Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following excerpts are from two articles published in the Australian Financial Review in 2021. These articles highlight the debate over the merits

Question 1

- The following excerpts are from two articles published in the Australian Financial Review in 2021. These articles highlight the debate over the merits of active versus passive investment management.

- If you are an investment manager, which style of investment management will you prefer? Active or passive? Discuss why you will select one investment style over the other. Justify your answer based on the characteristics of passive and active investment funds. (Max 250 words)

- On 4th May 2022, Tom invested in 200 shares of Grow Crop using the margin trading facility provided by his broker. The broker requires an initial margin of 60% and a maintenance margin of 50%. The following table shows the limit order book of Grow Crop stocks when Tom placed his market buy order.

| Limit buy orders | Limit sell orders | ||

| Price ($) | Shares | Price ($) | Shares |

| 49.75 | 500 | 50.50 | 100 |

| 49.50 | 800 | 51.50 | 200 |

| 49.25 | 500 | 54.75 | 300 |

| 49.00 | 200 | 58.25 | 100 |

| 48.50 | 600 |

|

|

- At what average price Toms market buy order for 200 Grow Corp stock got transacted?

- How much initial investment Tom had to make to buy these 200 Grow Corp stocks using the margin trading facility provided by his broker?

- If Grow Corp stock prices drop to $48.00 on 5th May 2022, do you think Tom will receive a margin call on that day? Justify your answer with appropriate calculations.

(4+ (2 + 1 + 3 = 6) = 10 Marks)

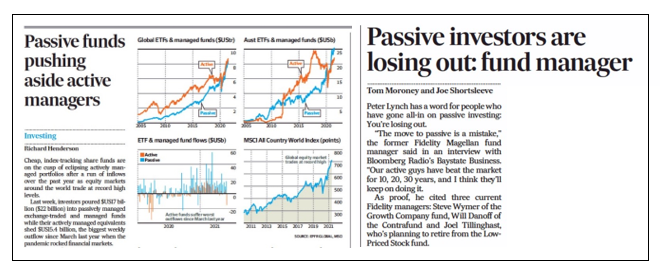

Passive funds Global ETFs & managed funds (SUS) Aust ETFs & managed funds (US) pushing A aside active managers Investing ETF & managed fund flows (SUS) MSCI All Country World Index(points) Richard Henderson Shalogulty mpcket Cheap, index tracking share funds are on the cusp of eclipsing actively man aged portfolion after a run of inflows over the past year as equity markets around the world trade at med high levels. Last week, investors poured US on (522 billion into ply managed exchange-traded and med find while their actively managed equivalents shed SS54 billion, the biggest weekly outflow since March last year when the pandemic rocked financial markets Passive investors are losing out: fund manager Tom Moroney and Joe Shortsleeve Peter Lynch has a word for people who have gone all-in on passive investing You're losing out. "The move to passive is a mistake," the former Fidelity Magellan fund manager said in an interview with Bloomberg Radio's Baystate Business. "Our active guys have beat the market for 10, 20, 30 years, and I think they'll keep on doing it. As proof, he cited three current Fidelity managers: Steve Wymer of the Growth Company fund, Will Danoff of the Contrafund and Joel Tillinghast, who's planning to retire from the Low- Priced Stock fund. Passive funds Global ETFs & managed funds (SUS) Aust ETFs & managed funds (US) pushing A aside active managers Investing ETF & managed fund flows (SUS) MSCI All Country World Index(points) Richard Henderson Shalogulty mpcket Cheap, index tracking share funds are on the cusp of eclipsing actively man aged portfolion after a run of inflows over the past year as equity markets around the world trade at med high levels. Last week, investors poured US on (522 billion into ply managed exchange-traded and med find while their actively managed equivalents shed SS54 billion, the biggest weekly outflow since March last year when the pandemic rocked financial markets Passive investors are losing out: fund manager Tom Moroney and Joe Shortsleeve Peter Lynch has a word for people who have gone all-in on passive investing You're losing out. "The move to passive is a mistake," the former Fidelity Magellan fund manager said in an interview with Bloomberg Radio's Baystate Business. "Our active guys have beat the market for 10, 20, 30 years, and I think they'll keep on doing it. As proof, he cited three current Fidelity managers: Steve Wymer of the Growth Company fund, Will Danoff of the Contrafund and Joel Tillinghast, who's planning to retire from the Low- Priced Stock fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started