Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Group Assignment One for MBA Students 2 0 2 4 ( 5 Marks ) - deadline 2 4 / 4 / 2 4 Question One

Group Assignment One for MBA Students Marksdeadline

Question One Marks

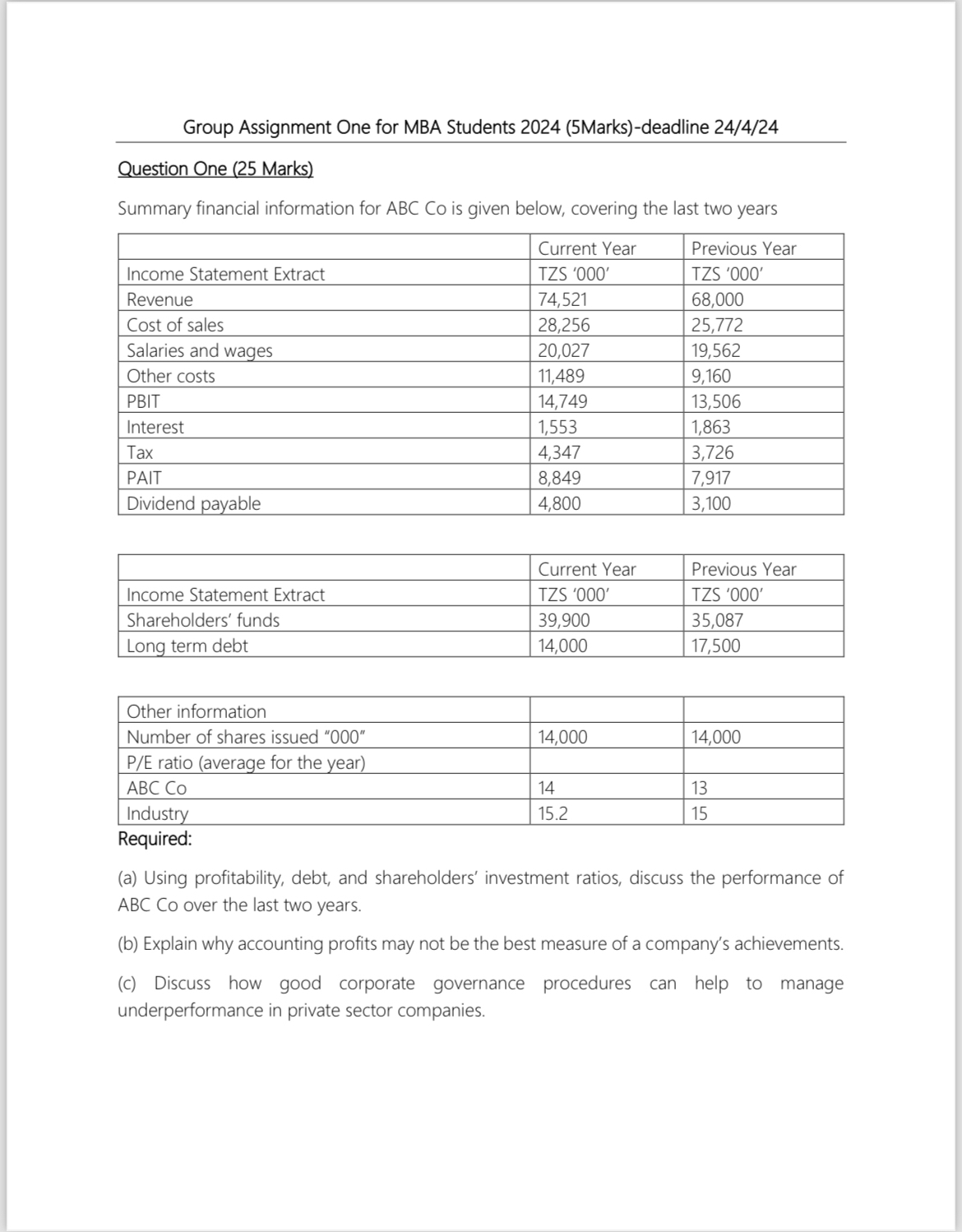

Summary financial information for ABC Co is given below, covering the last two years

tableCurrent Year,Previous YearIncome Statement Extract,TZS TZS RevenueCost of sales,Salaries and wages,Other costs,PBITInterestTaxPAITDividend payable,

tableCurrent Year,Previous YearIncome Statement Extract,TZS TZS Shareholders funds,Long term debt,

tableOther information,,Number of shares issued PE ratio average for the yearABC CoIndustry

Required:

a Using profitability, debt, and shareholders' investment ratios, discuss the performance of ABC Co over the last two years.

b Explain why accounting profits may not be the best measure of a company's achievements.

c Discuss how good corporate governance procedures can help to manage underperformance in private sector companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started