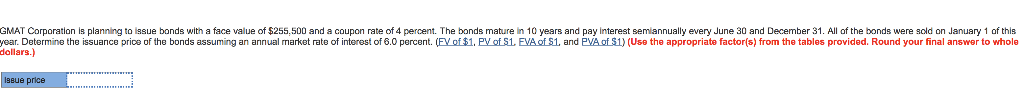

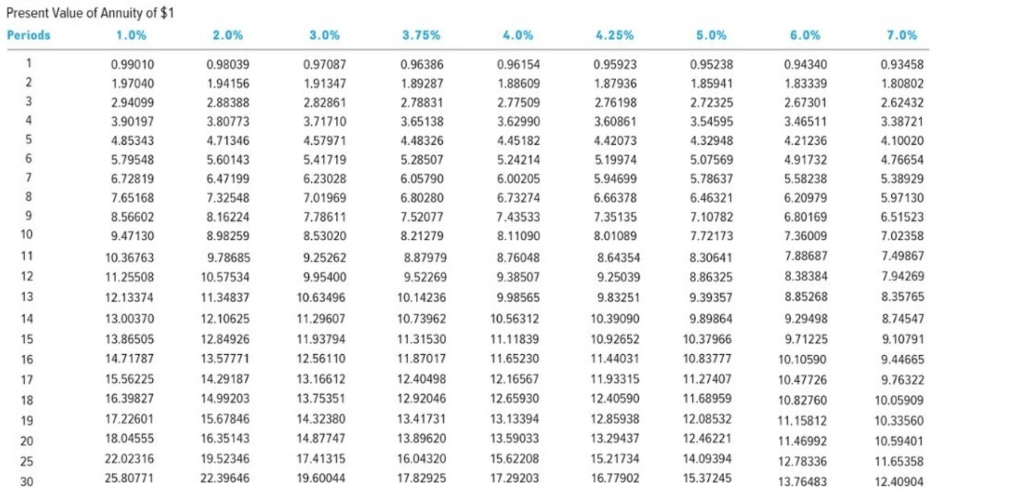

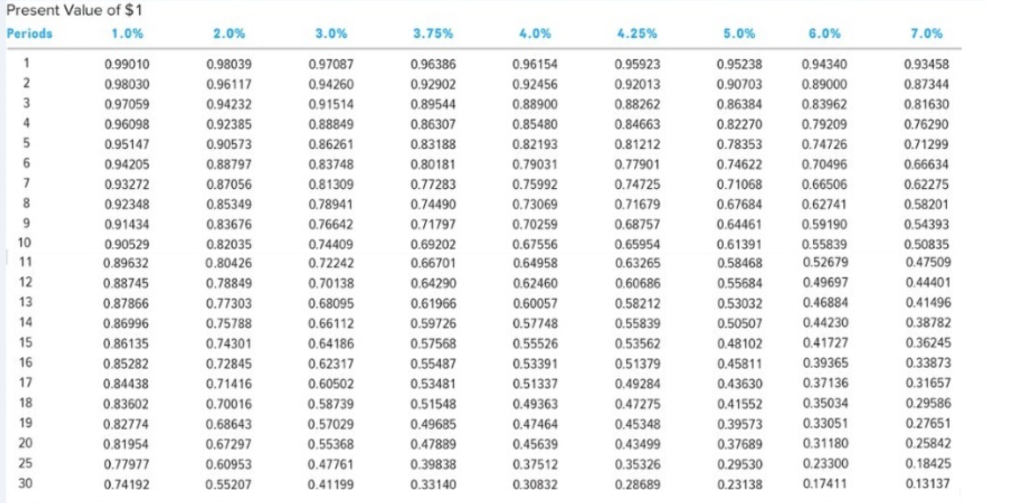

GMAT Corporation is planning to issue bonds with a face value of $255,500 and a coupon rate of 4 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Determine the issuance price of the bonds assuming an annual market rate of interest of 6.0 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your final answer to whole dollars.)

What is the Issue price?

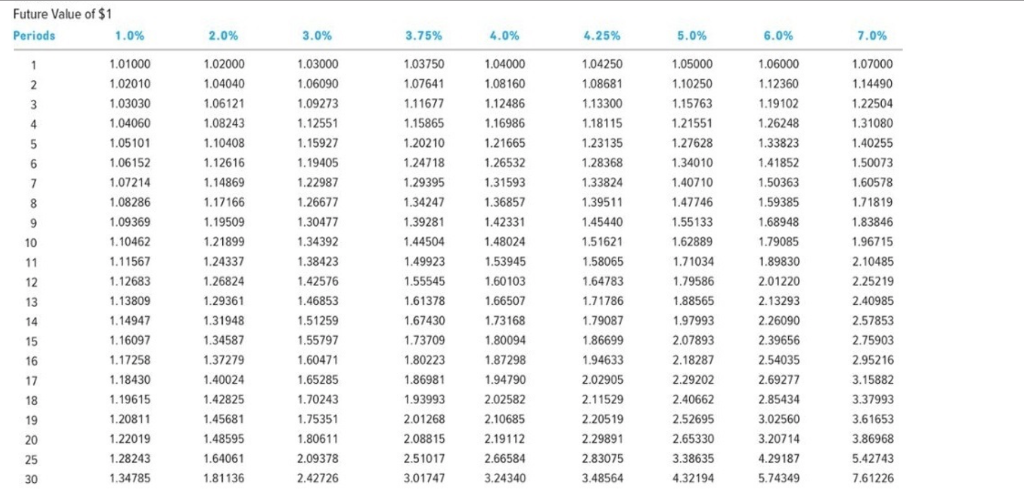

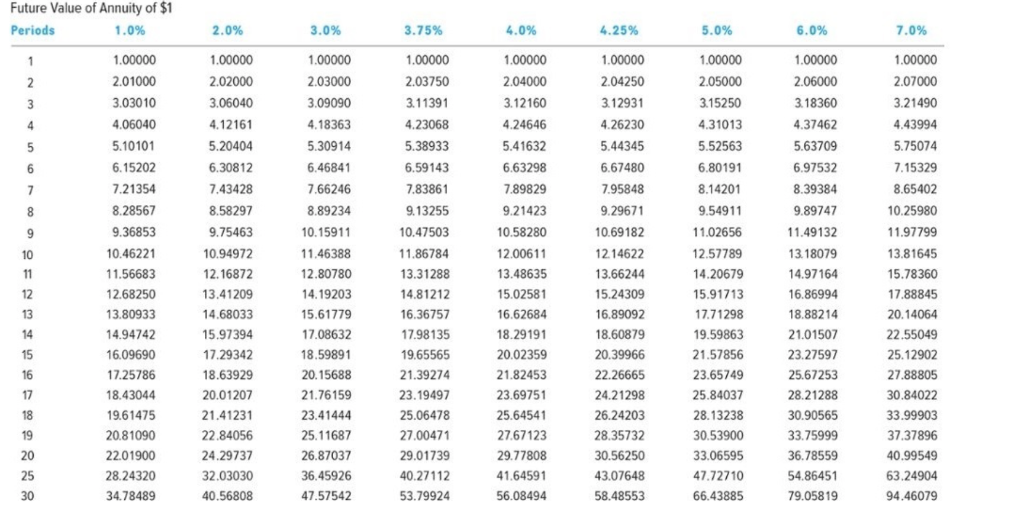

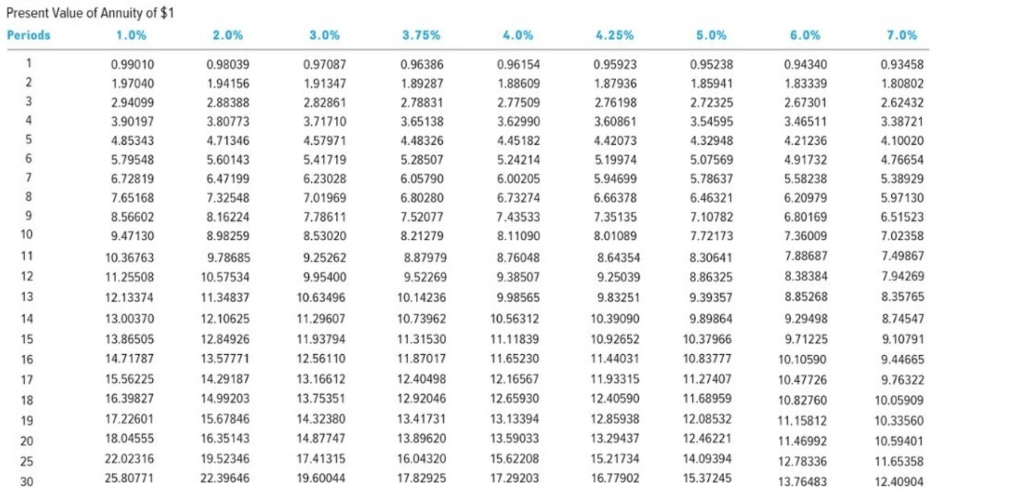

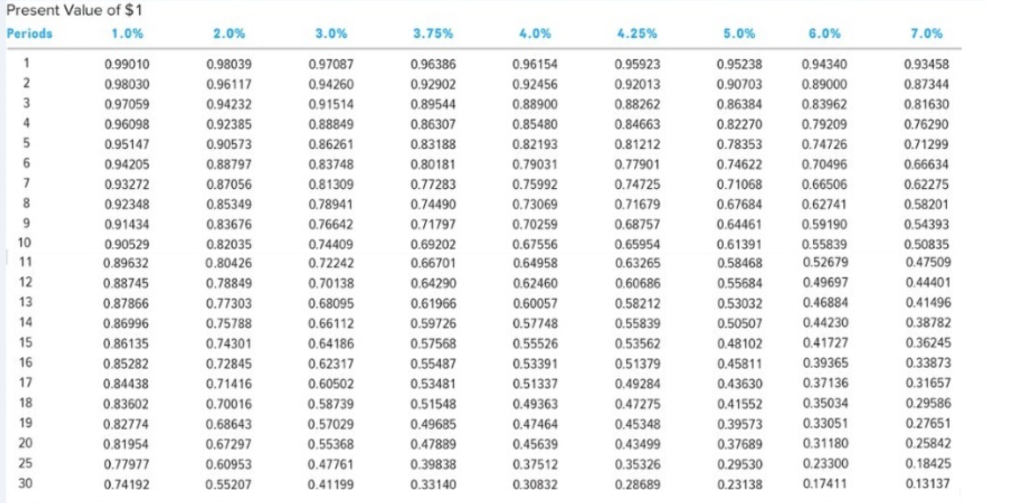

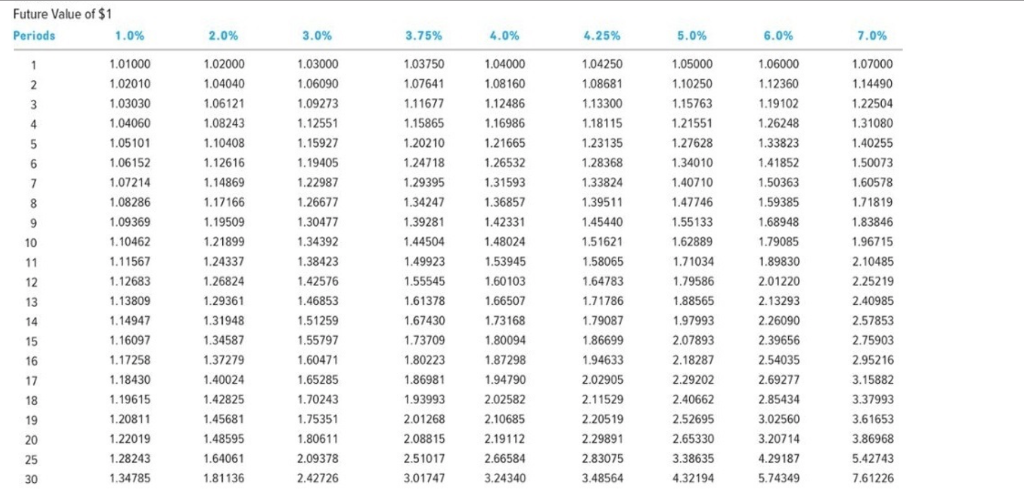

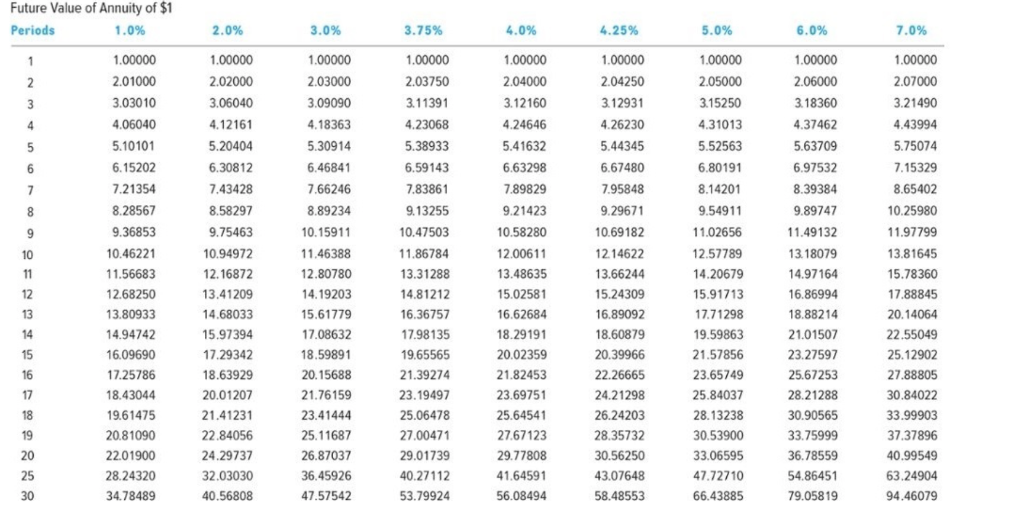

Future Value of $ Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4,25% 5.0% 6.0% 7.0% 1.01000 1.03750 1.04000 1.05000 1.02000 1.03000 1,04250 1.06000 1.07000 1.08160 1.02010 1,04040 1.06090 1.07641 1.08681 1.10250 1.12360 1.14490 1.03030 1.06121 1.09273 1.11677 1.12486 1.13300 1.15763 1.19102 1.22504 3 1.04060 1.08243 1.12551 1.15865 1.16986 1.18115 1.21551 1.26248 1.31080 4 1.0510 1.23135 1.10408 1.15927 1.20210 1.21665 1.27628 1.33823 1.40255 6 1.06152 1.12616 1.19405 1.24718 1.26532 1.28368 1.34010 1.41852 1.50073 1.07214 1.14869 1.22987 1.29395 1.31593 1.33824 1,40710 1,50363 1.60578 1.08286 1.17166 1.26677 1.34247 1,36857 1.39511 1.47746 1,59385 1.71819 1.09369 1.19509 1.30477 1.39281 1.42331 1.45440 1.55133 1.68948 1.83846 1.21899 1.51621 1.34392 1.44504 1.48024 1.96715 1.10462 1.62889 1.79085 10 1.11567 1.24337 1.53945 1.58065 1.71034 1.89830 2.10485 1.38423 1.49923 11 1.12683 1.26824 1,42576 1.55545 1.60103 1.64783 1.79586 2.01220 2.25219 12 1.13809 1.29361 1.46853 1.61378 1.66507 1.71786 1.88565 2.13293 2.40985 13 1,14947 1.79087 1.31948 1.51259 1.67430 1.73168 2.57853 1.97993 2.26090 14 1.16097 1.34587 1.55797 1.73709 1.80094 1.86699 2.07893 2.39656 2.75903 15 1.17258 1.37279 1.60471 1.80223 1.87298 1.94633 2.18287 2.54035 2.95216 16 1.18430 1.40024 1.65285 1.86981 1.94790 2.02905 2.29202 2.69277 3.15882 17 1.42825 1.70243 1.93993 2.02582 2.11529 2.40662 2.85434 3.37993 18 1.19615 1.20811 1.45681 1.75351 2.01268 2.10685 2.20519 2.52695 3.02560 3.61653 19 1.22019 1.48595 1.80611 2.08815 2.19112 2.29891 2.65330 3.20714 3.86968 20 1.28243 1.64061 2.66584 5.42743 2.09378 2.51017 2.83075 3.38635 4,29187 25 1.34785 1.81136 2.42726 3.01747 3.24340 3.48564 4.32194 5.74349 7.61226 30 Future Value of Annuity of $1 1.0 % Periods 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1 2.05000 2.06000 2.01000 2.02000 2.03000 2.03750 2.04000 2.04250 2.07000 2 3.12160 3.12931 3.03010 3.06040 3.09090 3.11391 3.15250 318360 3.21490 3 .06040 4,12161 4.18363 4.24646 4.26230 4.31013 4.43994 4.23068 4.37462 4 5.10101 5.41632 5.63709 5.20404 5.30914 5.38933 5.44345 5.52563 5.75074 5 ,15202 6 6.30812 6.46841 6.59143 6.63298 6.67480 6.80191 6.97532 7.15329 7.21354 7,43428 7.66246 7.95848 8.39384 8.65402 7.83861 7.89829 8.14201 7 8 8.28567 8.58297 9.21423 10.25980 8.89234 9.13255 9.29671 9.54911 9.89747 11.97799 9.36853 9.75463 10.15911 10.47503 10.58280 10.69182 11.02656 11.49132 9 10 10.46221 10.94972 11.46388 11.86784 12.00611 12.57789 13.18079 13.81645 12.14622 11 11.56683 12.16872 12.80780 13.31288 13.48635 13.66244 14.20679 14.97164 15.78360 12 12.68250 13.41209 14.19203 14.81212 15.02581 15.24309 15.91713 16.86994 17.88845 13 13.80933 14.68033 15.61779 16.36757 16.62684 16.89092 17.71298 18.88214 20.14064 14 14.94742 15.97394 17.08632 17.98135 18.29191 18.60879 19.59863 21.01507 22.55049 15 17.29342 18.59891 19.65565 20.02359 20.39966 21.57856 16.09690 23.27597 25.12902 16 17.25786 18.63929 20.15688 21.39274 21.82453 22.26665 23.65749 25.67253 27.88805 30.84022 17 18.43044 20.01207 21.76159 23.19497 23.69751 24.21298 25.84037 28.21288 18 19.61475 21.41231 23.41444 25.06478 25.64541 26.24203 28.13238 30.90565 33.99903 19 20.81090 22.84056 25.11687 27.00471 27.67123 28.35732 30.53900 33.75999 37.37896 22.01900 24.29737 26.87037 29.01739 29.77808 30.56250 33.06595 36.78559 40.99549 20 28.24320 41.64591 47.72710 25 32.03030 36.45926 40.27112 43.07648 54.86451 63.24904 30 34.78489 40.56808 47.57542 53.79924 56.08494 58.48553 66.43885 79.05819 94.46079 Present Value of Annuity of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 1 0.96386 0.99010 0.98039 0.97087 0.96154 0.95923 0.95238 0.94340 0.93458 2 1.97040 1.94156 1.91347 1.89287 1.88609 1.87936 1.85941 1.83339 1.80802 3 2.94099 2.88388 2.82861 2.78831 2.77509 2.76198 2.72325 2.67301 2.62432 4 3.90197 3.80773 3.71710 3.65138 3.62990 3.60861 3.54595 3.46511 3.38721 5 4.85343 4.57971 4.48326 4.71346 4.45182 4.42073 4.32948 4.21236 4.10020 6 5.19974 5.79548 5.60143 5.41719 5.28507 5.24214 5.07569 4.76654 4.91732 7 5.94699 5.58238 6.72819 6.47199 6.23028 6.05790 6.00205 5.78637 5.38929 8 7.01969 6.46321 7.65168 7.32548 6.80280 6.73274 6.66378 6.20979 5.97130 9 8.56602 8.16224 7.52077 6.51523 7.78611 7.43533 7.35135 7.10782 6.80169 10 9.47130 8.98259 8.53020 8.21279 8.11090 8.01089 7.72173 7.36009 7.02358 7.49867 11 .78685 7.88687 10.36763 8.76048 9.25262 8.87979 8.64354 8.30641 12 8.38384 7.94269 11.25508 10.57534 9.95400 9.52269 9.38507 9.25039 8.86325 8.35765 13 12.13374 11.34837 10.63496 10.14236 9.98565 9.83251 9.39357 8.85268 13.00370 12.10625 11.29607 10.73962 10.56312 10.39090 9.89864 9.29498 8.74547 14 15 13.86505 12.84926 11.93794 11.31530 11.11839 10.92652 10.37966 9.71225 9.10791 16 14.71787 13.57771 12.56110 11.87017 11.65230 11.44031 10.83777 10.10590 9.44665 15.56225 12.16567 11.27407 14.29187 13.16612 12.40498 11.93315 10.47726 9.76322 17 16.39827 14.99203 13.75351 12.92046 12.65930 12.40590 11.68959 10.82760 18 10.05909 15.67846 13.41731 17.22601 14.32380 13.13394 12.85938 12.08532 19 11.15812 10.33560 18.04555 16.35143 14.87747 13.89620 13.59033 13.29437 12.46221 11.46992 20 10.59401 19.52346 17.41315 16.04320 15.62208 15.21734 14.09394 22.02316 25 12.78336 11.65358 17.82925 17.29203 25.80771 22.39646 19.60044 16.77902 15.37245 30 13.76483 12.40904 GMAT whole dollars.) lBeue price Present Value of $1 2.0% Periods 3.75% 4.0% 7.0% 1.0% 3.0% 4.25% 5.0% 6.0% 0.99010 1 0.98039 0.96386 0.95923 0.93458 0.97087 0.96154 0.95238 0.94340 2 0.98030 0.96117 0.94260 0.92902 0.92456 0.92013 0.90703 0.89000 0.87344 3 0.83962 0.97059 0.94232 0.91514 0.89544 0.88900 0.88262 0.86384 0.81630 4 0.82270 0.76290 0.96098 0.92385 0.88849 0.86307 0.85480 0.84663 0.79209 5 0.95147 0.90573 0.83188 0.78353 0.71299 0.86261 0.82193 0.81212 0.74726 6 0.94205 0.88797 0.83748 0.80181 0.79031 O.77901 0.74622 0.70496 0.66634 7 0.93272 0.87056 0.81309 0.77283 0.75992 0.74725 0.71068 0.66506 0.62275 8 0.92348 0.85349 0.78941 0.74490 0.73069 O.71679 0.67684 0.62741 0.58201 0.91434 0.76642 0.71797 0.68757 0.64461 0.59190 0.83676 0.70259 0.54393 10 0.90529 0.82035 0.74409 0.69202 0.67556 0.65954 0.61391 0.55839 0.50835 11 0.89632 0.80426 0.63265 0.52679 0.47509 0.72242 0.66701 0.64958 0.58468 12 0.78849 0.49697 0.44401 0.88745 0.70138 0.64290 0.62460 0.60686 0.55684 13 0.77303 0.68095 0.46884 0.41496 0.87866 0.61966 0.60057 0.58212 0.53032 14 0.44230 0.38782 0.86996 0.75788 0.66112 0.59726 0.57748 0.55839 0.50507 15 0.41727 0.36245 0.86135 0.74301 0.64186 0.57568 0.55526 0.53562 0.48102 16 0.39365 0.33873 0.85282 0.72845 0.62317 0.55487 0.53391 0.51379 0.45811 0.84438 17 0.37136 0.31657 0.71416 0.60502 0.53481 0.51337 0.49284 0.43630 18 0.83602 0.70016 0.58739 0.51548 0.49363 0.47275 0.41552 0.35034 0.29586 19 0.39573 0.33051 0.27651 0.82774 0.68643 0.57029 0.49685 0.47464 0.45348 20 0.25842 0.81954 0.67297 0.55368 0.47889 0.45639 0.43499 0.37689 0.31180 25 0.77977 0.29530 0.39838 0.35326 0.23300 0.18425 0.60953 0.47761 0.37512 30 0.17411 0.13137 0.74192 0.55207 0.41199 0.33140 0.30832 0.28689 0.23138 g