Answered step by step

Verified Expert Solution

Question

1 Approved Answer

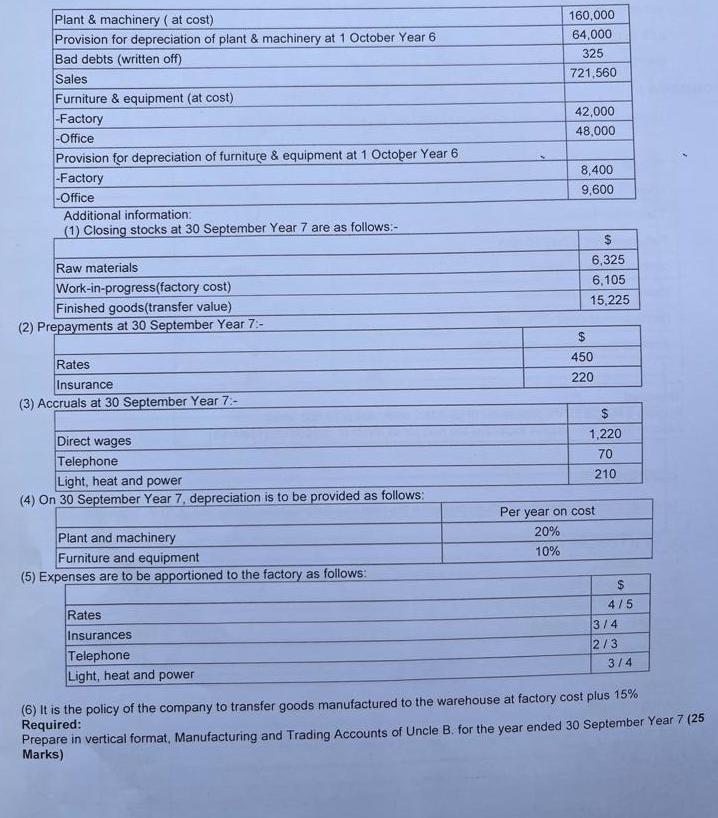

Given the information answer the question below. Plant & machinery (at cost) Provision for depreciation of plant & machinery at 1 October Year 6 Bad

Given the information answer the question below.

Plant & machinery (at cost) Provision for depreciation of plant & machinery at 1 October Year 6 Bad debts (written off) 160,000 64,000 Sales 325 721,560 Furniture & equipment (at cost) -Factory 42,000 -Office 48,000 Provision for depreciation of furniture & equipment at 1 October Year 6 -Factory 8,400 9,600 -Office Additional information: (1) Closing stocks at 30 September Year 7 are as follows:- Raw materials Work-in-progress(factory cost) Finished goods(transfer value) (2) Prepayments at 30 September Year 7:- Rates Insurance (3) Accruals at 30 September Year 7:- Direct wages Telephone Light, heat and power (4) On 30 September Year 7, depreciation is to be provided as follows: Plant and machinery Furniture and equipment (5) Expenses are to be apportioned to the factory as follows: Rates Insurances Telephone Light, heat and power $ 450 220 6,325 6,105 15,225 $ 1,220 70 210 Per year on cost 20% 10% $ 4/5 3/4 2/3 3/4 (6) It is the policy of the company to transfer goods manufactured to the warehouse at factory cost plus 15% Required: Prepare in vertical format, Manufacturing and Trading Accounts of Uncle B. for the year ended 30 September Year 7 (25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started