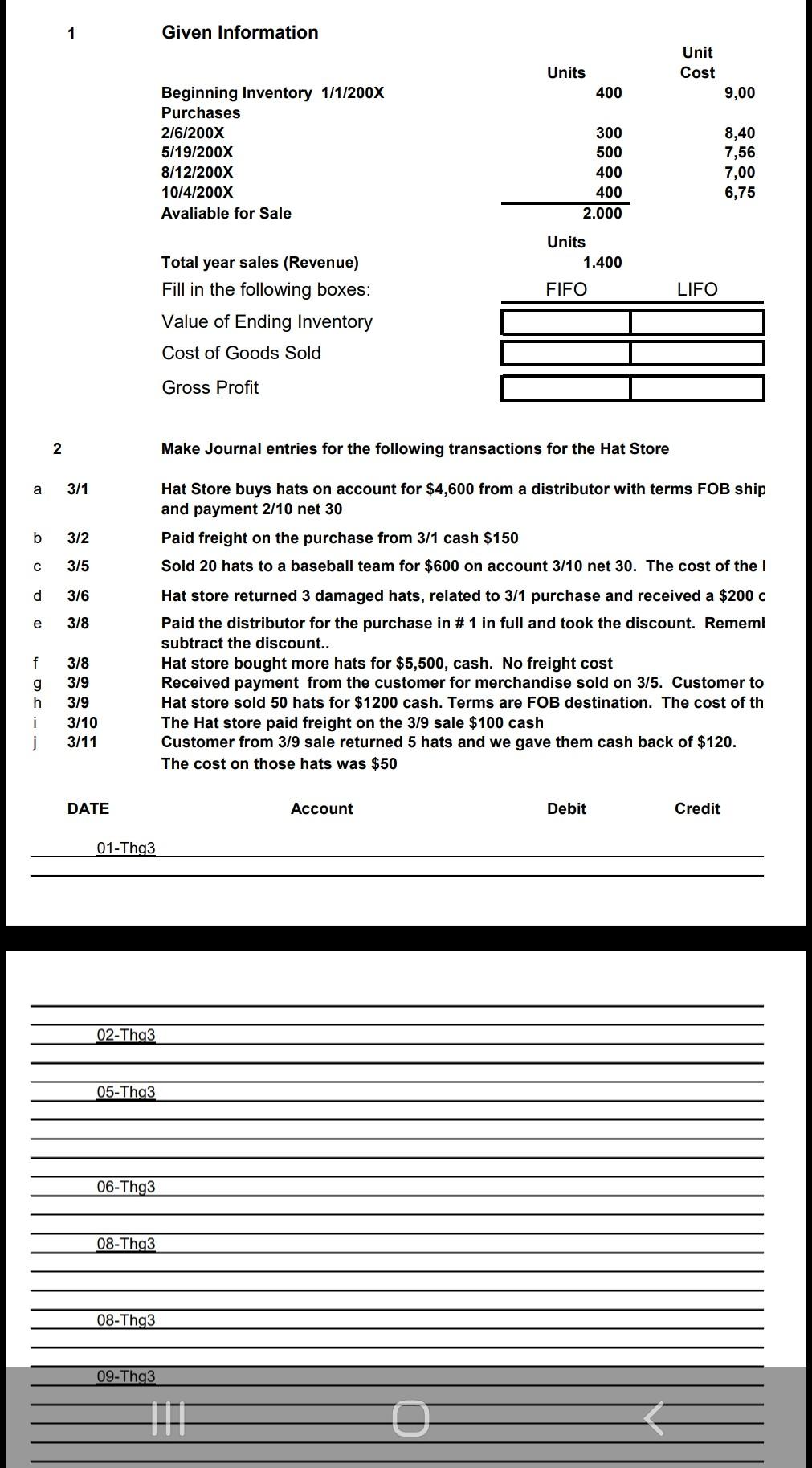

Given Information Unit Cost Units 400 9,00 Beginning Inventory 1/1/200X Purchases 2/6/200X 5/19/200X 8/12/200X 10/4/200X Avaliable for Sale 300 500 400 400 2.000 8,40 7,56

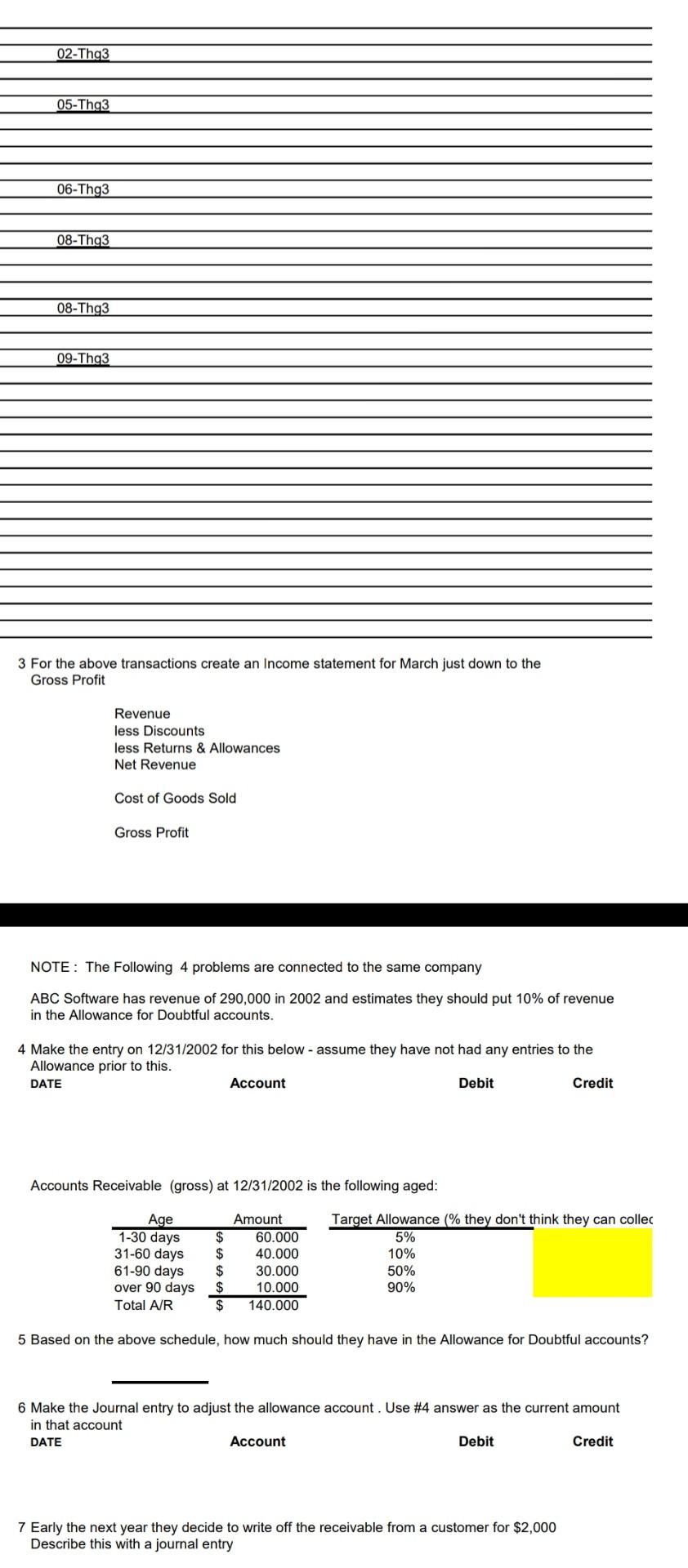

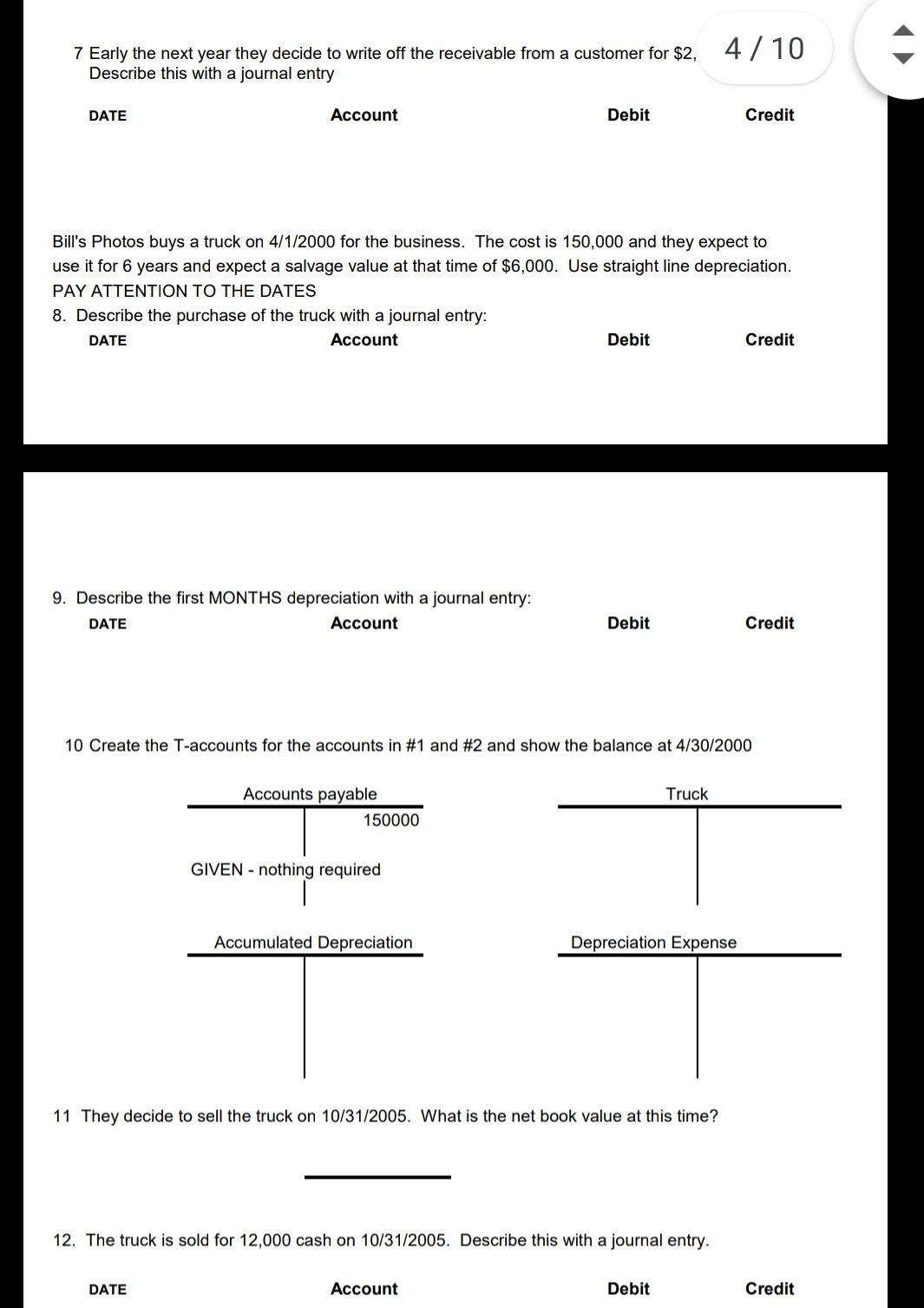

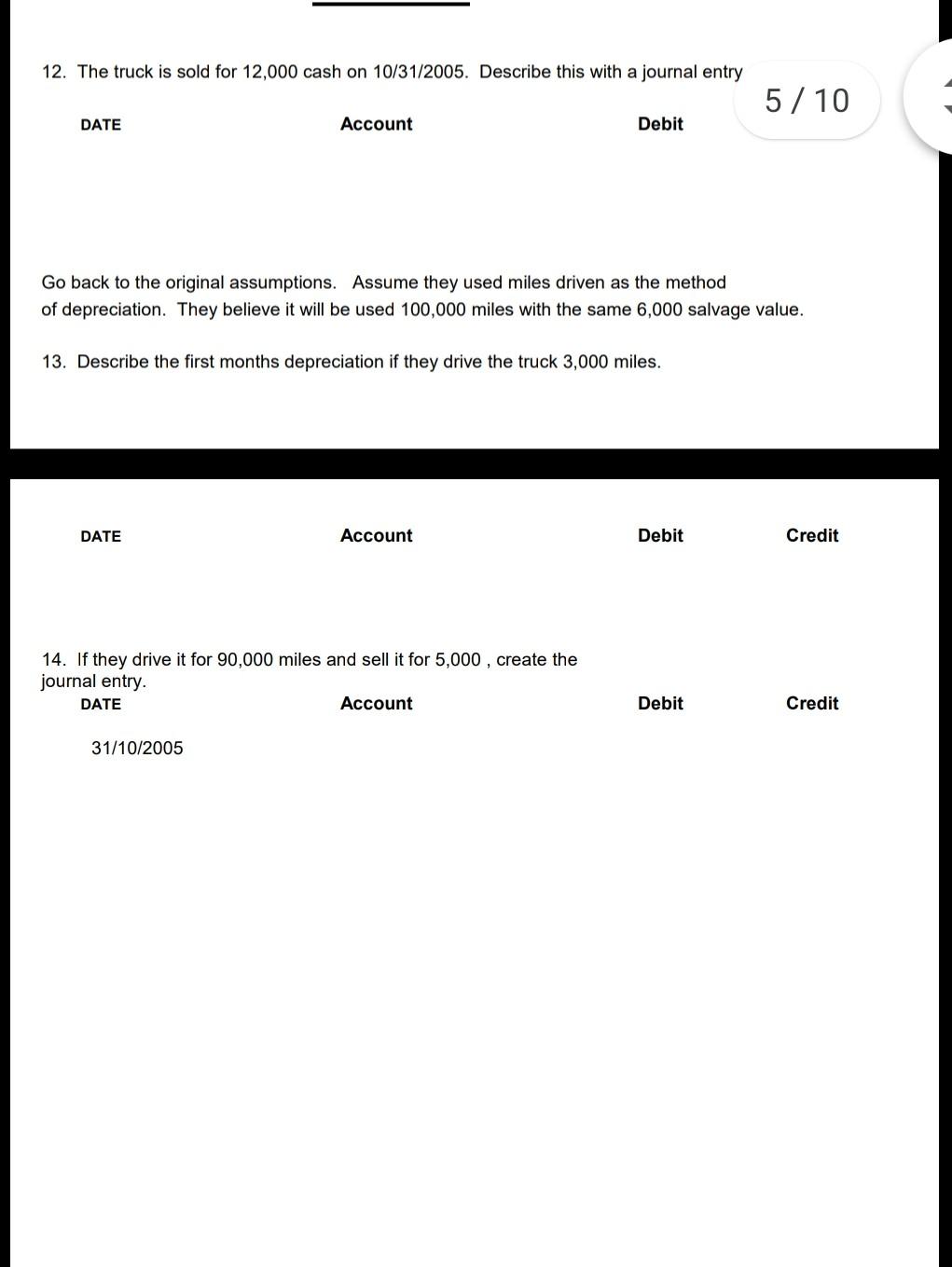

Given Information Unit Cost Units 400 9,00 Beginning Inventory 1/1/200X Purchases 2/6/200X 5/19/200X 8/12/200X 10/4/200X Avaliable for Sale 300 500 400 400 2.000 8,40 7,56 7,00 6,75 Units 1.400 FIFO LIFO Total year sales (Revenue) Fill in the following boxes: Value of Ending Inventory Cost of Goods Sold Gross Profit 2 Make Journal entries for the following transactions for the Hat Store a 3/1 b 3/2 3/5 d 3/6 3/8 Hat Store buys hats on account for $4,600 from a distributor with terms FOB ship and payment 2/10 net 30 Paid freight on the purchase from 3/1 cash $150 Sold 20 hats to a baseball team for $600 on account 3/10 net 30. The cost of the Hat store returned 3 damaged hats, related to 3/1 purchase and received a $200 C Paid the distributor for the purchase in # 1 in full and took the discount. Rememl subtract the discount.. Hat store bought more hats for $5,500, cash. No freight cost Received payment from the customer for merchandise sold on 3/5. Customer to Hat store sold 50 $1200 cas Terms are FOB destina n. The cost of th The Hat store paid freight on the 3/9 sale $100 cash Customer from 3/9 sale returned 5 hats and we gave them cash back of $120. The cost on those hats was $50 f g h i j 3/8 3/9 3/9 3/10 3/11 DATE Account Debit Credit 01-Thg3 02-Thg3 05-Thg3 06-Thg3 08-Thg3 08-Thg3 09-Thg3 O 02-Thg3 05-Thg3 06-Thg3 08-Thg3 08-Thg3 09-Thg3 3 For the above transactions create an Income statement for March just down to the Gross Profit Revenue less Discounts less Returns & Allowances Net Revenue Cost of Goods Sold Gross Profit NOTE: The Following 4 problems are connected to the same company ABC Software has revenue of 290,000 in 2002 and estimates they should put 10% of revenue in the Allowance for Doubtful accounts. have not had any entries to the 4 Make the entry 12/31/2002 for this below - assume Allowance prior to this. DATE Account Debit Credit Accounts Receivable (gross) at 12/31/2002 is the following aged: Age 1-30 days 31-60 days 61-90 days over 90 days Total A/R $ $ $ $ $ Amount 60.000 40.000 30.000 10.000 140.000 Target Allowance % they don't think they can collec 5% 10% 50% 90% 5 Based on the above schedule, how much should they have in the Allowance for Doubtful accounts? 6 Make the Journal entry to adjust the allowance account. Use #4 answer as the current amount in that account DATE Account Debit Credit 7 Early the next year they decide to write off the receivable from a customer for $2,000 Describe this with a journal entry 7 Early the next year they decide to write off the receivable from a customer for $2, 4/10 Describe this with a journal entry DATE Account Debit Credit Bill's Photos buys a truck on 4/1/2000 for the business. The cost is 150,000 and they expect to use it for 6 years and expect a salvage value at that time of $6,000. Use straight line depreciation. PAY ATTENTION TO THE DATES 8. Describe the purchase of the truck with a journal entry: DATE Account Debit Credit 9. Describe the first MONTHS depreciation with a journal entry: DATE Account Debit Credit 10 Create the T-accounts for the accounts in #1 and #2 and show the balance at 4/30/2000 Truck Accounts payable 150000 GIVEN - nothing required Accumulated Depreciation Depreciation Expense 11 They decide to sell the truck on 10/31/2005. What is the net book value at this time? 12. The truck is sold for 12,000 cash on 10/31/2005. Describe this with a journal entry. DATE Account Debit Credit 12. The truck is sold for 12,000 cash on 10/31/2005. Describe this with a journal entry 5/ 10 DATE Account Debit Go back to the original assumptions. Assume they used miles driven as the method of depreciation. They believe it will be used 100,000 miles with the same 6,000 salvage value. 13. Describe the first months depreciation if they drive the truck 3,000 miles. DATE Account Debit Credit 14. If they drive it for 90,000 miles and sell it for 5,000, create the journal entry. Account DATE Debit Credit 31/10/2005

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started