Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can

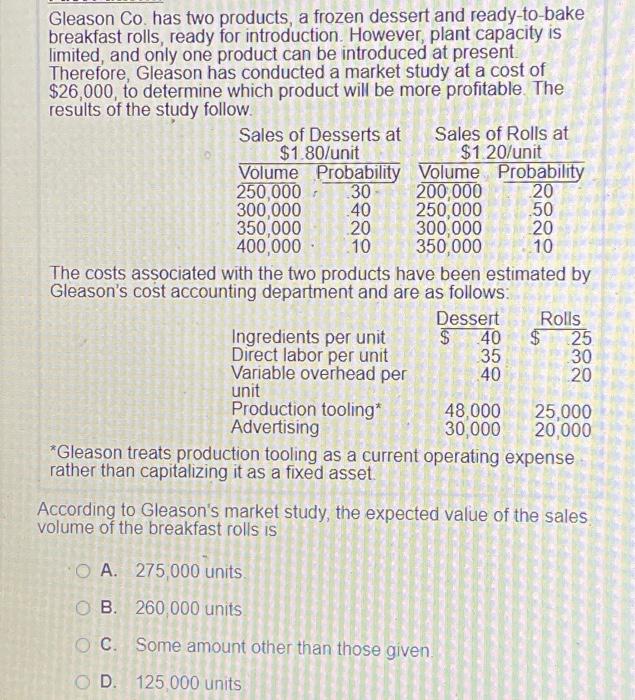

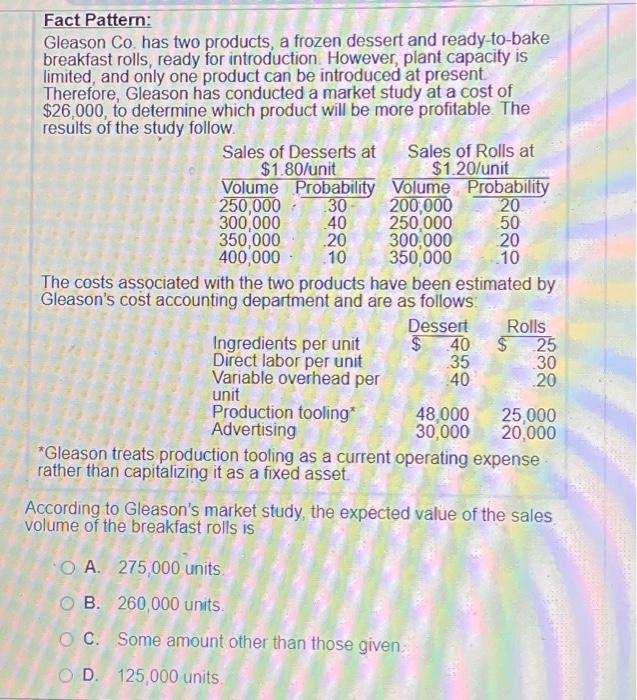

Gleason Co. has two products, a frozen dessert and ready-to-bake breakfast rolls, ready for introduction. However, plant capacity is limited, and only one product can be introduced at present. Therefore, Gleason has conducted a market study at a cost of $26,000, to determine which product will be more profitable. The results of the study follow. Sales of Desserts at $1.80/unit Volume Probability 30 250,000 - 40 300,000 350,000 400,000 20 10 Ingredients per unit Direct labor per unit Variable overhead per unit Sales of Rolls at $1.20/unit Production tooling* Advertising Volume Probability 200,000 20 250,000 50 20 10 The costs associated with the two products have been estimated by Gleason's cost accounting department and are as follows: Dessert $ 40 35 40 300,000 350,000 Rolls $ O A. 275,000 units. OB. 260,000 units O C. Some amount other than those given. OD. 125 000 units 25 30 20 48,000 25,000 30,000 20,000 *Gleason treats production tooling as a current operating expense rather than capitalizing it as a fixed asset. According to Gleason's market study, the expected value of the sales volume of the breakfast rolls is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started