Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harper Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage-bracket method in the federal tax

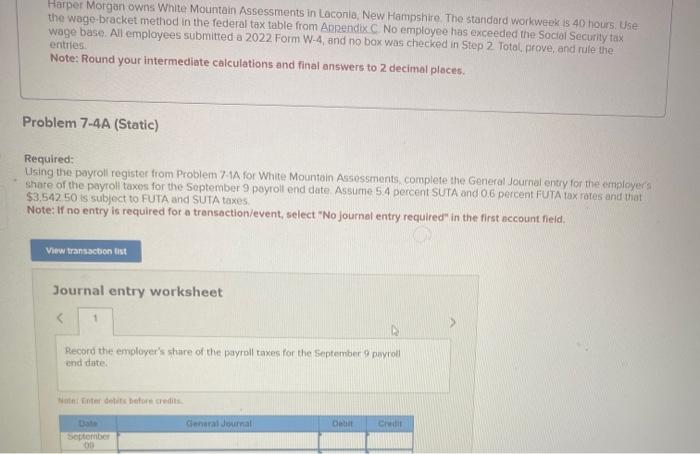

Harper Morgan owns White Mountain Assessments in Laconia, New Hampshire. The standard workweek is 40 hours. Use the wage-bracket method in the federal tax table from Appendix C. No employee has exceeded the Social Security tax wage base. All employees submitted a 2022 Form W-4, and no box was checked in Step 2. Total, prove, and rule the entries. Note: Round your intermediate calculations and final answers to 2 decimal places. Problem 7-4A (Static) Required: Using the payroll register from Problem 7-1A for White Mountain Assessments, complete the General Journal entry for the employer's share of the payroll taxes for the September 9 payroll end date. Assume 5.4 percent SUTA and 0.6 percent FUTA tax rates and that $3,542 50 is subject to FUTA and SUTA taxes Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the employer's share of the payroll taxes for the September 9 payroll end date. Note: Enter debits before credits Date September 08 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started