Question

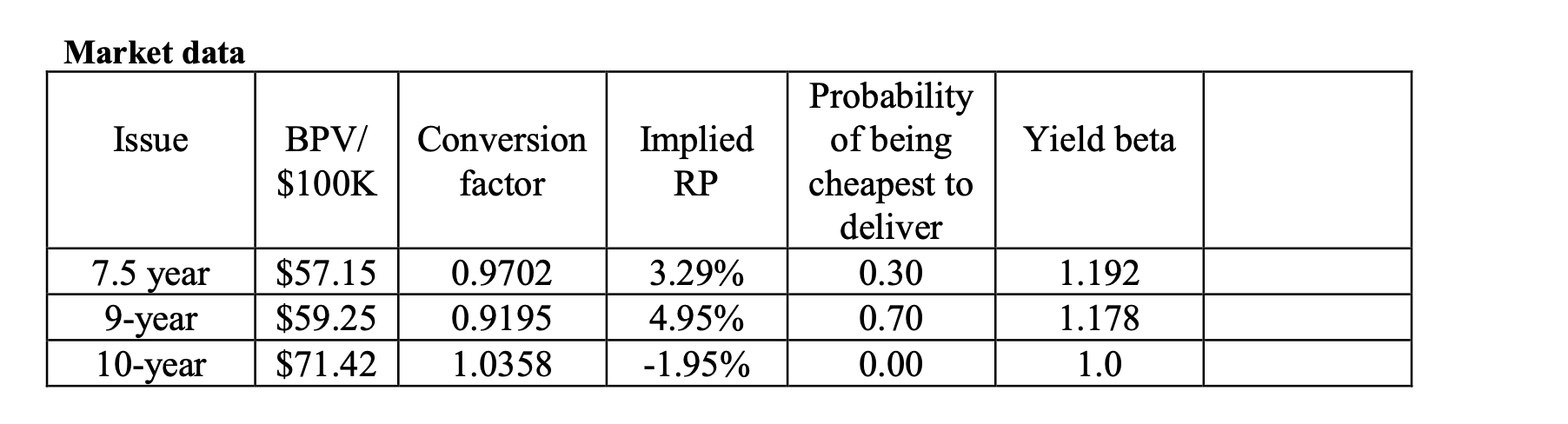

Given the market data provided in the table, determine A) the BPV of the futures contract using the standard industry rule of thumb. b)

Given the market data provided in the table, determine

A) the BPV of the futures contract using the standard industry rule of thumb.

b) an option-adjusted BPV of the futures contract that would be better than that given by the rule of thumb (for this question only, assume all yield betas are 1.0).

c) how many futures you should short to produce a BPV neutral hedge for a long position of $100 million in the 10-year using the industry rule of thumb.

d) whether, given the yield betas shown for each issue, your hedged position would tend to be helped or hurt by an increase in yields that is moderate but not large enough to cause a shift in the CTD.

e) whether, given the possibility of a change in the cheapest to deliver, the hedged position will be helped or hurt by a large decrease in note yields --- by a large increase in note yields?

f) whether the number of futures contracts required in your hedge will rise or fall if note yields fall.

Market data Issue BPV/ Conversion Implied $100K factor RP 7.5 year $57.15 0.9702 9-year $59.25 0.9195 10-year $71.42 1.0358 3.29% 4.95% -1.95% Probability of being cheapest to deliver 0.30 0.70 0.00 Yield beta 1.192 1.178 1.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A The BPV of the futures contract using the standard industry rule of thumb is 100 The industry rule of thumb states that the BPV of a futures contract is equal to 1000 divided by the conversion facto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started