Question

Halim and Halimah who are married, are both Malaysian citizens and tax residents. They have a ten year old son, Hilman. Details of Halim s

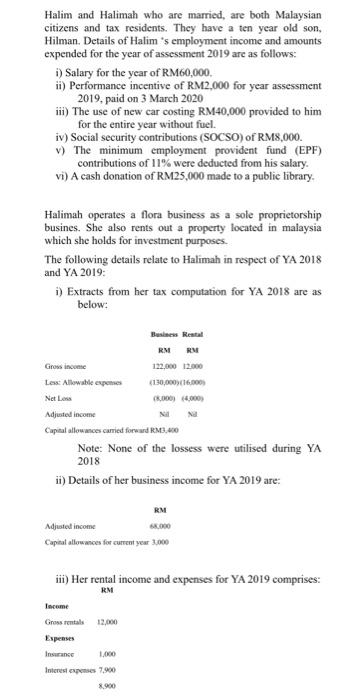

Halim and Halimah who are married, are both Malaysian citizens and tax residents. They have a ten year old son, Hilman. Details of Halim s employment income and amounts expended for the year of assessment 2019 are as follows:

Halimah operates a flora business as a sole proprietorship busines. She also rents out a property located in malaysia which she holds for investment purposes.

The following details relate to Halimah in respect of YA 2018 and YA 2019:

| Business | Rental |

| RM | RM |

Gross income | 122,000 | 12,000 |

Less: Allowable expenses | (130,000) | (16,000) |

Net Loss | (8,000) | (4,000) |

Adjusted income | Nil | Nil |

Capital allowances carried forward | RM3,400 |

|

Note: None of the lossess were utilised during YA 2018

| RM |

Adjusted income | 68,000 |

Capital allowances for current year | 3,000 |

| RM |

Income |

|

Gross rentals | 12,000 |

Expenses |

|

Insurance | 1,000 |

Interest expenses | 7,900 |

| 8,900 |

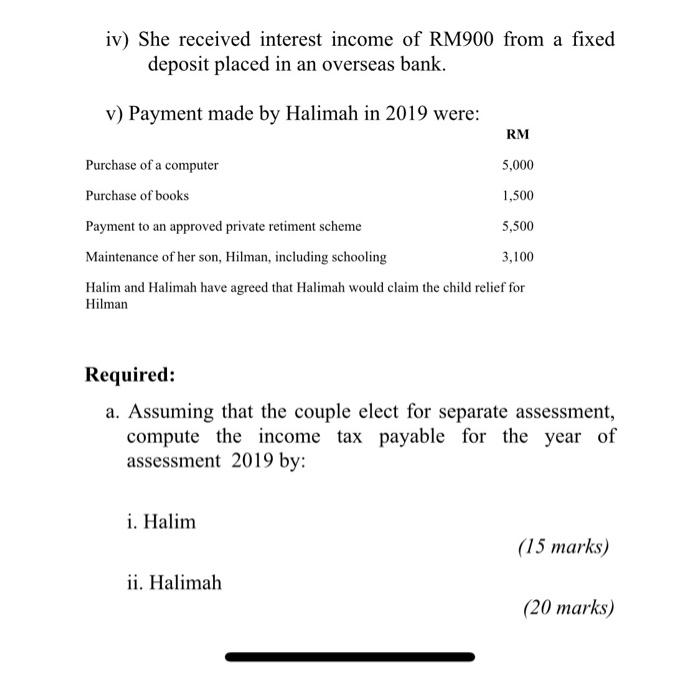

| RM |

Purchase of a computer | 5,000 |

Purchase of books | 1,500 |

Payment to an approved private retiment scheme | 5,500 |

Maintenance of her son, Hilman, including schooling | 3,100 |

Halim and Halimah have agreed that Halimah would claim the child relief for Hilman | |

Required:

(15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started