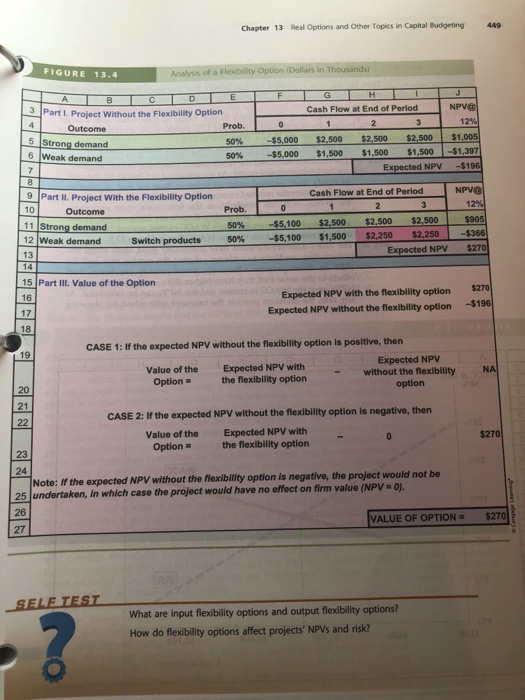

Go over figures 13.1 to 13.4 in your textbook and be familiar with the following computations: Expected NPV, std. dev., CV and value of the option.

Notes:

1. I am referring to the figures embedded in the narrative of the chapter and not the end of chapter problems.

2. I will post an Announcement showing all the computations for figure 13.1. You may omit that figure, but you need to show the computations for parts I, II and III in figures 13.2, 13.3 and 13.4.

Chapter 13 Real Options and Other Topics in Capital Budgeting 449 FIGURE 13.4 Analysis of a Flexibility Option (Dollars NPV@ 3 Part I. Project Without the Flexibility Option Cash Flow at End of Period 12% Outcome 50% -$5,000 S2.500 $2.500 $2.500! $1,005 5 Strong demand 6 Weak demand $5.000 $1.500 $1,500 $1,500 1-51.397 Expected NPV -$196 50% Cash Flow at End of Period Part II, Project with the Flexibility Option 10 Outcome Prob 50% -$5.100 s2,500 s2,500 s2.500| s905 50% 12 Weak demand 13 14 $5,100 $1,500 $2.250 $2,250-$366 Expected NPV $270 Switch products Part Ill. Value of the Option 16 17 18 Expected NPV with the flexibility option $270 Expected NPV without the flexibility option $196 CASE 1: If the expected NPV without the flexibility option is positive, then 19 Expected NPV Value of the Expected NPV with Optionthe flexibility option -without the flexlibility NA 20 21 CASE 2: If the expected NPV without the flexibility option is negative, then Value of the Option Expected NPV with the flexibility option $270 24 Note: If the expected NPV witho ut the flexibility option is negative, the project would not be 25 undertaken, in which case the project would have no effect on firm value (NPV 0. 26 VALUE OF OPTION$270 27 What are input flexibility options and output flexibility options? How do flexibility options affect projects' NPVs and risk? Chapter 13 Real Options and Other Topics in Capital Budgeting 449 FIGURE 13.4 Analysis of a Flexibility Option (Dollars NPV@ 3 Part I. Project Without the Flexibility Option Cash Flow at End of Period 12% Outcome 50% -$5,000 S2.500 $2.500 $2.500! $1,005 5 Strong demand 6 Weak demand $5.000 $1.500 $1,500 $1,500 1-51.397 Expected NPV -$196 50% Cash Flow at End of Period Part II, Project with the Flexibility Option 10 Outcome Prob 50% -$5.100 s2,500 s2,500 s2.500| s905 50% 12 Weak demand 13 14 $5,100 $1,500 $2.250 $2,250-$366 Expected NPV $270 Switch products Part Ill. Value of the Option 16 17 18 Expected NPV with the flexibility option $270 Expected NPV without the flexibility option $196 CASE 1: If the expected NPV without the flexibility option is positive, then 19 Expected NPV Value of the Expected NPV with Optionthe flexibility option -without the flexlibility NA 20 21 CASE 2: If the expected NPV without the flexibility option is negative, then Value of the Option Expected NPV with the flexibility option $270 24 Note: If the expected NPV witho ut the flexibility option is negative, the project would not be 25 undertaken, in which case the project would have no effect on firm value (NPV 0. 26 VALUE OF OPTION$270 27 What are input flexibility options and output flexibility options? How do flexibility options affect projects' NPVs and risk