Answered step by step

Verified Expert Solution

Question

1 Approved Answer

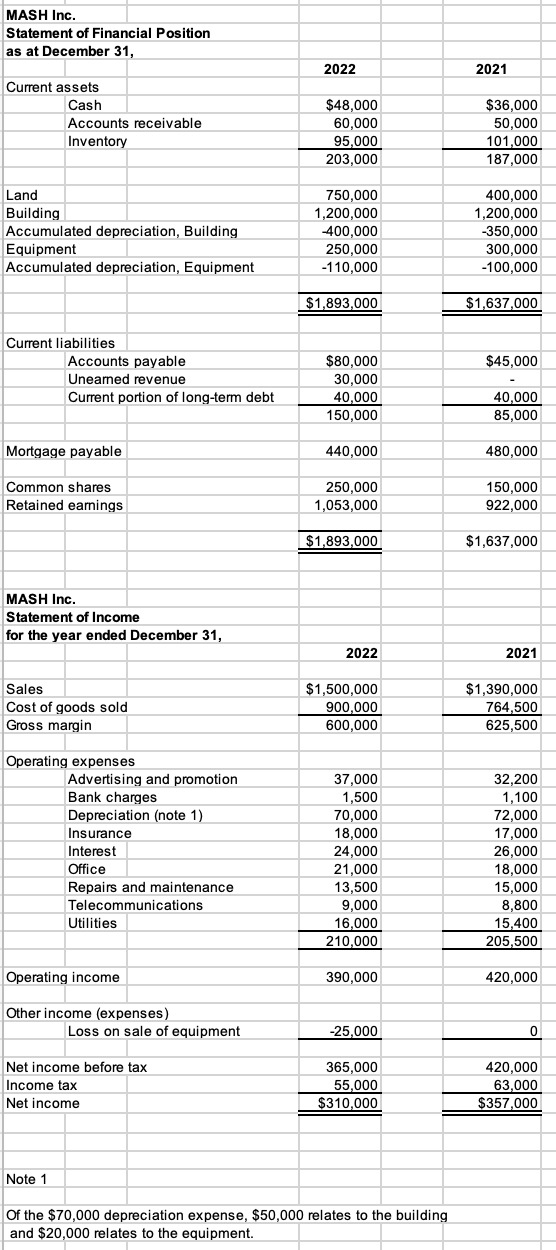

GUARANTEED UPVOTE - if you solve this!! a) Calculate EACH of the following ratios for 2022 AND briefly explain what the ratio means: i. Quick

GUARANTEED UPVOTE - if you solve this!!

a) Calculate EACH of the following ratios for 2022 AND briefly explain what the ratio means:

i. Quick ratio

ii. Inventory turnover

b) i. Calculate the gross margin percentage for both 2022 and 2021. ii. Is it improving or declining? iii. Provide ONE explanation as to why that may be the case.

PLEASE DO BOTH THANK YOU BLESS YOUR SOUL

based on the information attached in the photo:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started