Question

Great Timepiece Limited (GTL) is an entity with its issued shares being traded on the Hong Kong Stock Exchange. It is engaged in the manufacturing

Great Timepiece Limited (GTL) is an entity with its issued shares being traded on the Hong

Kong Stock Exchange. It is engaged in the manufacturing of watches for export to Europe. Over

the years, GTL has built a good reputation in the timepiece industry due to the quality of products

it manufactures. GTL has achieved steady growth over the years and it has been profit making

that has been providing good investment return to its shareholders in the form of dividends.

A few years ago, the company acquired a piece of land which was originally planned to be used

for building a warehouse on it for own use. During the year ended 31 December 2019, the

company identified and acquired a new and readily available warehouse with an appropriate price.

In view of this management of GTL disposed of the piece of land to a third party. The disposal

resulted in a significant gain of HKD100 million which has been accounted for in GTLs income

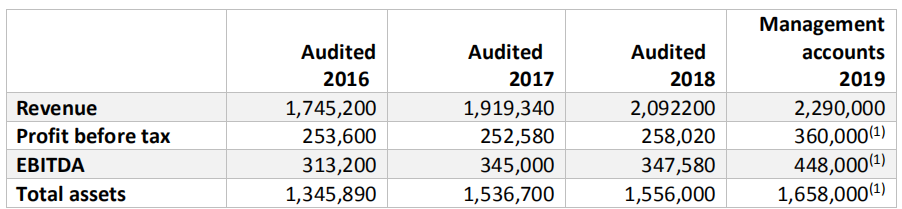

statement for the year ended 31 December 2019. The companys results (in thousands of HKD)

as of and for each of the four years ended 31 December 2019 are as follows:

You are the audit manager of CPA & Co working on the audit of GTL for the year ended 31

December 2019 and your firm has been GTLs auditor since 1 January 2014. Based on past

experience and the interim work already performed, your firm has found that GTLs internal

control is sound and there have been very limited audit issues or material uncorrected

misstatements identified by your firm in previous years. Management of GTL advised that there

were no changes in business and operating activities as well as internal control during the year

ended 31 December 2019.

A member of your team has requested you to coach him how you initially determined the overall

and performance materiality levels at the planning stage. 8 | P a g e

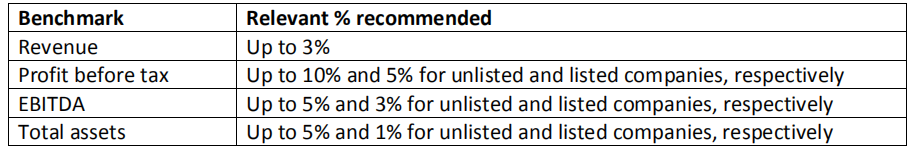

The firm has the following quantitative benchmark guidance for the determination of overall

materiality:

Question 5 (continued)

The firms guidance also recommends that the performance materiality be set at 50% or 75% of

the overall materiality, based on the assessed risk of misstatement, the internal control of the client,

the competency of the client management as well as the complexity of the accounting issues that

require significant judgement and /or more estimates with high estimation uncertainty.

Required:

(a)

What benchmark should be used for the calculation of the overall materiality for the audit

of the 2019 financial statements of GTL? Explain your justification.

(b)

Explain how you initially calculated the overall materiality for 2019 at the planning stage.

(c)

Explain how you initially calculated the performance materiality for 2019 at the planning

stage.

(d) What would be impact on your determination of the performance materiality level if during

the course of the audit for the year ended 31 December 2019, you noted a few issues related

to over provision for certain slow-moving inventory items and the misstatements which

were marginally significant were adjusted by management in the 2019 financial statements

upon your discovery and before you completed your audit? Explain your reasons.

Revenue Profit before tax EBITDA Total assets Audited 2016 1,745,200 253,600 313,200 1,345,890 Audited 2017 1,919,340 252,580 345,000 1,536,700 Audited 2018 2,092200 258,020 347,580 1,556,000 Management accounts 2019 2,290,000 360,000(1) 448,000(1) 1,658,000(1) Benchmark Revenue Profit before tax EBITDA Total assets Relevant % recommended Up to 3% Up to 10% and 5% for unlisted and listed companies, respectively Up to 5% and 3% for unlisted and listed companies, respectively Up to 5% and 1% for unlisted and listed companies, respectively Revenue Profit before tax EBITDA Total assets Audited 2016 1,745,200 253,600 313,200 1,345,890 Audited 2017 1,919,340 252,580 345,000 1,536,700 Audited 2018 2,092200 258,020 347,580 1,556,000 Management accounts 2019 2,290,000 360,000(1) 448,000(1) 1,658,000(1) Benchmark Revenue Profit before tax EBITDA Total assets Relevant % recommended Up to 3% Up to 10% and 5% for unlisted and listed companies, respectively Up to 5% and 3% for unlisted and listed companies, respectively Up to 5% and 1% for unlisted and listed companies, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started